ADVERTISEMENT

Bitcoin could lose the $30K price level if the stocks start crashing because the downside risks for BTC increased due to the recent dollar bounce as we are reading more in our latest bitcoin news today.

Back in 2020, the prospect of a fast-spreading coronavirus pandemic led to a massive lockdown across developed and emerging economics so, in turn, the global stocks crashed along and BTC lost half of its value in two days. In the meantime, the US dollar index or DXY which represents the greenback’s strength against a basket of other currencies has climbed by 8.7% to 102,992 marking the highest level since 2017.

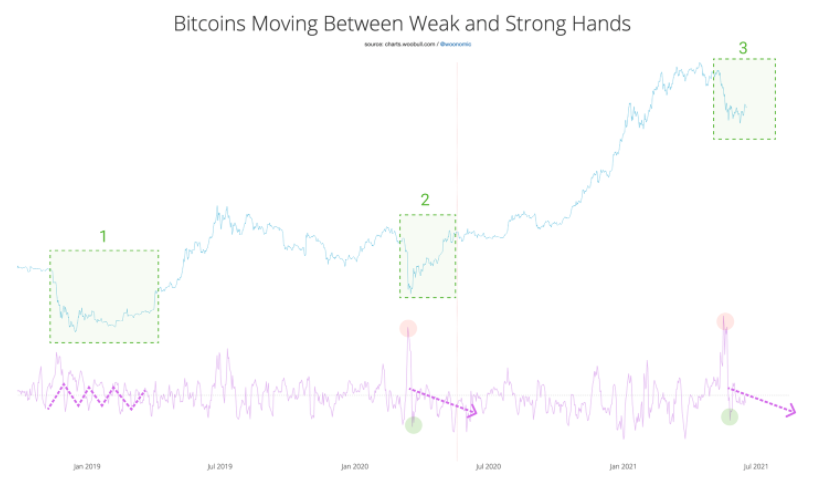

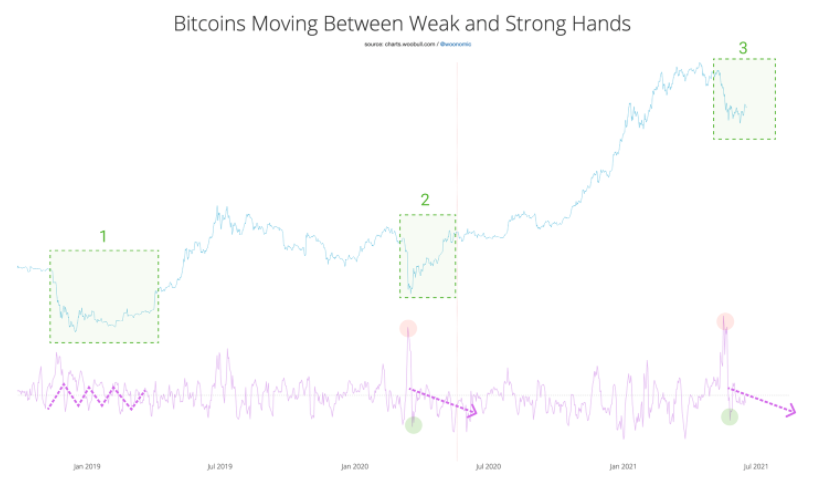

The inverse correlation showed that the investors are dumping their stocks and BTC holdings and sought safety in that they believed was a better choice which was the dollar. More than a year later, Bitcoin and the stock markets wrestled again with a similar bearish sentiment that was led by a renewed demand for the US dollar after the Federal Reserve’s announcements. The US Central bank announced that it will start hiking the benchmark interest rates by the end of 2023 which is one year before the initial plan.

Lower interest rates helped to pull BC and the US Stock market out of their bearish slumber and the cryptocurrency jumped from $3858 to almost $60,000 in 2021 as the FED pushed the lending rates to 0% or 0.25%. In the meantime, the S&P 500 index increased more than 95% from its March 2020 peak and Dow Jones and Nasdaq rallied as well. This is what happened after the FED rate hike announcement but the US dollar index also jumped to its two-month high and hinted at a renewed appetite for the dollar on the market. Analyst Willy Woo said that the stock market crash along with the rising dollar could increase the bearish propositions for bitcoin:

ADVERTISEMENT

“Some downside risk if stonks tank, a lot of rallying in the DXY (USD strength) which is typical of money moving to safety.”

The head of Scion Asset Management Michael Burry sounded the alarm of a Bitcoin and stock market crash, adding that Bitcoin could lose the $30K level if the stocks drop from their trillions:

“The problem with crypto, as in most things, is the leverage. If you don’t know how much leverage is in crypto, you don’t know anything about crypto.”

- 000

- 2020

- 7

- 9

- analyst

- announced

- Announcement

- Announcements

- appetite

- asset

- asset management

- Bank

- bearish

- Benchmark

- Bitcoin

- BTC

- Central Bank

- Coins

- Coronavirus

- Coronavirus pandemic

- Crash

- crypto

- Crypto News

- cryptocurrency

- currencies

- Demand

- Dollar

- dow

- Dow Jones

- Drop

- Economics

- Editorial

- Fed

- Federal

- Free

- Global

- head

- High

- How

- HTTPS

- Increase

- index

- interest

- Interest Rates

- Investors

- IT

- Led

- lending

- Level

- Leverage

- lockdown

- management

- March

- march 2020

- Market

- Markets

- money

- Nasdaq

- news

- offer

- Other

- pandemic

- policies

- price

- Rates

- Reading

- Risk

- S&P 500

- Safety

- sentiment

- set

- So

- standards

- start

- stock

- stock market

- Stock markets

- Stocks

- trillions

- u.s.

- Update

- us

- US Dollar

- USD

- value

- Website

- year