- Crypto Fear and Creed Index hit its 12-month low as investors were closer to ‘extreme fear’

- The downward move wiped out $200 billion in the altcoin market cap.

- Calling ‘alt season’ at the first sign of a recovery in Bitcoin’s price is an imprecise strategy.

Bitcoin reached a $64,900 all-time high on April 14 after accumulating 124.5% gains in 2021. Nevertheless, a 27.5% correction followed over the next eleven days, marking a $47,000 local bottom.

On April 25, the popular Crypto Fear and Greed Index hit its 12-month low, indicating that investors were closer to “extreme fear,” which was the exact opposite of the “extreme greed” level seen during the Bitcoin rally above $60,000.

Notably, this downward move from April 14 to April 25 wiped out $200 billion in the altcoin market capitalization. However, the ensuing recovery could serve as a guide to what to expect when Bitcoin finally manages to exit below the $40,000 level.

Altcoins showed a similar trend, bottoming out at $850 billion on April 22 but fully recovering to an all-time high of $1.34 trillion on May 10. On the other hand, there is no guarantee that this pattern will be repeated. That’s why experts are using the recent market itself as a source of information.

Cheaper does not always mean better

Many investors believe that altcoins are consistently outpacing the rise in the Bitcoin price, but is that so?

While this was the case in 2021, Bitcoin was the clear winner in the last quarter of 2020 as it outperformed the broader market by 110%. Still, experts’ analysis of the winners of the bull run at the end of April can present interesting insights into what to expect from the next rally.

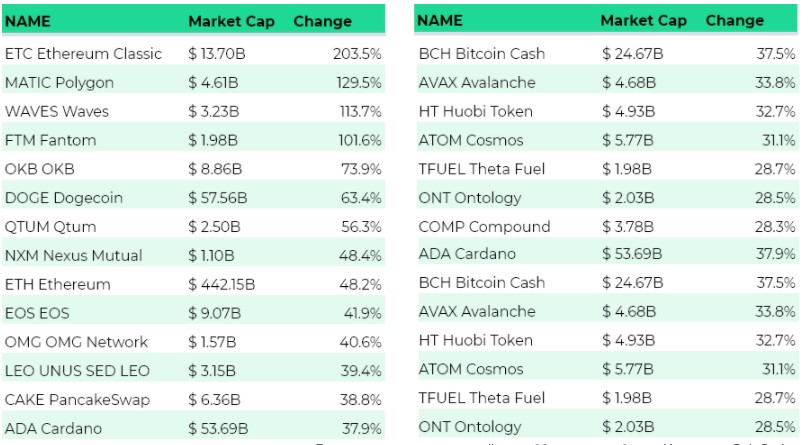

Among the top-100 tokens, Ether Classic, Polygon, Waves, and Fantom were the obvious winners. The winners were either smart contract platforms or scaling solutions, with the sector leader Ether also outperforming the market.

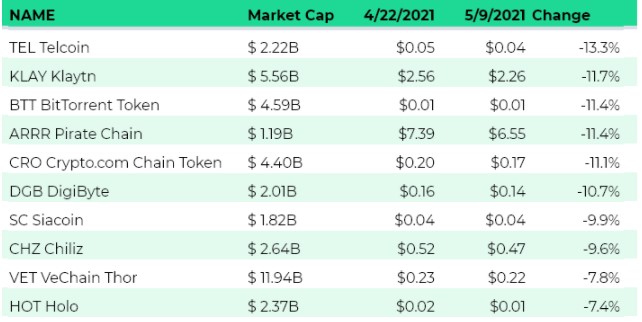

80% of the worst performances were tokens under $1, which is exactly the opposite of the usual expectations of investors. There is a tenacious myth that cheap altcoins will differ during an altcoin rally, but this is clearly not the case.

It is impossible to time the market

Unfortunately, it is impossible to predict when the current correction will end, and altcoins historically are not doing well during bearish trends. This means that calling ‘alt season’ at the first sign of a recovery in Bitcoin’s price is an imprecise strategy that could lead to financial ruin.

The general rule of thumb for the start of an ‘alt season’ is two or three consecutive days, when 30% or more of the cumulative gains from cryptocurrencies barely evolve, including Dogecoin, Litecoin, and Ether Classic.

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.

Follow us on Twitter, Telegram and Google News

Source: https://coinquora.com/bitcoins-next-breakout-may-not-be-an-altcoin-season-signal/

- 000

- 2020

- 9

- advice

- All

- Altcoin

- Altcoins

- among

- analysis

- April

- article

- bearish

- BEST

- Billion

- Bitcoin

- Bitcoin Price

- Bitcoin Rally

- breakout

- Bull Run

- closer

- contract

- crypto

- cryptocurrencies

- Current

- Dogecoin

- dollars

- eleven

- Ether

- Exit

- experts

- Finally

- financial

- First

- General

- guide

- High

- HTTPS

- Including

- index

- information

- insights

- investing

- investment

- Investors

- IT

- lead

- Level

- Litecoin

- local

- Market

- Market Cap

- Market Capitalization

- move

- Opinions

- Other

- Pattern

- performance

- Platforms

- Popular

- present

- price

- rally

- recovery

- research

- Run

- scaling

- smart

- smart contract

- So

- Solutions

- start

- Strategy

- time

- Tokens

- Trends

- us

- USD

- users