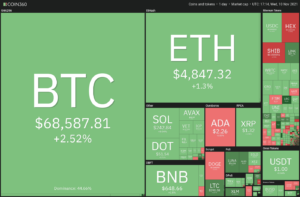

A group calling itself “Victims of Ankr Exploit” have claimed that its members lost over 13,000 BNB liquid staking coins (over $4 million worth at the time of writing) as a result of the Dec. 2 Ankr exploit, but have not been adequately reimbursed by the Ankr company. According to a Jan. 19 statement from the group received by Cointelegraph, affected members alleged that they have only received half of the amount they lost. The group has called on Binance’s Chanpeng Zhao (also known as “CZ”) to put pressure on Ankr to get the funds released.

1/4 Mi, žrtve izkoriščanja Ankr, zvišujemo nagrado s 100 BNB na 110 BNB (trenutno vrednih 28700 $) za osebo (vključno z vplivneži in mediji), ki:

✅ pomaga @cz_binance razumeti nepravično nadomestilo IN;

✅ naredi @ankr da nas nadomesti 100% https://t.co/sZlkqGW58a— Alex Soh (@AlexSoh14) Januar 7, 2023

Skupina je posebej trdila, da načrt povračila objavljene Ankr 20. decembra ni bil pošten do ponudnikov likvidnosti na borzi Wombat. V skladu s tem načrtom je Ankr predlagal "delno kritje izgube ponudnikov likvidnosti stkBNB na Wombatu." Ankr je trdil, da bi bilo polno povračilo nepravično, ker je "narava mešanih likvidnostnih skladov" na Wombatu težko ugotoviti, koliko so ponudniki likvidnosti izgubili.

Skupina žrtev izkoriščanja Ankr je priznala, da jim je Ankr nadomestil 50 % BNB, izgubljenega v napadu, vendar je vztrajala, da bi jim morala plačati 100 % odškodnine.

Skupina je trdila, da jim je Ankr zavrnil popolno odškodnino, ker so bili izgubljeni žetoni za likvidne vložke stkBNB in BNBx konkurenti lastnim žetonom Ankr ankrBNB:

»Očitno je, da gre za segregacijo in diskriminacijo žrtev, ki je neopravičljiva. In [a] dejstvo, da od prizadetih protokolov X samo dva od njih (Stader in pSTAKE), neposredna konkurenta Ankr, vidita svoje uporabnike kot žrtve.«

Citing a tweet from ZachXBT, they argued that Ankr has the ability to compensate them fully because it izterjati 1,559 ETH (približno 2.4 milijona dolarjev v času pisanja) od Huobi Global, potem ko ga je napadalec poskušal uporabiti za izplačilo.

Povezano: Uniswap razmišlja o lansiranju v verigi BNB

The Ankr team responded to these allegations through a Jan. 25 email sent to Cointelegraph. In the email, the Ankr representative stated that the reimbursement plan was “more than generous” to liquidity providers on Wombat. From the company’s perspective, much of the stkBNB and BNBx losses on Wombat were due to poor risk management of these rival staking protocols and illiquidity on Wombat, as they explained:

“50% of all BNBx and stkBNB liquid staking was on Wombat alone due to Stader and pStake incentives. This represents an obvious concentration risk[…]Ankr cannot be held responsible for the lack of risk management of other pools. To put things in context, Ankr paid Wombat pools in all 4x more than the aBNBc TVL we had on Wombat, which is more than generous”

The team argued further that critics of the plan do not understand the “flow of money” that led to the loss of funds, stating:

“We have to comprehend what happened and follow the flow of money. The exploiter sold aBNBc on Wombat against BNB and then against BNBx and stkBNB. Then he sold BNBx and stkBNB on other DEX where there was more BNB liquidity[…]In this story, some people made money.”

The Ankr team also argued that it has not recovered enough funds to compensate users, stating that “criminal investigations are ongoing to recover part of the funds, and the amount we think we can recover is significantly less than what we paid.”

Ankr BNB je prišlo do vdora v protokol stakinga on Dec. 2, 2022, and the attacker was able to obtain $5 million in crypto from the attack. On Dec. 21, the company announced that the attack had been ki jih izvaja bivši zaposleni. V isti objavi je obljubil, da bo okrepil svoje varnostne prakse in žrtvam povrnil stroške.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://cointelegraph.com/news/ankr-exploit-victims-group-alleges-the-company-only-reimbursed-them-50

- 000

- 1

- 100

- 2022

- 7

- 9

- a

- sposobnost

- Sposobna

- Po

- ustrezno

- priznal

- po

- proti

- alex

- vsi

- Obtožbe

- domnevno

- sam

- znesek

- in

- Ankr

- razglasitve

- Objava

- približno

- napad

- ker

- bnb

- se imenuje

- kliče

- ne more

- Denar

- Izplačam

- Chanpeng Zhao

- trdil,

- Kovanci

- Cointelegraph

- podjetje

- Podjetja

- kompenzirano

- Odškodnina

- tekmovalci

- razumeti

- koncentracija

- meni

- ozadje

- pokrov

- Kritiki

- kripto

- Trenutno

- Ugotovite,

- Dex

- neposredna

- E-naslov

- dovolj

- ETH

- Izmenjava

- razložiti

- Izkoristite

- Pretok

- sledi

- iz

- polno

- v celoti

- Skladi

- nadalje

- dobili

- Globalno

- skupina

- Pol

- se je zgodilo

- Trdi

- Hero

- Pomaga

- Kako

- HTTPS

- Huobi

- HuobiGlobal

- prizadeti

- in

- spodbude

- Vključno

- narašča

- vplivom na

- preiskave

- IT

- sam

- John

- znano

- Pomanjkanje

- začetek

- Led

- Tekočina

- vložki tekočine

- likvidnostno

- ponudniki likvidnosti

- off

- izgube

- je

- IZDELA

- upravljanje

- mediji

- člani

- milijonov

- mešano

- Denar

- več

- Narava

- Očitna

- v teku

- Ostalo

- lastne

- plačana

- del

- ljudje

- oseba

- perspektiva

- Načrt

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Bazeni

- slaba

- vaje

- tlak

- predlagano

- protokol

- protokoli

- ponudniki

- dal

- prejetih

- Obnovi

- sprosti

- predstavnik

- predstavlja

- odgovorna

- povzroči

- Nagrada

- Tveganje

- upravljanje s tveganji

- Tekmec

- Enako

- varnost

- shouldnt

- bistveno

- prodaja

- nekaj

- posebej

- Staking

- navedla

- Izjava

- Zgodba

- skupina

- O

- njihove

- stvari

- skozi

- čas

- do

- Boni

- TVL

- tweet

- pod

- razumeli

- Odklopite

- us

- uporaba

- Uporabniki

- Žrtva

- žrtve

- Kaj

- ki

- vredno

- bi

- pisanje

- X

- Zachxbt

- zefirnet

- Zhao