DIA and Chainlink prices are held in tight ranges. However, DIA/USDT prices are open for $3 as LINK/USDT bulls aim to close above $35.

Chainlink (LINK)

The blockchain-agnostic and oracle service provider Chainlink has struck deals with many trusted partners. Through the protocol, providers can monetize their data. LINK is the platform’s utility token.

Past Performance of LINK

There are gains in the daily chart, but LINK struggles to make advances against BTC and ETH.

LINK is at near breakeven versus BTC on the last trading week, adding five percent against USD and trailing ETH—losing eight percent.

Meanwhile, trading volumes are down 24 percent to around $1 billion.

Day-Ahead and What to Expect

LINK/USDT prices remain on consolidation within a $12 range zone with identifiable caps at $35 and $23.

From a top-down approach, buyers are still in control.

Determining the daily chart, LINK found support at the 61.8 percent Fibonacci retracement level of the Q1 2021 trade range.

This level, $20, is critical in the short-to-medium term, anchoring bulls.

LINK/USDT Technical Analysis

LINK price action is defined by the May 19 bear bar since bulls are struggling to unwind losses.

In the short term, every low may be a buying opportunity with targets at $54.

If LINK/USDT prices fall below $23, bears may flow back, forcing prices to $13 in a sell-off, reflecting those of mid-May 2021.

DIA

The oracle provider is angling to be the “Wikipedia of financial data.”

Using the DIA token, the Ethereum-based platform links smart contracts with verified off-chain data.

Past Performance of DIA

There were less than 220 DIA transactions on the last day.

Meanwhile, price is retracting from all-time highs. As of writing, DIA is up seven percent week-to-date against the USD.

At the same time, it is up roughly eight percent against BTC and ETH on the last trading day.

The only exception is the shrinking trading volumes which fell 24 percent to $19.8 million.

Day-Ahead and what to Expect

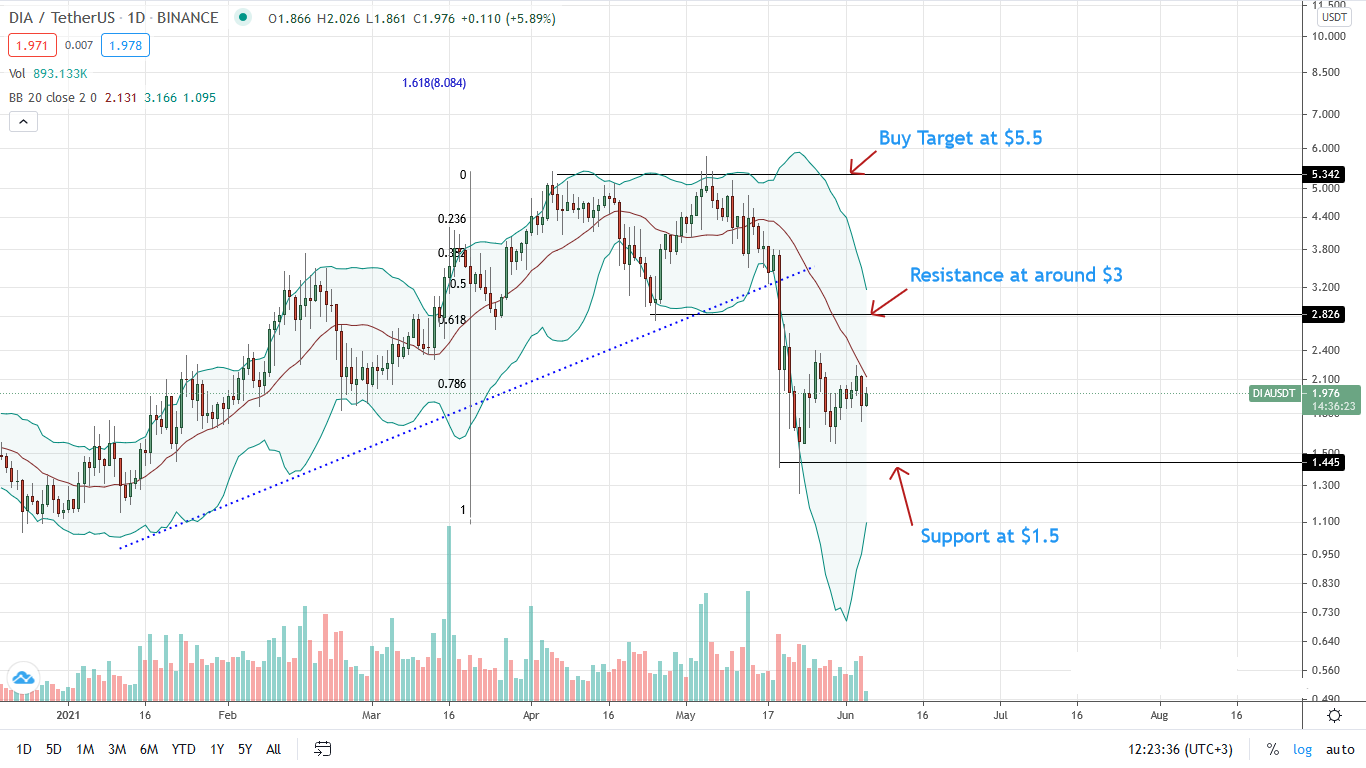

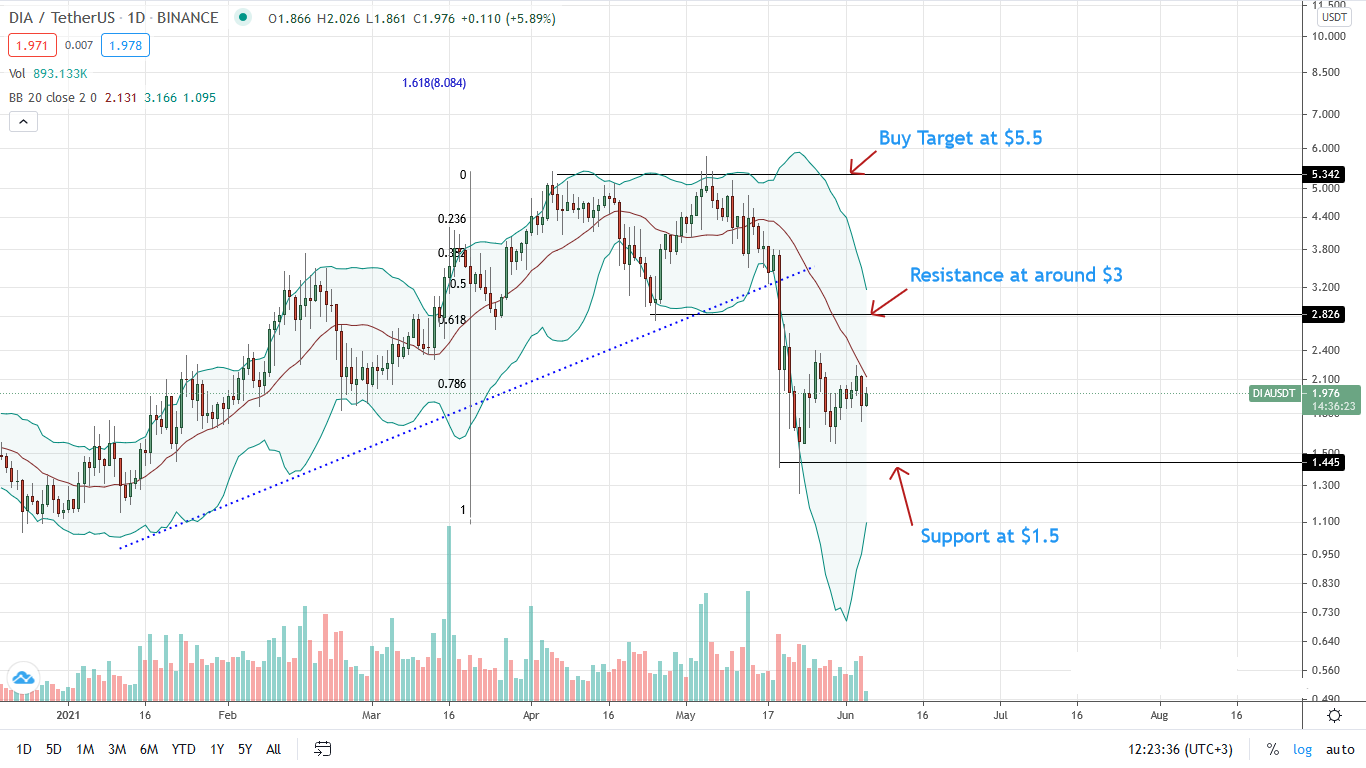

DIA/USDT is trading within a bear breakout pattern, sinking below a multi-month support trend line—now resistance.

Besides, DIA prices are pinned inside May 19 bear bar and below the middle BB. Technically, this is bearish, only invalidated once DIA races past $3.5, wiping sellers of May 19.

DIA/USDT Technical Analysis

Price action favors DIA bears in the short-term despite gains of the last day and week.

Nonetheless, aggressive DIA traders can buy the dips targeting $3—the main resistance level. Catalysts for more demand will be present, especially if bulls edge past the middle BB in the short term.

Confirmation of June 4 losses in a bear trend continuation could trigger a sell-off below the primary support at $1.5 towards $1.

Source: https://www.cryptoknowmics.com/news/chainlink-link-and-dia-technical-analysis-what-to-expect

- "

- 000

- Action

- active

- analysis

- around

- bearish

- Bears

- Billion

- border

- breakout

- BTC

- Bulls

- buy

- Buying

- Chainlink

- chainlink (link)

- Coins

- consolidation

- contracts

- Customers

- data

- day

- Deals

- Demand

- Edge

- ETH

- Figure

- financial

- financial data

- flow

- future

- hack

- HTTPS

- IT

- Kraken

- Level

- LINK

- million

- Monero

- Near

- net

- open

- Opportunity

- oracle

- Pattern

- performance

- platform

- Posts

- present

- price

- Q1

- range

- Sellers

- Short

- smart

- Smart Contracts

- So

- support

- surge

- Technical

- Technical Analysis

- time

- token

- trade

- Traders

- Trading

- Transactions

- u.s.

- USD

- utility

- Utility Token

- Versus

- week

- within

- writing