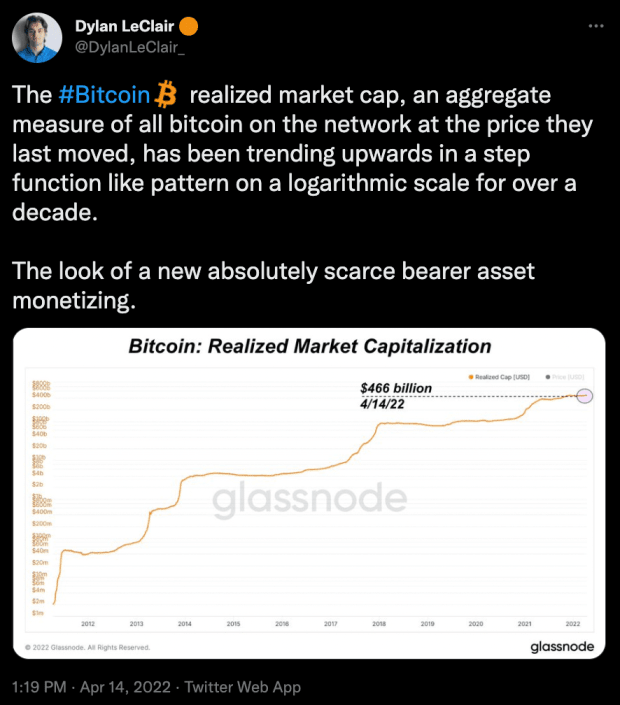

Realized market capitalization of bitcoin is one of the best ways to quantify the monetization process and the metric is showing re-accumulation.

Spodaj je izvleček iz nedavne izdaje revije Bitcoin Magazine Pro, glasila o vrhunskih trgih revije Bitcoin Magazine. Če želite biti med prvimi, ki bodo te vpoglede in druge analize trga bitcoinov v verigi prejeli naravnost v svoj nabiralnik, naročite se zdaj.

Realizirani trendi tržne kapitalizacije

Today, we’re providing an in-depth breakdown of realized market capitalization. Traditional asset classes along with bitcoin itself are often quoted in terms of their market capitalization, which is calculated by finding the product of price and circulating supply. With bitcoin, and the introduction of a completely transparent set of property rights, you can calculate the realized market capitalization, which values each unit of supply at the price it was last moved across the network.

The realized market capitalization of bitcoin is one of the best ways to quantify the monetization process of the asset, as the infamous volatility of the asset is seemingly only occurring to the upside. The fluctuations in the exchange rate are not nearly as volatile as the gradual-then-sudden appreciation of the realized market value of the asset.

The realized market capitalization of bitcoin is one of the best ways to quantify the monetization process of the asset, as the infamous volatility of the asset is seemingly only occurring to the upside. The fluctuations in the exchange rate are not nearly as volatile as the gradual-then-sudden appreciation of the realized market value of the asset.

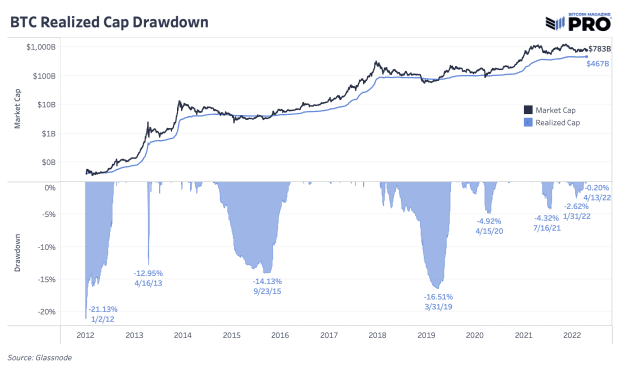

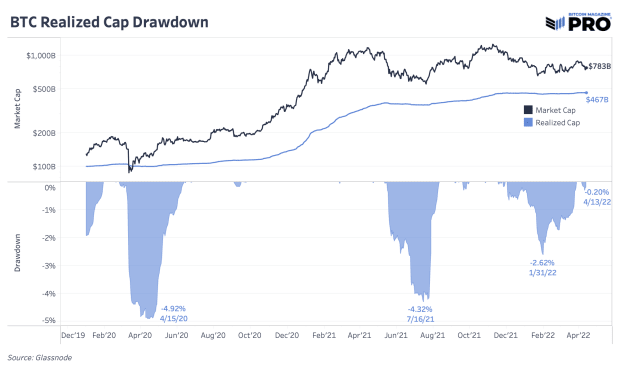

Currently the realized cap of bitcoin is $467 billion, a mere 0.20% off of its all-time high. Despite falling by more than 50% off of the highs since November, the realized market value of bitcoin has only fallen from peak to trough by 2.62%.

A navoj written in December 2021 covers this dynamic extensively, citing the patterns of realized price during bitcoin market cycles.

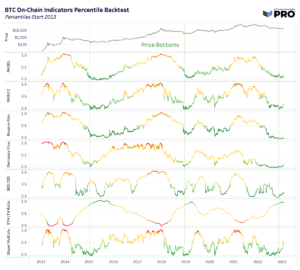

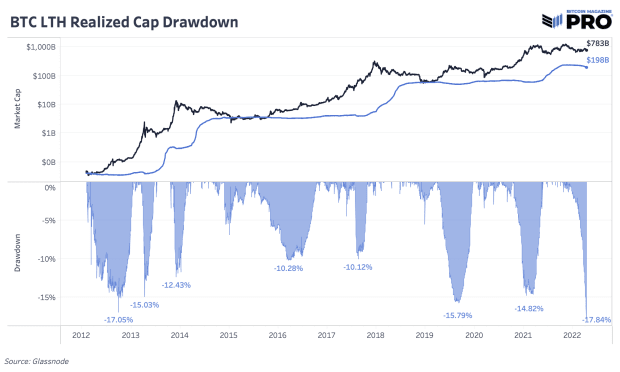

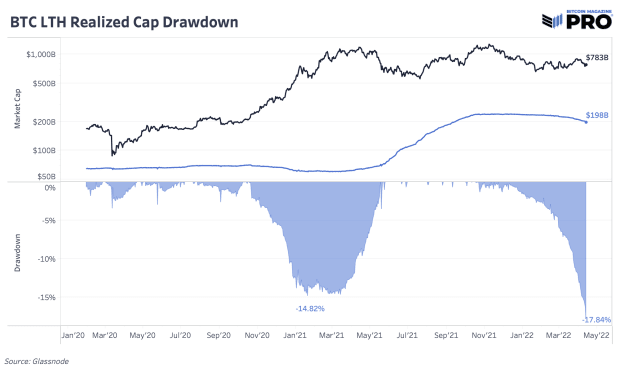

We can also break down realized capitalization into different cohorts including long- and short-term holders. Under the surface, we’re seeing the largest drawdown in long-term holder realized capitalization in bitcoin’s history.

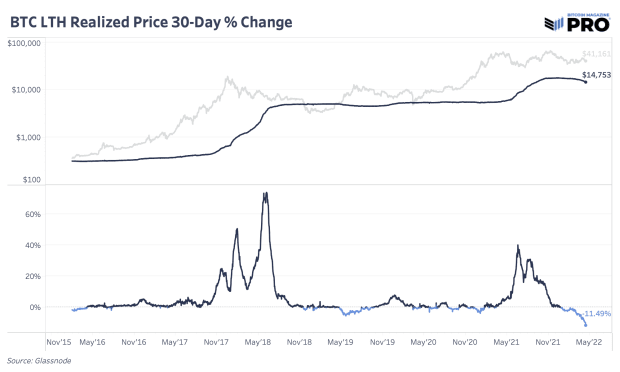

Čeprav je ponudba dolgoročnih imetnikov dokaj nevtralna od začetka leta in se je povečala za 0.6 %, ko se kopičenje in staranje kovancev v tej skupini nadaljuje, podatki kažejo, da je bilo tudi veliko prodaje. Dolgoročni imetniki so realizirali kapitalizacijo in realizirane padce cene, ko se prodajajo kovanci z višjo nabavno osnovo. To zniža skupno povprečno osnovo stroškov, ki se je v zadnjih 11.49 dneh znižala za 30 %.

S temi podatki in postopkom, s katerim dolgoročni imetniki so kvantificirani, razred imetnikov 2021, ki je pred kratkim postal kohorta, je tisti, ki seli svoja gospodarstva.

Ponovno kopičenje je naš osnovni primer od začetka prvega četrtletja 1 in stanje teh meritev še naprej podpira te tržne obete kljub nedavnemu povečanju dolgoročnih prodajnih pritiskov imetnikov.

- 11

- 2021

- 2022

- čez

- stari

- med

- Analiza

- apreciacija

- sredstvo

- povprečno

- Osnova

- BEST

- Billion

- Bitcoin

- Kapitalizacija

- spremenite

- razred

- razredi

- bližje

- Kovanci

- popolnoma

- naprej

- se nadaljuje

- datum

- Kljub

- drugačen

- navzdol

- dinamično

- izdaja

- Izmenjava

- iskanje

- prva

- stekleno vozlišče

- skupina

- visoka

- več

- zgodovina

- imetnika

- imetniki

- HTTPS

- Vključno

- vpogledi

- IT

- sam

- januar

- Največji

- dolgoročna

- Tržna

- Analiza trga

- Tržna kapitalizacija

- Prisotnost

- Meritve

- več

- premikanje

- mreža

- Novice

- Ostalo

- Outlook

- odstotek

- Veliko

- Premium

- tlak

- Cena

- za

- Postopek

- Izdelek

- nepremičnine

- zagotavljanje

- Q1

- realizirano

- prejeti

- nastavite

- kratkoročno

- prodaja

- Začetek

- Država

- dobavi

- podpora

- Površina

- tradicionalna

- pregleden

- vrednost

- Volatilnost

- leto