January Market Outlook

Where will crypto go this year?

2021 witnessed a fourth major bull cycle for bitcoin and crypto. Historically, in the years that followed the prior big bull runs we’ve seen a struggle to hold gains (to put it politely).

And with one of the general lessons of economic history being the frequent temptation to incorrectly believe “this time is different” it may seem reasonable to expect a crypto market crash in 2022.

But we see multiple reasons to be optimistic that crypto prices could break with the historical pattern and finish 2022 even higher than where they ended in 2021.

For one, there is a now near universal recognition that crypto is not going away. This was not the case after any of the prior bull runs, including the most recent 2017 initial coin offering fueled boom.

Further, with rapidly growing interest in new categories like kripto umetnost, blockchain-powered gaming, plačila s stabilnimi kovanci, and other massive economic sectors, the present multi-trillion dollar total market value of all cryptoassets is defensible in our view.

A few factors that are likely to drive crypto higher in 2022 include:

- A record-setting wall of crypto VC money raised in 2021 that is being deployed ($25b vs. a previous high of $6b)

- Bitcoin is still valued at a small fraction of the total market value of gold and yet is increasingly recognized as the future of “store of value”

- As legendary investor Bill Miller stated, bitcoin “gets less risky the higher it goes”. This is “the opposite of what happens to most stocks”, Miller added, lending support to the thesis that more institutions (which are underexposed to crypto and arguably overexposed to stocks) will allocate more capital into crypto in 2022

- Numerous fundamental technical improvements expected in 2022 including the Ethereum 2.0 proof-of-stake protocol upgrade and improvements to layer 2 scaling solutions

- And so much more

Now, to be clear, we are not expecting it to be all roses this year:

- As crypto investors become more discerning we see a growing chance of a shakeout amongst the many (too many, in our view) competing “Ethereum killer” smart contract platforms

- The ambitious development roadmap and associated technical and execution risks that many crypto players face in 2022 may not be priced-in

- Regulatory developments will continue to play an important role in how crypto markets evolve

In short, continued crypto turbulence should be expected.

But the bottom line as we begin a new year is that we have never been more optimistic and confident about the future of crypto.

Hodl higher!

Povzetek:

- Premiki trga

- For 2021 cryptoasset markets massively outperformed other asset classes with Bitcoin (BTC) up a solid 60% and Ethereum (ETH) up a whopping 397%

- On the year many cryptoassets were up a staggering 1,000%+, such as Dogecoin ($DOGE), with a select group up over 10,000%+ including Polygon (MATIC), Solana (SOL), Terra (LUNA), Axie Infinity (AXS)

- Gold suffered a historic setback as a store of value, dropping 4% in a year with the highest consumer price inflation in four decades

2. Vpogled v verigo

- Bitcoin’s estimated hash rate increased 7.1% in December, alongside a 0.6% gain on the average daily active addresses.

- Overall bitcoin on-chain payments and transaction activity decreased in the month of December

3. Kaj beremo, slišimo in gledamo

- Bloomberg, Bitcoin Magazine, MIT Technology Review and much more

1. Tržna gibanja

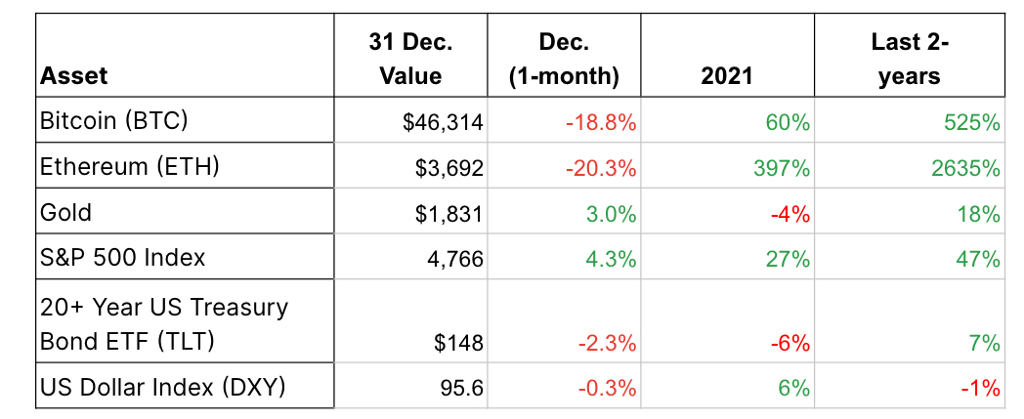

For 2021 cryptoasset markets massively outperformed other asset classes with Bitcoin (BTC) up a solid 60% and Ethereum (ETH) up a whopping 397% (Table 1).

Tabela 1: Uspešnost cene: Bitcoin, Ethereum, zlato, ameriške delnice, USD, dolgotrajne zakladnice ZDA

Viri: Blockchain.com, Google Finance

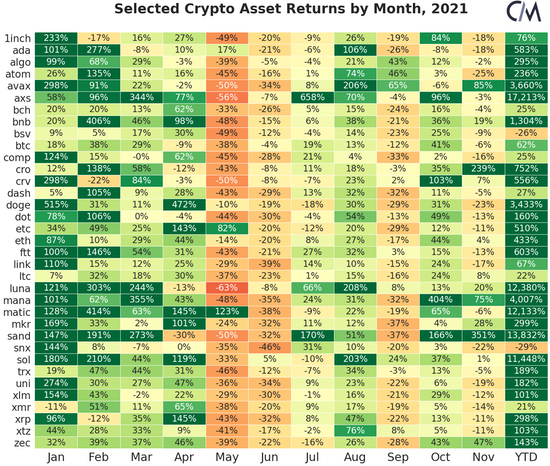

On the year many cryptoassets were up a staggering 1,000%+, such as Dogecoin ($DOGE).

a select group up over 10,000%+ including Polygon (MATIC), Solana (SOL), Terra (LUNA), Axie Infinity (AXS) (Figure 1).

Figure 1: Select Cryptoasset Returns by Month and for 2021

vir: CoinMetrics

Traditional markets were mixed on the year: stocks were up +27% for 2021 while gold suffered a historic setback as a store of value, dropping 4% in a year with the highest inflation in 40 years. The all-mighty long dated US treasury bond market also suffered, down an even greater 6% on the year.

December did see market conditions soften in crypto, with declines for Bitcoin (BTC) down 19% and Ethereum (ETH) down 20%. Some may fear a loss of momentum as we enter a new year.

A counterweight to these concerns is the lack of a singular, frenzied “blow-off top” moment in 2021 and the odpornost crypto prices have shown following multiple setbacks last year.

Indeed, the failure of crypto prices to implode as they consistently have in the past following epic bull runs like 2021 are a sign, in our view, of how much crypto markets have matured since the last great blow-off top year-end finish in 2017.

2. Dejavnost v verigi

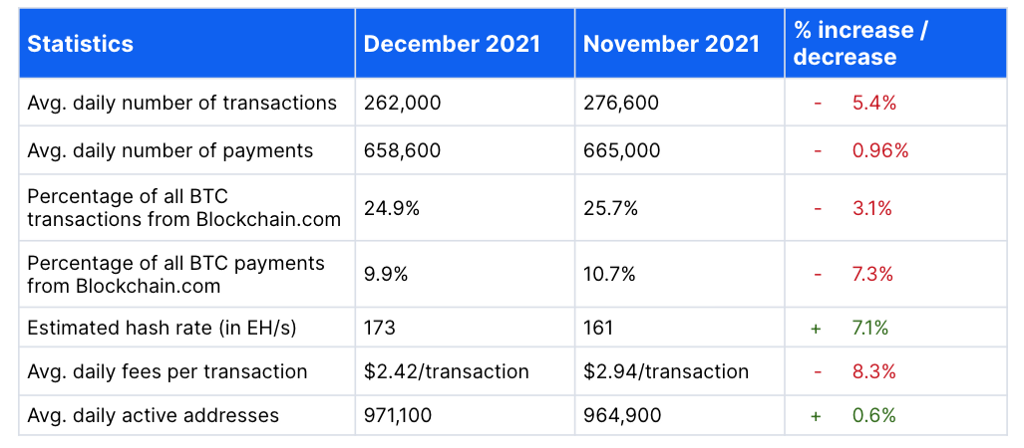

On a monthly basis, overall bitcoin on-chain activity continued declining in the month of December (Table 2).

Table 2: December vs November bitcoin on-chain network activity

The total BTC transactions and payments from Blockchain.com in December are down -3.1% and -7.3% respectively compared to November, as well as the average number of daily transactions (-5.4%) and payments (-0.96%).

The estimated hash rate has increased 7.1% this month, alongside a 0.6% gain on the average daily active addresses.

The average daily fees per transaction have dropped from $2.94 per transaction in November to $2.42 per transaction in December.

3. Kaj beremo, slišimo in gledamo

Crypto

- Bitcoin Magazine: This Is Bitcoin’s Moment, Don’t Let Politicians Waste It

- ChainAnalysis: The Biggest Threat to Trust in Cryptocurrency: Rug Pulls Put 2021 Scam Revenue Close to All-time Highs

- Coin Centre: Congress Takes Its War on Cash to Digital Assets

- Coin Metrics: State of the Network Issue 133

- Coin Metrics: State of the Network Issue 134

- Coinbase: Perspective: Bitcoin is Not Boring

- Dirt Road: Fei <> Rari: This Is Not an Exit, or Is It?

- How To Fix The Internet: The Life of the (Crypto) Party

- Jameson Lopp: Bitcoin 2021 Annual Review

- Liberty Street Economics: Why Central Bank Digital Currencies?

- NY Times: Can We Trust What’s Happening to Money?

- The Defiant: Governance of DeFi Giant Curve in Flux as Smaller Convex Exerts Control

Onkraj kripto

- All-In: The 2021 Bestie Awards PLUS Jack Dorsey starts the Web3 Wars

- Bloomberg: Omicron Sounds Death Knell for Globalization 2.0

- Epsilon Theory: Inflation and the Common Knowledge Game

- KrebsonSecurity: NY Man Pleads Guilty in $20 Million SIM Swap Theft

- MacRumours: Apple CEO Tim Cook ‘Secretly’ Signed $275 Billion Deal With China in 2016

- Marginal Revolution: In Which Ways Does Inflation Harm the Poor?

- MIT Technology Review: The US Crackdown on Chinese Economic Espionage is a Mess

- NY Times: Her Instagram Handle Was ‘Metaverse.’ Last Month, It Vanished

- SlashDot: Earth is Getting a Black Box To Record Events that Lead To the Downfall of Civilization

- The Economist: The Hidden Costs of Cutting Russia off from SWIFT

- The Intercept: Bit by Bit, the Noose Is Tightening Around the Nuclear Weapons Industry

Pomembno opozorilo

Raziskave, ki jih ponujamo tukaj, so namenjene splošnim informacijam in uporabi in niso namenjene obravnavi vaših posebnih zahtev.

Zlasti informacije ne predstavljajo nobene oblike nasveta ali priporočila Blockchain.com in niso namenjene temu, da bi se uporabniki zanašali nanje pri sprejemanju (ali vzdržanju) kakršnih koli naložbenih odločitev.

Pred kakršno koli takšno odločitvijo je treba dobiti ustrezen neodvisen nasvet.

![]()

2022: Višje je bil prvotno objavljen v @blockchain na Medij, kjer ljudje nadaljujejo pogovor s poudarjanjem in odgovorom na to zgodbo.

Source: https://medium.com/blockchain/2022-higher-f58c5a8d3bbb?source=rss—-8ac49aa8fe03—4

- "

- 7

- aktivna

- nasveti

- vsi

- Apple

- okoli

- sredstvo

- Banka

- največji

- Bill

- Billion

- Bit

- Bitcoin

- črna

- blockchain

- Blockchain.com

- Bloomberg

- boom

- Pasovi

- BTC

- transakcije btc

- Kapital

- Denar

- Centralna banka

- digitalne valute centralne banke

- ceo

- verigo

- Kitajska

- kitajski

- CNBC

- Coin

- coinbase

- Skupno

- Kongres

- Potrošnik

- naprej

- Naročilo

- Pogovor

- stroški

- Crash

- kripto

- Kripto tržnica

- Crypto Markets

- cryptocurrency

- plačila

- krivulja

- ponudba

- Defi

- Razvoj

- DID

- digitalni

- digitalne valute

- Dogecoin

- Dollar

- padla

- Zemlja

- Gospodarska

- Economics

- vohunjenja

- ETH

- ethereum

- ethereum (ETH)

- ethereum 2.0

- dogodki

- Izhod

- Obraz

- Napaka

- pristojbine

- Slika

- fiksna

- obrazec

- Prihodnost

- splošno

- Gold

- upravljanje

- veliko

- skupina

- Pridelovanje

- hash

- hitrost hash

- visoka

- zgodovina

- držite

- Kako

- HTTPS

- Vključno

- inflacija

- Podatki

- Začetna ponudba kovancev

- Institucije

- obresti

- Internet

- naložbe

- Investitor

- Vlagatelji

- IT

- znanje

- vodi

- posojanje

- vrstica

- Long

- velika

- Izdelava

- moški

- Tržna

- Prisotnost

- Matic

- srednje

- Meritve

- milijonov

- MIT

- mešano

- Momentum

- Denar

- Blizu

- mreža

- novo leto

- NY

- ponujanje

- Ostalo

- Vzorec

- Plačila

- ljudje

- performance

- perspektiva

- Predvajaj

- poligon

- slaba

- predstaviti

- Cena

- Dokaz o deležu

- protokol

- reading

- Razlogi

- Zahteve

- Raziskave

- vrne

- prihodki

- pregleda

- Rusija

- skaliranje

- Prevara

- Sektorji

- Neuspeh

- Kratke Hlače

- DA

- Zamenjava SIM

- majhna

- pametna

- pametna pogodba

- So

- Solana

- Država

- Zaloge

- trgovina

- ulica

- podpora

- tehnični

- Tehnologija

- Zemlja

- čas

- vrh

- transakcija

- Transakcije

- Zaupajte

- Universal

- us

- ameriški dolar

- Uporabniki

- vrednost

- vrednoti

- VC

- Poglej

- vojna

- Web3

- leto

- let