Bitcoin and Ethereum both tested their initial targets of $40,000 and $2400 over the past day, after consistently rallying over the last week. The market sentiment is currently improving for both assets. While Bitcoin has been the driving force for the majority of the bull markets, smaller altcoins have rallied behind Ether’s bullish period as well.

Leta 2021 je Bitcoin dosegel najvišjo vrednost med 15. in 20. aprilom in dosegel vrednost 64,000 USD. Temu so sledila tudi druga sredstva, ko pa se je Ethereum 4375. maja dotaknil ATH v višini 1 USD, so mu sledila sredstva, kot sta Ethereum Classic in MATIC.

Upoštevajoč bikovsko perspektivo v ozadju smo analizirali, katero sredstvo bo v naslednjih nekaj tednih cenovnega delovanja verjetno preseglo drugo.

Primerjava ravni med Bitcoin in Ethereum

The price structure for both Bitcoin and Ethereum look similar but both assets have different bullish resistance ranges. For Bitcoin, $42,000 is the range above which the asset needs to close a daily candle, after which a strong bullish narrative can be justified.

za Ethereum, the price range is $3000. Now, there are evident discrepancies in terms of ETH’s range being more far off in terms of percentage growth, but it is the same range that was re-tested post-May 19th, after which collective collapse was observed.

Tako za Bitcoin kot za Ethereum gre trenutno za prečkanje njunih stopenj 42,000 in 3000 dolarjev, da bi narekovali rally. Vprašanje je, katero sredstvo najprej uporabi?

Korelacijski status in razpon nestanovitnosti

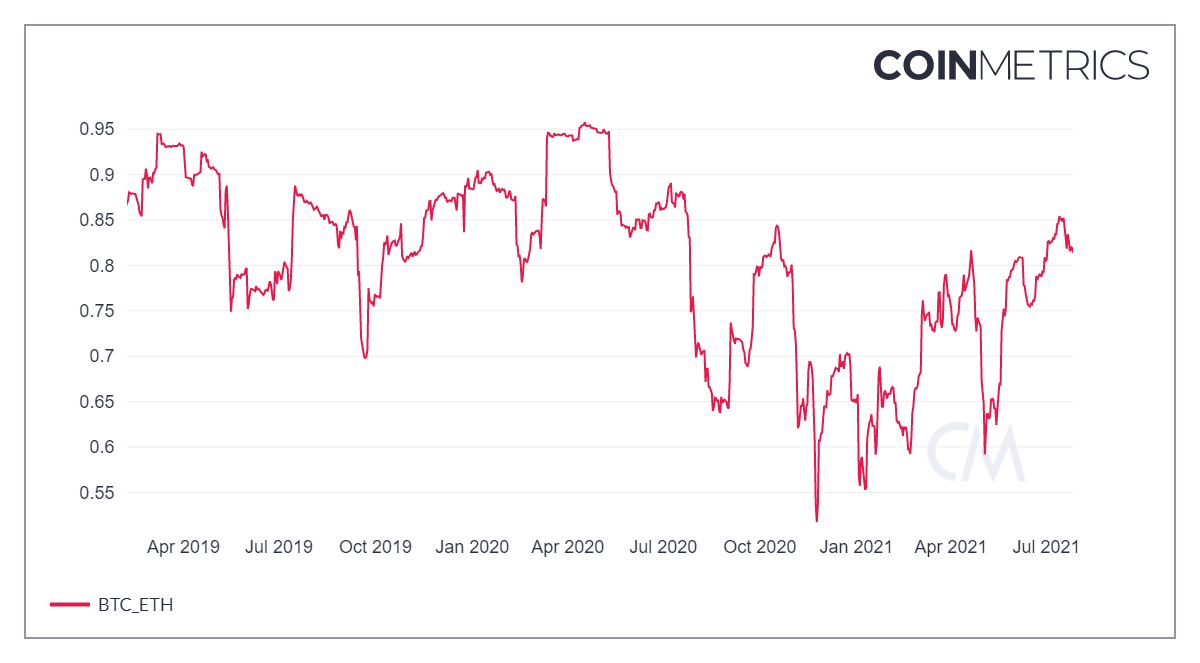

Analiza korelacijske karte med Bitcoinom in Ethereumom je pokazala, da imata oba sredstva v zadnjih nekaj mesecih višjo stopnjo korelacije. Trenutno znaša 0.85, kar pomeni, da je ne glede na prevlado prevladujoča linearnost med obema, premikanjem navzgor ali navzdol. Vendar kratkoročni razmiki nestanovitnosti razkrivajo več o trenutnem zagonu na trgu.

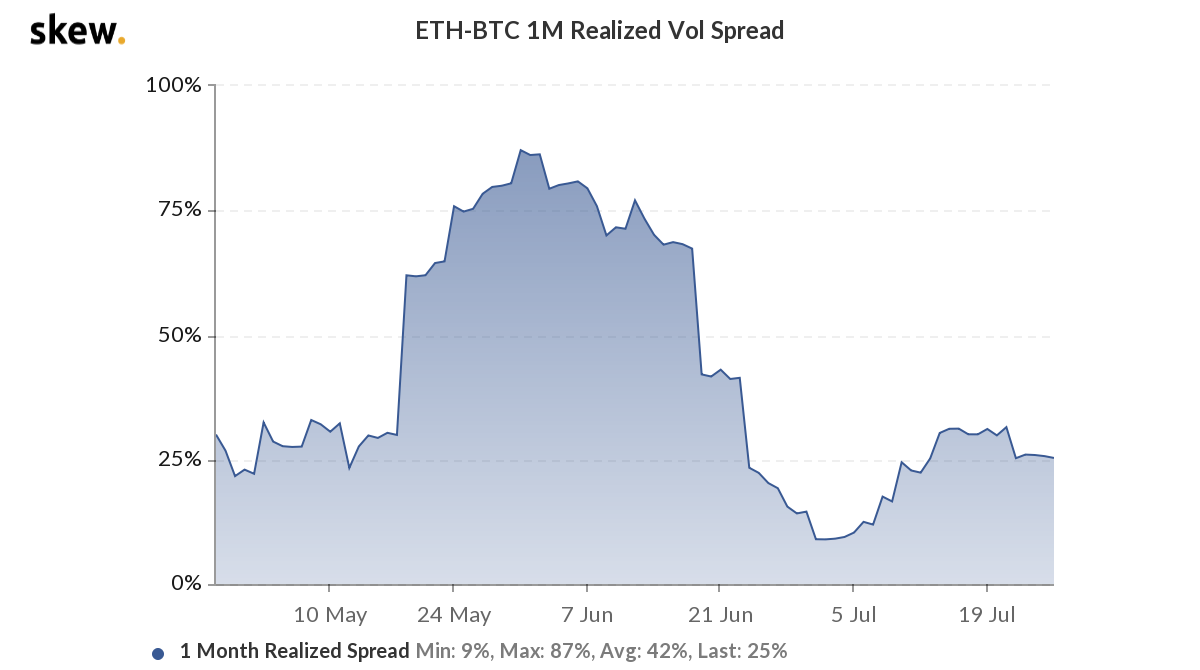

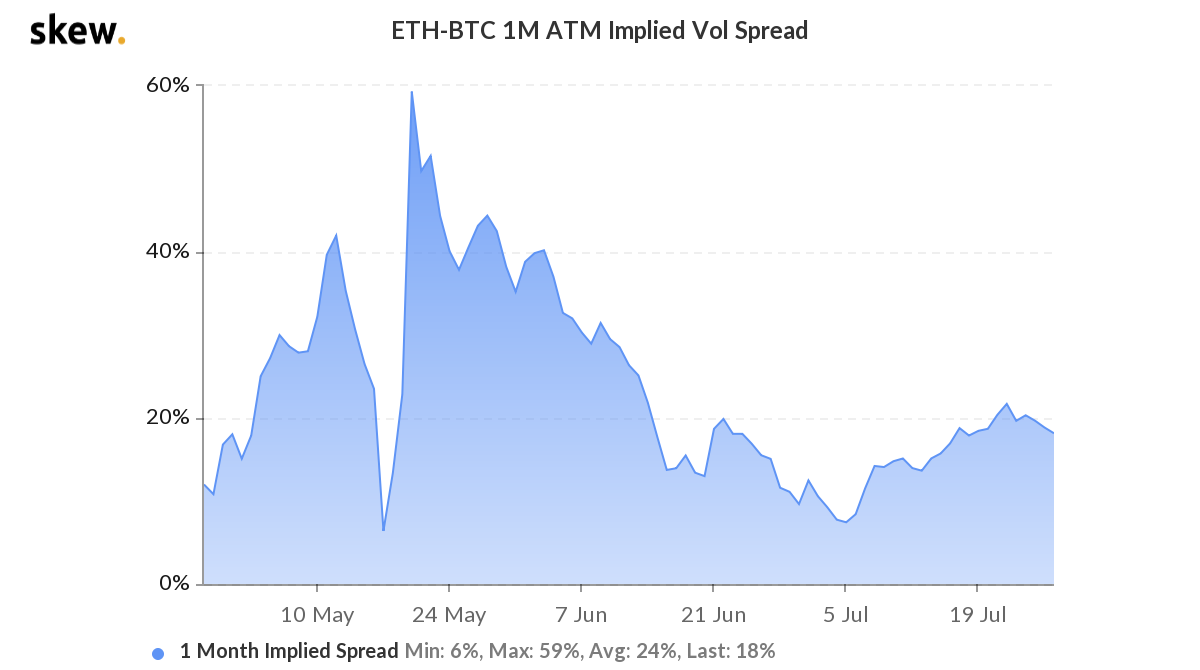

ETH-BTC 1-mesečni razpon volatilnosti in 1 implicitni razmik volatilnosti kažeta, katero sredstvo ima v zadnjih mesecih prevladujoče lastništvo nad drugim. Vsakič, ko se oba indeksa dvigneta, je Ethereum v veliki meri premagal volatilnost v bikovski in medvedji smeri. Trenutno ETH-BTC realizirana in implicitna volatilnost upada, kar pomeni, da ima BTC pozicijsko prednost.

Če upoštevamo to pripoved, se bo Bitcoin, ki doseže 42,000 USD, verjetno zgodil, preden Ethereum doseže 3000 USD. Začetno okrevanje trenutno podpira nestanovitnost Bitcoinov, ki je močnejša in bolj usmerjena.

Kam vlagati?

Naročite se na naše najnovejše novice in analize Crypto spodaj: