On Monday (August 2), three days after Ethereum’s sixth birthday and three days before the London hard fork is scheduled to go live on the mainnet, Ether’s price action is continuing to impress the crypto community.

Last Friday (July 30), Ethereum celebrated its sixth birthday (since the mainnet went live on 30 July 2015).

O original Ethereum white paper (titled: “Ethereum White Paper: A next-generation smart contract and decentralized application platform”) was written by Russian-Canadian programmer Vitaly Dmitriyevich Buterin (better known as “Vitalik Buterin”), and published on his blog in December 2013.

Here is how Vitalik described the main objective of Ethereum in the abstract of this paer:

“What Ethereum intends to provide is a blockchain with a built-in fully fledged Turing-complete programming language that can be used to create ‘contracts’ that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code.”

Ethereum got razglasitve avtor Vitalik 27. januarja 2014 na 2. dan severnoameriške Bitcoin konference v Miamiju na Floridi.

During his talk, Vitalik said that one of the uses for Ethereum was to create cryptoassets for specialized purposes:

“Let’s not have one currency. Let’s have 1,000s of currencies.”

Around six months later (on 7 June 2014), Ethereum’s eight co-founders―Vitalik Buterin, Anthony Di Iorio, Charles Hoskinson, Mihai Alisie, Amir Chetrit, Joseph Lubin, Gavin Wood, and Jeffrey Wilke―met in a rented house in Zug, Switzerland (a town that has been given the nickname “Crypto Valley”). At this meeting, Vitalik proposed that the Ethereum project should proceed as a non-profit.

Ethereum’s Development was funded via an initial coin offering (ICO) during July–August 2014, with the participants paying for the Ether (ETH) token with Bitcoin (BTC). This ICO raised 3,700 BTC in its first 12 hours, and in total, $18 million was raised.

Ethereum Foundation’s last proof-of-concept prototype, which was codenamed “Frontier”, went live on 30 July 2015.

Prihajajoči londonski hard fork, katerega najpomembnejši sestavni del je EIP-1559, was originally expected to go live on the ETH 1.0 mainnet in July, as you can see from the two Twitter posts below (from February ) by Ethereum consultant Ryan Berckmans.

Tukaj je opis, kako bo Ethereumov mehanizem za določanje cen transakcij deloval po tem, ko bo EIP-1559 začel delovati:

»Predlog v tem EIP je, da začnemo z osnovnim zneskom pristojbine, ki ga protokol prilagaja navzgor in navzdol glede na to, kako preobremenjeno je omrežje. Ko omrežje preseže ciljno porabo plina na blok, se osnovna pristojbina nekoliko poveča, ko pa je zmogljivost pod ciljem, se rahlo zmanjša.

»Ker so te osnovne provizije omejene, je največja razlika v osnovni proviziji od bloka do bloka predvidljiva. To nato omogoča denarnicam, da samodejno nastavijo pristojbine za plin za uporabnike na zelo zanesljiv način.

»Pričakuje se, da večini uporabnikov ne bo treba ročno prilagajati pristojbin za plin, tudi v obdobjih visoke omrežne aktivnosti. Za večino uporabnikov bo osnovna provizija ocenjena glede na njihovo denarnico, samodejno pa bo nastavljena majhna prednostna provizija, ki rudarjem nadomesti tveganje, ki ne obstaja (npr. 1 nanoeth). Uporabniki lahko tudi ročno nastavijo najvišjo provizijo za transakcijo, da omeji svoje skupne stroške.

»Pomemben vidik tega sistema nadomestil je, da rudarji obdržijo le prednostno nadomestilo. Osnovna pristojbina se vedno zažge (tj. uniči jo protokol). To zagotavlja, da se za plačilo transakcij na Ethereumu lahko kadar koli uporablja le ETH, s čimer se utrdi gospodarska vrednost ETH znotraj platforme Ethereum in zmanjšajo tveganja, povezana z vrednostjo, ki jo lahko pridobi rudar (MEV).

»Poleg tega ta izgorevanje uravnava inflacijo Ethereuma, hkrati pa rudarjem še vedno daje nagrado za blok in prednostno pristojbino. Nazadnje je pomembno zagotoviti, da rudar bloka ne prejme osnovnega nadomestila, ker odstrani spodbudo rudarja, da manipulira s nadomestilom, da bi od uporabnikov pridobil več nadomestil.«

The London hard fork is predvidoma v živo on the Ethereum mainnnet at block height 12965000 at 12:00 UTC on August 5.

Earlier today, one Ethereum fan explained on Twitter that although EIP-1559 “doesn’t make $ ETH deflationary by default”, it is still “very bullish for $ ETH” and proceeded to explain why:

He/she then went on to say that once Ethereum has fully completed its transition to a Proof-of-Stake (PoS) consensus mechanism (i.e. once “The Merge” has taken place, which is expected to occur sometime in the first half of 2022), then EIP-1559 should help ETH to become a deflationary asset:

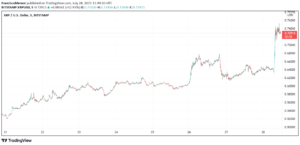

Yesterday (August 1), Simon Dedić, who is Co-Founder and Managing Partner at Moonrock Capital, a blockchain advisory and investment partnership based in London and Hamburg”, had this to say about Ethereum’s recent price action:

Nekaj ur kasneje, Chris Burniske, a partner at crypto-focused venture capital firm Placeholder, said that ETH seems to be much more in demand than BTC:

Then, earlier today, Popular cryptocurrency analyst Michaël van de Poppe expressed his bullishness in ETH by saying that he believe that ETH will eventually flip BTC (i.e. its market cap will eventually exceed that of BTC).

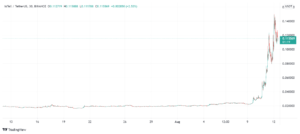

According to data by TradingView, on crypto exchange Bitstamp, ETH-USD is currently (as of 16:27 UTC on August 2) trading around $2,660, up 4.5% in the past 24-hour period and up 264% Ince the start of 2021.

DISCLAIMER

Pogledi in mnenja, ki jih je izrazil avtor ali osebe, omenjene v tem članku, so zgolj informativne narave in ne predstavljajo finančnega, naložbenega ali drugega nasveta. Pri vlaganju v kriptoasete ali trgovanju z njimi obstaja tveganje finančne izgube.

KREDIT SLIKA

- 7

- Ukrep

- oglasi

- nasveti

- svetovanje

- vsi

- Dovoli

- Ameriška

- Analitik

- uporaba

- okoli

- članek

- sredstvo

- Avgust

- Bitcoin

- Bitstamp

- blockchain

- Blog

- BTC

- Bikovski

- buterin

- klic

- kapaciteta

- Kapital

- Charles

- charles hoskinson

- So-ustanovitelj

- Koda

- Coin

- Coindesk

- skupnost

- komponenta

- Konferenca

- Soglasje

- Naročilo

- stroški

- kripto

- kripto izmenjava

- cryptocurrency

- plačila

- valuta

- datum

- dan

- Decentralizirano

- Povpraševanje

- uničeni

- Razvoj

- Gospodarska

- ETH

- Eter

- Eter (ETH)

- ethereum

- projekt ethereum

- Izmenjava

- Moda

- pristojbine

- končno

- finančna

- Firm

- prva

- florida

- vilice

- Petek

- stvarno

- Prihodnost

- GAS

- pristojbine za plin

- Giving

- veliko

- trde vilice

- visoka

- Hiša

- Kako

- HTTPS

- ICO

- Vključno

- inflacija

- Začetna ponudba kovancev

- vlaganjem

- naložbe

- IT

- julij

- jezik

- kosilo

- London

- vodilni partner

- Tržna

- Market Cap

- milijonov

- Rudarji

- Model

- Ponedeljek

- mesecev

- mreža

- neprofitna

- sever

- ponujanje

- odmik

- Komentarji

- Da

- Ostalo

- Papir

- partner

- Partnerstvo

- Plačajte

- ljudje

- platforma

- Popular

- PoS

- Prispevkov

- Cena

- cenitev

- za

- Programiranje

- Projekt

- Dokaz o deležu

- dokazilo (PoS)

- snubitev

- Nagrade

- Tveganje

- Zaslon

- nastavite

- SIX

- majhna

- pametna

- pametna pogodba

- Začetek

- Država

- švica

- sistem

- sistemi

- ciljna

- žeton

- Trgovanje

- transakcija

- Transakcije

- Uporabniki

- vrednost

- podjetje

- tveganega kapitala

- vitalik

- denarnica

- Denarnice

- Bela knjiga

- WHO

- v

- delo

- pisanje

- Zug