There was good news on the UK inflation front, as the November data pointed to a drop in inflation. CPI fell to 10.7% y/y, down from 11.1% in October and below the consensus of 10.9%. Core CPI eased to 6.3% y/y, down from 6.5% a month earlier, which was also the consensus. Even with the welcome drop in inflation, it still remains in double digits and is more than five times the Bank of England’s target of 2%.

The British pound is almost unchanged today, despite the drop in inflation. This is in sharp contrast to the reaction on Tuesday to the drop in US inflation, which fell to 7.3% and was softer than expected. The US dollar was about 1% lower against the majors, as once again a soft inflation report raised hopes that the end of the Fed’s tightening cycle is not far off.

Todos os olhos no Federal Reserve

The Fed will announce the benchmark rate later today, after Tuesday’s dramatic CPI report. Inflation fell to 7.1%, down from 7.7% and below the consensus of 7.3%. This hasn’t changed the pricing of an 80% likelihood that the Fed will deliver a 50-basis point hike. The markets will be listening carefully to the tone of Jerome Powell’s rate statement and follow-up remarks, hoping for clues about the next meeting in February. There is a strong chance that the Fed will hike by 25 bp in February and then end the current rate-hike cycle at a terminal rate of 4.75%, on the lower side of the 4.75% to 5.25% range that is considered most likely.

BoE rate decision next

The BoE meets on Thursday and is expected to deliver a 50-basis point hike, which would raise the benchmark rate to 3.50%. This week’s employment and inflation numbers were within market expectations, and a stronger pound has also helped lower the need for a more aggressive 75-bp move. We could see some disagreement among MPC members in today’s vote, which could shed some light on where the BoE goes from here.

Thursday’s rate decision is the final one of the year, with the next meeting not until February 2nd. The most likely scenarios are for a hike of either 25 or 50 points. There is speculation that the February meeting could mark the end of the current tightening cycle, but I am sceptical unless inflation has fallen dramatically by then.

.

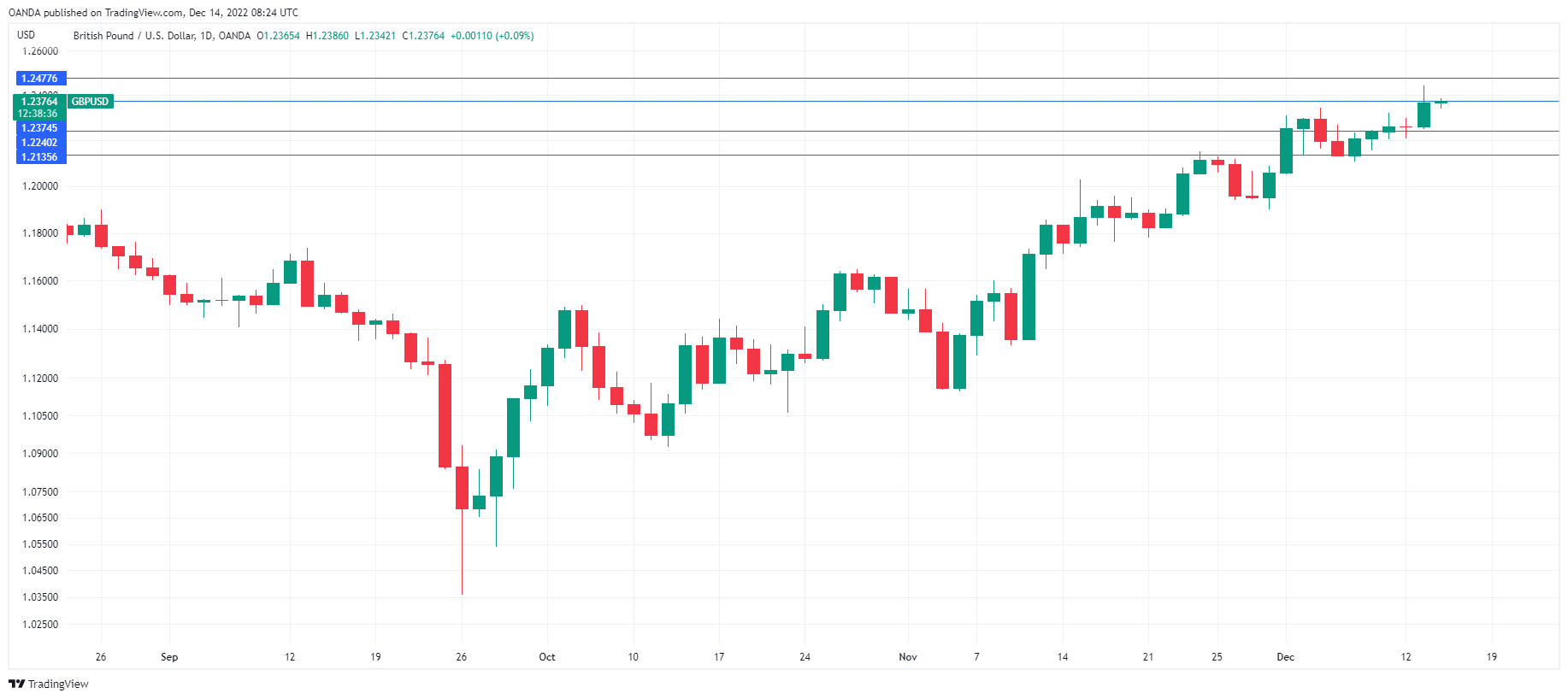

GBP / USD Técnico

- 1.2240 e 1.2136 são os próximos níveis de suporte

- GBP/USD está testando a resistência em 1.2374. Em seguida, há resistência em 1.2478

Este artigo é apenas para fins de informação geral. Não é um conselho de investimento ou uma solução para comprar ou vender títulos. As opiniões são os autores; não necessariamente da OANDA Corporation ou de qualquer uma das suas afiliadas, subsidiárias, executivos ou diretores. A negociação alavancada apresenta alto risco e não é adequada para todos. Você pode perder todos os seus fundos depositados.

- Bitcoin

- blockchain

- conformidade do blockchain

- conferência blockchain

- Decisão de taxa de BOE

- Bancos Centrais

- coinbase

- Coingenius

- Consenso

- conferência de criptografia

- crypto mining

- criptomoedas

- Descentralizada

- DeFi

- Ativos Digitais

- ethereum

- Reunião de taxa do Fed

- FX

- GBP

- GBP / USD

- aprendizado de máquina

- MarketPulse

- Noticias & Eventos

- Fonte de Notícias

- token não fungível

- platão

- platão ai

- Inteligência de Dados Platão

- Platoblockchain

- PlatãoData

- jogo de platô

- Polygon

- prova de participação

- IPC básico do Reino Unido

- Reino Unido CPI

- CPI dos EUA

- USD

- W3

- zefirnet