About a fortnight ago, May 12 to be exact, Elon Musk dropped a sucker-punch on the Crypto markets when he took to Twitter to announce that his company Tesla had stopped vehicle purchases using Bitcoin. Concerns about the “rapidly increasing use of Fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel”, were sighted by Elon for this decision. The world’s richest man went on to say that, “Cryptocurrency is a good idea on many levels” and he and his company “believe it has a promising future, but this cannot come at a great cost to the environment”.

Tweet by Elon Musk Sends Bitcoin Into A Downward Spiral

This Twitter announcement sent the market into a selling frenzy as traders started to dump Bitcoin because people interpreted the announcement as Tesla looking to sell its Bitcoin holdings. The top cryptocurrency was down by 38.3% and the whole market lost over $800b and is still struggling to recover from that dump, with Bitcoin currently trading around the $40,000 range.

To back his tweet, Elon pointed to research by Cambridge University that showed Bitcoin’s electricity consumption increasing this year.

While Elon isn’t entirely wrong about the energy concerns surrounding Bitcoin, there are even bigger concerns about energy consumption when it comes to Bitcoin’s direct rival; the traditional finance industry and I’ll talk about them in this article.

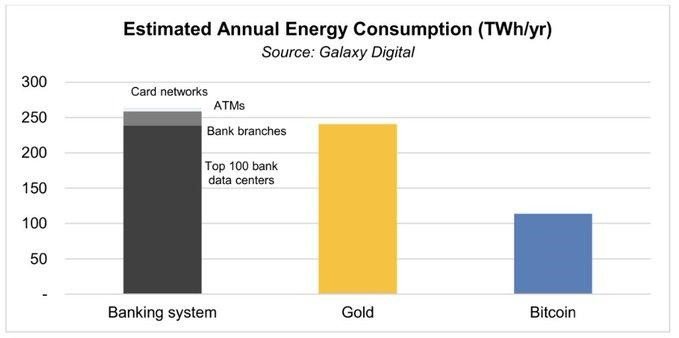

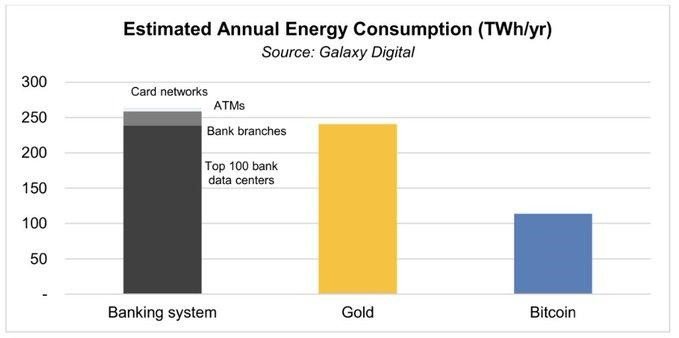

One major concern is how studies have shown that the traditional banking sector uses 2x the energy Bitcoin mining does.

Let’s delve more into this.

According to a recently released study by Galaxy Digital, a Cryptocurrency Investment firm, the energy consumption of the entire Bitcoin network is estimated at 113.89 terawatts per hour (TWh) and out of this, 99% comes from mining computers which carry out work that includes everything from pool power consumption to node power consumption to miner power consumption to energy for mine demand.

While this may seem like a lot of energy, the figure is lower than that of the University of Cambridge Centre for Alternative Finance, which estimated Bitcoin’s energy consumption at 128 TWH as of March 2021. Both of these statistics though are less than half of what the traditional banking system consumes. Theirs is estimated at 263.72 TWH.

While it is only electricity spent by miners to mine Bitcoin that can be considered for the bitcoin industry – because there is no energy usage in bitcoin transactions on exchanges -, energy usage by bank branches, card network’s data centers, ATMs, and banking data centers all contribute towards the energy use by the traditional finance sector.

All of these are enshrouded in the all too ‘secretive’ way by which electricity consumption reports can be gotten for the traditional finance system. And this has made sure the energy consumed in the industry has been kept under wraps for years now. Compare this to bitcoin which offers final settlement and reports are gotten in a straightforward manner because of its transparency. As I have already hinted, the banking system does not do the same. They require multiple settlement layers and do not report electricity consumption directly.

Also, miners are starting to look at using green energy (renewable energy) for mining as it’s getting a lot cheaper to produce them. This will result in Bitcoin mining having an even smaller carbon footprint and less harm to the environment. A lot more effort in adopting greener energy than can be said for the banks. Places like Iceland and the province of Sichuan in China are known to attract miners due to their cheap electricity and rich hydropower resources.

Last month, amidst all of the arguments about Bitcoin causing carbon emissions and leading to degradation of the environment, Square, the fintech company owned by Twitter chief Jack Dorsey, and Cathie Wood’s Ark Invest released a whitepaper where they argued in favor of Bitcoin mining. In the paper, they made salient points as to how the asset will actually drive renewable energy innovation. Elon should have read that paper.

If you ask me, I’d say it also stinks a bit like hypocrisy if Elon Musk is talking about sustainable energy when SpaceX isn’t exactly practicing sustainable energy with its rockets as they continue to use rocket fuel.

GoMining Token (GMT) Looking to Solve the Problem of Mining

Mining Bitcoin isn’t an easy job and this is why not a lot of investors are into it. Complexities as a result of the high cost of buying equipment, installation of this equipment, delivery to a data center, connection to a stable and fast network, and all of the other technical complexities of mining prevent non-professional investors from making forays into mining.

The GoMining token however has stepped in to solve these problems with a simple but very efficient solution. GoMining is a professional mining company that was founded by international investors in 2017. The company spends most of the earned money on the construction of new data centers, the purchase of equipment and the development of infrastructure. The GoMining token is backed by real assets, with a daily income payment in Bitcoin (BTC) to its owners.

Some of the headaches this token solves for you as an investor is it

- Constructs and maintains data centers and high voltage infrastructures.

- Purchases equipment and arranges international logistics of that equipment.

- Sets up this equipment and develops software integrations with pools.

- Services, maintains, and repairs these equipment when they develop faults.

- Build relationships with regional authorities and comply with legalities.

- Maintains legal support for clients.

As a GMT holder, you don’t have to think about purchasing equipment, setting it up, maintaining and upgrading it, and being involved in the bureaucratic process of mining. All of these are done for you by the GMT service centers. The token, unlike the mining equipment, is a highly liquid asset. You can sell it in just a few minutes. In other words, it doesn’t suffer from all the problems getting mining equipment gives you.

GMT holders, just like it is when you mine bitcoin, earn profit that is paid out directly to the holder’s wallet from the pool. So, imagine holding an asset that is exchange-tradable, and at the same time brings you passive income on a daily basis. This is what GoMining token is offering.

And among other things, 80% of GMT’s electricity comes from environmentally friendly sources such as wind and hydroelectric power. “Elon, you’re wrong,” the company confidently declares on its social networks.

Elon is silent, but the discussion has only just begun.

Source: https://www.cryptoknowmics.com/news/elon-musks-bitcoin-sentiment-is-wrong

- "

- 000

- 2020

- active

- All

- among

- Announcement

- arguments

- Ark

- around

- article

- asset

- Assets

- Bank

- Banking

- Banks

- Bit

- Bitcoin

- Bitcoin mining

- bitcoin transactions

- border

- BTC

- Bullish

- Buying

- cambridge

- carbon

- carbon emissions

- chief

- China

- Coal

- company

- computers

- construction

- consumption

- continue

- crypto

- Crypto Markets

- cryptocurrency

- data

- data centers

- delivery

- Demand

- develop

- Development

- digital

- dropped

- electricity

- Elon Musk

- Emissions

- energy

- Environment

- equipment

- ETH

- Exchanges

- FAST

- Figure

- finance

- fintech

- Firm

- Fuel

- future

- Galaxy Digital

- good

- great

- Green

- green energy

- High

- How

- HTTPS

- idea

- Income

- industry

- Infrastructure

- Innovation

- integrations

- International

- investment

- investor

- Investors

- involved

- IT

- Job

- leading

- Legal

- Liquid

- logistics

- major

- Making

- man

- March

- Market

- Markets

- Miners

- Mining

- money

- network

- networks

- offering

- Offers

- Other

- owners

- Paper

- payment

- People

- pool

- Pools

- Posts

- power

- Profit

- purchase

- purchases

- range

- Recover

- Relationships

- renewable energy

- report

- Reports

- research

- Resources

- Rival

- sell

- sentiment

- setting

- settlement

- Sichuan

- Simple

- So

- Social

- social networks

- Software

- SOLVE

- SpaceX

- square

- started

- statistics

- studies

- support

- sustainable

- system

- talking

- Technical

- Tesla

- time

- token

- top

- Traders

- Trading

- traditional banking

- traditional finance

- Transactions

- Transparency

- tweet

- university

- university of cambridge

- vehicle

- Wallet

- Whitepaper

- wind

- words

- Work

- xrp

- year

- years