1. May Market Movements

In May Bitcoin (BTC) followed-up April’s relatively modest decline (which had been the first monthly decline since September 2020) with a major sell-off.

Bitcoin finished May -36% for the month. Ethereum fared better but was still down -8%.

What happened? A near perfect storm of negativity ranging from damaging Elon Musk tweets to China “bans bitcoin” (for the umpteenth time) hammered crypto markets.

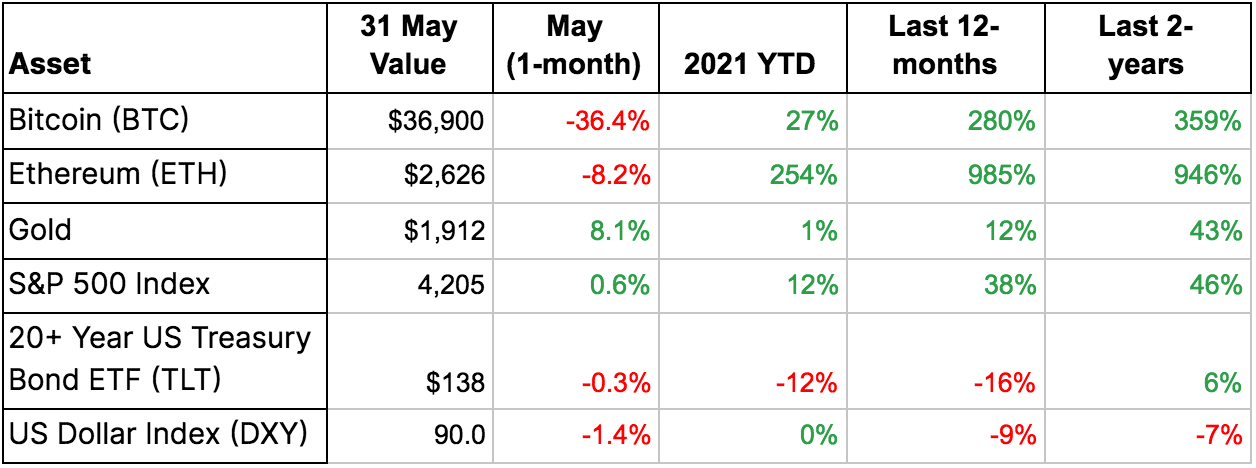

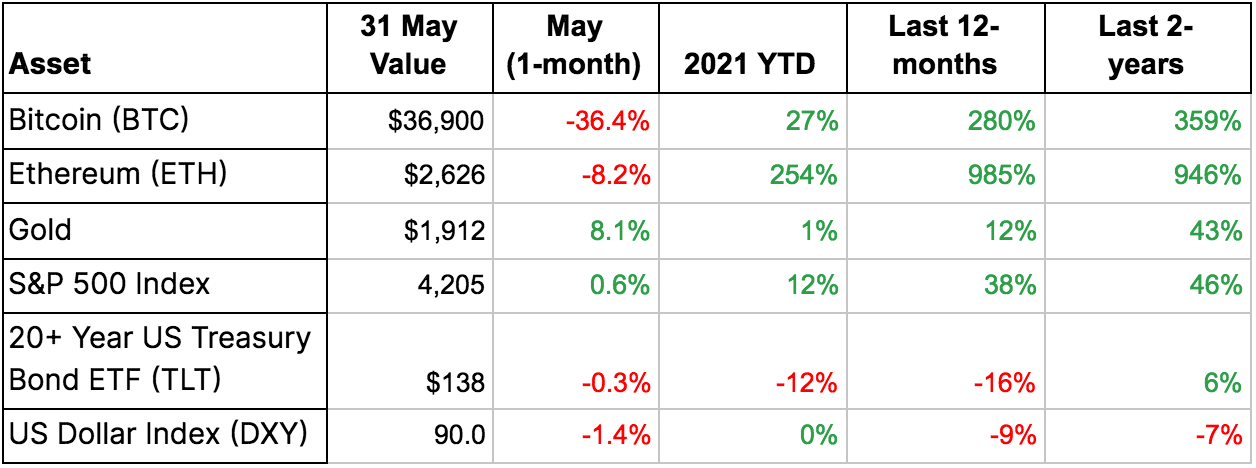

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

Probably the most interesting non-crypto market action in May that is relevant to crypto (and bitcoin in particular) was the performance of gold.

The yellow metal had its best month in nearly a year, up 8% for May. Price inflation data is coming in hot with food, energy and other prices rising sharply (Figure 1).

Figure 1: Some food prices are at five years highs, which could prove particularly destabilizing in developing countries

Food and energy prices (with increases in the latter often driving the former higher given the role energy plays in food production) can prove very destabilizing in vulnerables areas.

Indeed, the Arab Spring a decade ago was arguably triggered in part by increasing food costs. Many laid the blame for rising food prices on the Federal Reserve’s loose monetary policy at that time under Chairman Ben Bernanke.

Bottom line: we believe our hard asset investment thesis is being validated and the crypto bull market is intact.

2. Our thoughts on the latest China crypto developments

As we are set to publish bitcoin’s price is being buoyed by news that El Salvador will be the first country to make bitcoin legal tender. This and significant institutional demand for MicroStrategy’s latest debt raise to purchase bitcoin have combined to push bitcoin back above the $36k level.

At the same time, we are watching closely for continued downward price pressure on crypto due to the still evolving situation in China.

Crypto market participants have understandably become somewhat jaded to the numerous “China is cracking down on bitcoin!” announcements through the years. In the past these headlines have failed to materialize into significant or lasting impact on crypto adoption both within China and around the world.

As our friends at Panterra also recently pointed out, there is also the very bullish history of China cracking down on various technology platforms and how the market value of those platforms performed post-China ban.

With that said, the Chinese government appears to be following through on May’s announced policy shift and is in fact cracking down on mining in China.

We are also seeing evidence of social media censorship targeted at Chinese exchange trading.

Two points we would make about China cracking down on crypto:

First, China is squandering its early lead in blockchain technology and a golden opportunity to utilize bitcoin to advance China’s geopolitical objectives.

Blockchain technology innovation is largely happening in the private sector crypto space, not inside large organizations and governments. If China drives crypto offshore it will drive the entrepreneurs, capital and technology development away from China. All of these would benefit the Chinese government’s efforts to leverage distributed ledger technology for state-prioritized blockchain initiatives.

Second, while China cannot kill bitcoin, crypto will be significantly smaller if China’s government can successfully suppress Chinese crypto adoption.

Smaller in terms of hash rate. Smaller in terms of user base. And smaller in terms of market value.

In terms of what’s next in China, there are a couple things worth keeping an eye on.

Allowing crypto mining to continue in Sichuan province, where excess and renewable hydro power is widely utilized, would be an indication that the Chinese government is not looking to completely drive crypto out of China.

Also, not following-up the current mining/OTC market/social media crackdown with a pursuit crypto owners holding funds (private keys) in non-custodial wallets like the Blockchain.com wallet would be another cause for optimism around the future of crypto in China.

3. On-Chain Analysis

Each month, we dive into on-chain data to explore interesting trends or movements on the Bitcoin network. Overall, on-chain activity dropped in the month of May.

Table 2: May vs April Bitcoin network activity

The average daily fees per transaction dropped in the month of May from $30 / transaction to $15 / transaction — the mempool size was at its lowest level since early 2021 by the end of the month. However, these lowered fees did not entice users into increased activity. In fact, May saw a decrease in activity across the board.

A surprising increase in the estimated hash rate?

Somewhat surprisingly, the estimated hash rate (in EH/s) increased in May from 157 EH/s to 161 EH/s.

As we discussed in last month’s report, one contributing factor to fee increase or decrease is the hash rate.

In this month’s case, when there are more blocks confirmed, more transactions get confirmed. Users don’t have to pay increased fees to make sure their transactions are included in the block, as there’s now a higher likelihood of their transactions being confirmed without it. Ultimately leading to lower transaction fees.

This increase in hash rate shows that mining bitcoin has remained profitable for most of the miners despite the drop in the bitcoin price. Continued mining profitability in the wake of a declining bitcoin price may be due to increasing activity in areas such as North America where “free” flared gas, zero-negative price solar/wind energy in Texas, and stranded energy assets are utilized.

Dive into the mempool size

After months of high fees and a congested mempool, May saw a first drop in mempool size around the 10th of May, and eventually dropped by the end of May, and has even cleared in early June at the time of writing.

This is a direct consequence of sustained hash rate levels and lower on-chain activity.

What this means is that sending bitcoin is now more affordable, with the average fee per transaction being as little as 7 dollars on average.

Whether the mempool size will remain low in the future will depend on the general chain activity. However, you can already take advantage of the low fees and consolidate your funds into a single UTXO so that it is cheaper to send in the future. Moreover, sending transactions from your Blockchain.com Wallet will be cheaper to use now that it supports Segwit transactions, and it will contribute to keeping the general state of the mempool low. We dive into this in more details below for those not familiar with utxos and segwit.

What are UTXOs and what can I do to pay less transaction fees ?

UTXO stands for Unspent Transaction Output. You can think of it as a coin that you receive in your wallet, which has a specific value, say 0.1 BTC. The balance in your wallet is the sum of all the UTXOs that you received in the past and that you haven’t redeemed yet.

Imagine you have two wallets, they both have a balance of 0.7 BTC, but one has 3 UTXOs of 0.3 BTC, 0.15 BTC and 0.25 BTC, while the other wallet has only one UTXO of 0.7 BTC. When sending 0.6 BTC to a third party, the first wallet will have to include those 3 UTXOs as inputs of the transaction, while the second one will only have to include 1 UTXO. The first transaction will be bigger in block weight than the second one, making the transaction more expensive.

Consolidating multiple UTXOs into one UTXO when fees are low will make it more affordable to send funds in the future when fees are higher. To do so in practice, you can send your whole balance to yourself, and it will create a single UTXO of the amount of your current balance, minus the fees you had to pay for the transaction.

Segwit

Blockchain.com now supports Segwit, which decreases the weight of an UTXO in a bitcoin transaction. Because 28% of all bitcoin transactions were sent from Blockchain.com, this release will contribute to keeping mempool congestion low.

4. How the Crypto Crash Reflected in DeFi Lending Protocols? — Guest Post by Into the Block’s Jesus Rodriguez

The recent crash in the crypto markets had all sorts of ripple effects across different areas of the market. One of the segments that was severely tested were the DeFi lending markets. As investors in protocols such as Aave or Compound rush to adjust or unwind some of their positions, the dynamics of the protocols were severely stress tested and the composition of those markets radically changed.

Some news have covered the increase in liquidations in DeFi lending protocols in general terms but I thought it would be cool to look into some of the data. For the sake of the example, I will use the Compound protocol analytics included in the IntoTheBlock platform.

1) Liquidations Skyrocketed

The rapid unwinding of positions in Compound was conducive to a massive increase in liquidations. In the Compound protocols liquidations this week were almost 20x previous levels as shown in this graph from the IntoTheBlock analytics for Compound.

2) Repaid Loans Were Off the Charts

Literally! IntoTheBlock Debt Repaid indicator for Compound shows that in May 19th, the aggregated debt repaid rose to over $1.7B from about $80M the day before.

3) Withdrawals Increased Drastically

With the market crash, people rushed to withdraw their funds from DeFi lending protocols. IntoTheBlock Withdrawals indicator for Compound shows that withdrawals in May 19th increased to over $2.2B from $400M the day before.

4) Majority of Loans Were Between 10k-$100K

IntoTheBlock Loan Size Distribution indicator shows that the majority of loans were between $10K-$100k which speaks to the fact that mid-market investors were the most active during the crash.

5) Outflows Dominated

IntoTheBlock Net Loans indicator for Compound turned to negative showing that there was more debt repaid than new loans originated.

Even though we used Compound in this analysis, the behavior was consistent for other DeFi lending protocols. All things considered, these protocols held up incredibly well showing the resiliency of the DeFi space.

5. What we’re reading, hearing, and watching.

Crypto

Beyond Crypto

- 2020

- 7

- Action

- active

- Adoption

- ADvantage

- All

- america

- analysis

- analytics

- announced

- Announcements

- April

- around

- asset

- Assets

- Ban

- BEST

- Bitcoin

- Bitcoin Price

- bitcoin transactions

- blockchain

- blockchain technology

- Blockchain.com

- board

- BTC

- Bullish

- capital

- Cause

- Censorship

- chairman

- change

- China

- chinese

- Coin

- coming

- Compound

- continue

- Costs

- Couple

- Crash

- crypto

- Crypto adoption

- Crypto Markets

- crypto mining

- Current

- data

- day

- Debt

- DeFi

- Demand

- Development

- DID

- Distributed Ledger

- distributed ledger technology

- Dollar

- dollars

- driving

- Drop

- dropped

- DX

- Early

- Elon Musk

- energy

- entrepreneurs

- ethereum

- EV

- exchange

- eye

- Federal

- Fees

- Figure

- First

- food

- funds

- future

- General

- Gold

- Government

- Governments

- Guest

- Guest Post

- hash

- hash rate

- Headlines

- High

- history

- How

- hr

- HTTPS

- ia

- Impact

- Increase

- inflation

- Innovation

- Institutional

- intotheblock

- investment

- Investors

- IT

- keeping

- keys

- large

- latest

- lead

- leading

- Ledger

- Legal

- lending

- Level

- Leverage

- Line

- liquidations

- Loans

- major

- Majority

- Making

- Market

- Markets

- Media

- medium

- Mempool

- metal

- Miners

- Mining

- months

- Near

- net

- network

- news

- North

- north america

- Opportunity

- Other

- owners

- Pay

- People

- performance

- platform

- Platforms

- policy

- power

- pressure

- price

- private

- Private Keys

- Production

- profitability

- publish

- purchase

- raise

- Reading

- Ripple

- rush

- SegWit

- set

- shift

- Sichuan

- Size

- So

- Space

- spring

- State

- Storm

- stress

- Supports

- Technology

- Technology Development

- texas

- time

- transaction

- Transactions

- Trends

- us

- US Dollar

- users

- value

- Wallet

- Wallets

- week

- within

- world

- worth

- writing

- year

- years