- Stronger fundamentals, growing institutional interest and mainstream adoption of cryptocurrencies bode well for the prospects of bitcoin

- The asset can also work as a hedge against macroeconomic risks

Bitcoin Gearing Up For Bull Run?

At the time of writing, bitcoin is hovering above the US$10,000 mark. The last time we saw bitcoin reach this price was in December 2017, after which, the cryptocurrency went on to reach its all-time high of nearly US$20,000 in a matter of days.

The cryptocurrency market remained bearish for all of 2018, but with the way bitcoin is charging upwards and setting new highs in 2019, it is safe to say that the crypto-winter is behind us already. In the past several years, we have witnessed a cyclical pattern emerging in the cryptocurrency space.

And with each cycle, we reached exponentially greater heights.This time around, analysts have come up with bolder price predictions, ranging from US$21,000 all the way up to US$100,000, all of which begs the question: is the current bull market any different from the last one?

See: Expert Predictions: Price Forecasts of Bitcoin and Ethereum

Bitcoin, the world’s largest cryptocurrency, surged in value to hit US$13,000 in late June. Illustration: ReutersAt the time of writing, bitcoin has just surpassed the US$13,000 mark. The last time we saw bitcoin reach this price was in December 2017, after which, the cryptocurrency went on to reach its all-time high of nearly US$20,000 in a matter of days.

2018: Year of the Bears

The cryptocurrency market remained bearish for all of 2018, but with the way bitcoin is charging upwards and setting new highs in 2019, it is safe to say that the crypto-winter is behind us already. In the past several years, we have witnessed a cyclical pattern emerging in the cryptocurrency space. And with each cycle, we reached exponentially greater heights.This time around, analysts have come up with bolder price predictions, ranging from US$21,000 all the way up to US$100,000, all of which begs the question: is the current bull market any different from the last one?

inRead invented by TeadsDuring the peak of the 2017 cryptocurrency bull run, several sceptics compared it to the Tulip mania of the 17th century, with most convinced that bitcoin was a bubble. However, since 2017, bitcoin and other cryptocurrencies have come a long way in terms of maturity. Bitcoin fundamentals are stronger than ever, institutional interest is at an all-time high and mainstream adoption is on the rise, strengthening the argument for why the market is not based totally on hype this time.

.

Earlier this month, Blockchain.info reported that bitcoin’s hash-rate – the speed at which a bitcoin mining machine operates – reached a historical high of 74,548,543 terahashes per second. In simpler terms, the bitcoin blockchain is more secure than it ever has been and breaching the network would require unimaginable computing power. In addition, the average number of transactions on the blockchain has consistently risen. As reported by localbitcoins.org, the weekly average transaction volume has remained above US$50 million since September 2017.

Daily active bitcoin wallets crossed the 1 million mark in June this year, according to data published by Coin Metrics, providing another indication that more people are now using bitcoin.

Institutional Investors are Coming

Institutional involvement in the cryptocurrency space, over the past year, has been incredible. It is easy to argue that the 2017 bull-run was largely fuelled by retail investors. This time around, institutional investment in cryptocurrencies has gained traction.

Will China be forced to develop its own cryptocurrency in response to Libra?

Fidelity is set to launch cryptocurrency trading for institutional investors, seeing huge demand in that niche. Earlier this month, CME Group recorded open interest – the number of active contracts held by investors – in 5,311 contracts, totalling 26,555 bitcoin, significantly higher than the 2017 price peak.

Furthermore, JP Morgan, one of the biggest investment banks in the world, launched its own token, JPM coin, to settle payments between institutional clients. The biggest social network in the world, Facebook, is set to launch its own cryptocurrency, Libra, next year. Regardless of the use cases of these institutional cryptocurrencies, they are a step in the right direction, giving more legitimacy to the industry.

Is Bitcoin Digital Gold?

To most, the thought of bitcoin as a safe haven may sound completely absurd given its volatility. However, a recent study from Grayscale Research analyses the correlation between bitcoin and macroeconomic developments, illustrating the use of bitcoin as a hedge against political unrest and macroeconomic uncertainty.

Even though bitcoin does not really feature in the conventional list of safe havens, more people are relying on the cryptocurrency as a hedge against movements in the “traditional” financial market. Correlation does not necessarily mean causation but the key takeaway here is that bitcoin and other cryptocurrencies are becoming more popular among investors for diversifying their portfolios.

To stimulate their economies, central banks around the world are turning dovish: cutting interest rates and printing more money. While this has made investors rejoice in the short term, bitcoin holders are confident that in the long term, bitcoin will outperform fiat currencies, the supply of which is growing at a rapid pace.

Read: Why the stock market rally will not last long

The cryptocurrency market is definitely more mature than it was during the last bull run and there is more intelligent money in the market than there was the last time. Fear of missing out will still definitely be a huge catalyst in driving up prices but we cannot ignore the other developments that have added legitimacy and increased the ways in which cryptocurrencies could be used, paving the way for mainstream adoption.

How prices will move remains of interest. Past performance is not an indication of future results, but if the observed pattern were to continue, we could be looking a year-end price well above the US$20,000 mark.

Bitcoin Volatility Lowest Levels Since May

- Bitcoin’s price volatility, as represented by Bollinger bandwidth, has hit the lowest level since May 3, and is closing on a level seen ahead of violent price swings in the past.

- While technical charts are increasingly favoring a downside move, bitcoin’s non-price metrics continue to call a bullish move, which, so far, has remained elusive.

- BTC risks falling to $9,855 (Sept. 11 low) in the next couple of days and could extend the decline toward $9,320 (Aug. 29 low).

- The bearish case would weaken above Sept. 13’s high of $10,458. The outlook, as per the daily chart would turn bullish above $10,956 (Aug. 20 high).

Bitcoin’s volatility has hit its lowest level in over four months – a price squeeze that may force a significant move either way.

BTC’s bull run stalled at highs above $13,800 on June 26 and prices have created lower highs and higher lows ever since.

Notably, the trading range has narrowed sharply over the last two weeks, with bitcoin consolidating between $9,850 and 10,950, as per Bitstamp data.

As a result, the Bollinger bands – volatility indicators placed 2 standard deviations above and below the price’s 20-day moving average – have narrowed sharply.

More importantly, Bollinger bandwidth, an indicator used to gauge market volatility, has dropped to 0.11 – the lowest reading since May. 3, as seen in the chart below.

Bollinger Bandwidth

The volatility level has dropped steadily from 0.62 to lows near 0.10 in the 2.5-months.

In the past, BTC has witnessed big moves following drops to or below 0.10 (marked by arrows).

For instance, the bandwidth dropped to 0.06 a week before BTC broke into a bull market with a high-volume move to $5,000 on April 2. It also fell to 0.10 on May 2 – a day before BTC jumped above $5,600, marking an upside break of a three-week-long consolidation. And, in the days leading up to last November’s sell-off below $6,000, volatility dropped to 0.05.

If history is a guide, then BTC could soon witness a big move on either side. Technical analysis theory also states than an extended period of low volatility is often followed by a big move.

While the record high hash rate (miner confidence) is calling a bullish move, the technical charts are beginning to favor the bears.

As of writing, BTC is changing hands at $10,170 on Bitstamp, representing little change on a 24-hour basis.

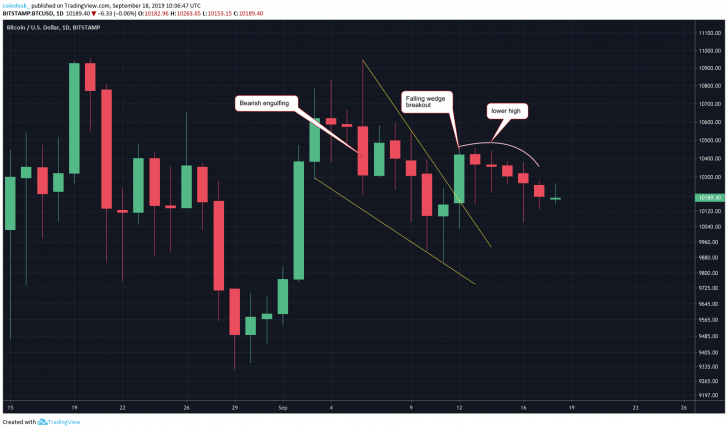

Daily chart

Bitcoin jumped 2.6 percent on Sept. 12, confirming an upside break of a falling wedge pattern. The bullish breakout, however, failed to draw bids and the cryptocurrency has ended up creating another lower high at $10,458 (Sept. 13 high).

With the failed breakout, the bearish view put forward by Sept. 6’s big red engulfing candle has gained credence.

BTC risks falling back to the Sept. 11 low of $9,855 in the short-term. A violation there would open the doors for $9,320 (Aug. 29 low).

A few observers are calling for a deeper drop to levels below $8,000. That possibility cannot be ruled out as the cryptocurrency is looking heavy on the longer duration charts.

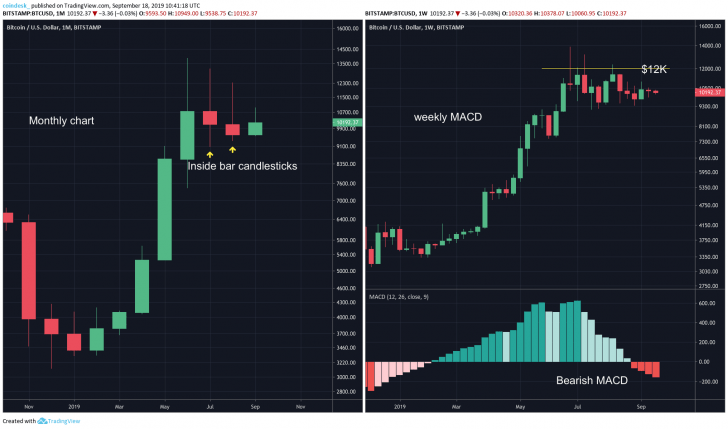

Monthly and weekly charts

The back-to-back inside bar candlestick patterns on the monthly chart (above left) indicate buyer exhaustion following a stellar rally from $4,000 to $13,880.

A bearish “inside bar” reversal would be confirmed if prices close (UTC) below $9,049 – the low of the first inside bar created in July – on Sept. 30.

Further, a negative reading on the weekly moving average convergence divergence (MACD) indicates scope for a deeper pullback.

The bearish case would weaken if prices rise above $10,956 (Aug. 20 high), invalidating the lower highs setup on the daily chart.

That said, a weekly close (Sunday, UTC) above $12,000 is needed for bull revival, as discussed last month.

Article by

&

- 000

- 11

- 2019

- active

- Adoption

- All

- among

- analysis

- April

- around

- asset

- Banks

- bearish

- Bears

- Biggest

- Bitcoin

- Bitcoin bull

- Bitcoin mining

- Bitfarms

- Bitstamp

- blockchain

- Bloomberg

- breakout

- BTC

- Bull Run

- Bullish

- call

- Canada

- cases

- Central Banks

- change

- charging

- Charts

- China

- CME

- Coin

- coin metrics

- computing

- confidence

- consolidation

- continue

- contracts

- Couple

- Creating

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- Cryptocurrency Mining

- cryptocurrency trading

- Currency

- Current

- data

- day

- Demand

- develop

- digital

- digital currency

- digital gold

- driving

- Drop

- dropped

- ethereum

- Facility

- Feature

- Fiat

- financial

- First

- Forward

- Fundamentals

- future

- Giving

- Gold

- gray

- Grayscale

- Group

- Growing

- guide

- hash

- hash rate

- here

- High

- history

- HTTPS

- huge

- industry

- info

- Institutional

- interest

- Interest Rates

- investment

- investment banks

- Investors

- IT

- jp morgan

- JPMorgan

- July

- Key

- launch

- leading

- Level

- Libra

- List

- LocalBitcoins

- Long

- Mainstream

- mark

- Market

- Metrics

- million

- Mining

- money

- months

- move

- Near

- network

- open

- Other

- Outlook

- Pattern

- payments

- People

- performance

- Popular

- power

- Predictions

- price

- Quebec

- rally

- range

- Rates

- Reading

- research

- response

- Results

- retail

- Retail Investors

- Reuters

- Run

- safe

- Safe Haven

- set

- setting

- Short

- So

- Social

- social network

- Space

- speed

- States

- Stellar

- stock

- stock market

- supply

- Technical

- Technical Analysis

- time

- token

- Trading

- transaction

- Transactions

- us

- value

- View

- Volatility

- volume

- Wallets

- week

- weekly

- Work

- world

- writing

- year

- years