The Australian dollar has posted sharp gains, as the US dollar is lower against the majors in the North American session. AUD/USD is trading at 0.6542, up 0.97%.

Business confidence slows to zero

Australia’s NAB Business Confidence for October slipped to zero, down from 5 points in September. The significant decline is reflective of a drop in orders, higher rates at home and a gloomy global negative outlook. The soft data comes on the heels of Westpac Consumer Sentiment, which plunged by 6.9% to 78 points, its lowest level since April 2020, when the Covid pandemic had just started. Inflation is galloping at a 7.3% clip, China’s economy is weakening and the energy crisis in Europe is likely to worsen in the winter.

These headwinds are not about to go away, which does not bode well for the Australian economy. The Australian dollar has fallen sharply in 2022, although we’re seeing a rebound, with gains of 2.9% on Friday, courtesy of the US nonfarm payrolls, and strong gains today as well. The US dollar’s decline on Friday and again today are against all the majors, which means that this is a case of US dollar weakness rather than Australian dollar strength. I would be surprised if the Aussie can hold onto these recent gains, as the currency faces plenty of headwinds.

In the US, the midterm elections are being held today, which is widely being viewed as a referendum on President Biden’s performance. The economy is giving mixed signals and Biden’s popularity is sagging, which could result in the Republicans taken control of both the House and the Senate. If the Republicans grab either one, it will translate into deadlock in Washington and a weakened President Biden. The election could move the US dollar if we see a Democratic surprise or a clean sweep by the Republicans.

.

AUD / USD Tehnični

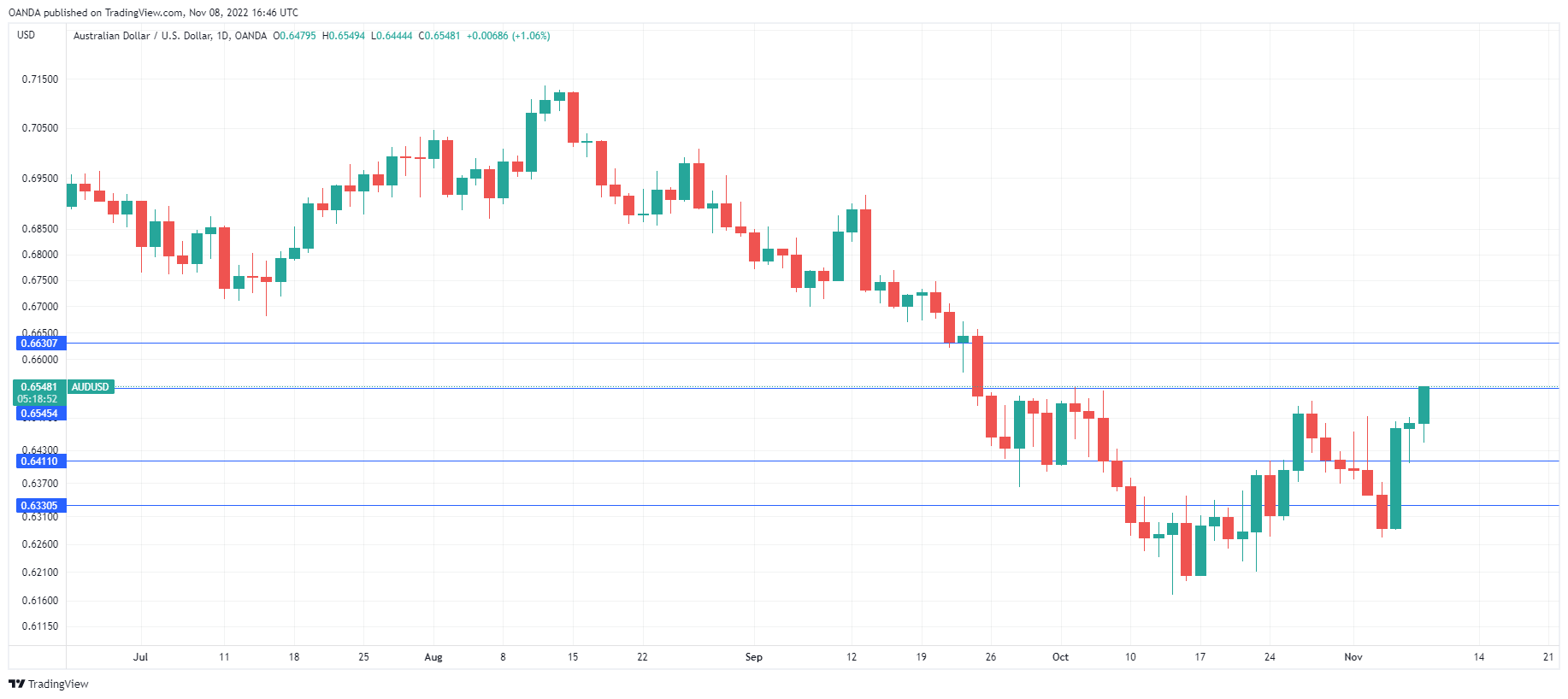

- AUD/USD is testing resistance at 0.6545. Next, there is resistance at 0.6631

- Podpora je na 0.6411 in 0.6329

Ta članek je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno korporacije OANDA Corporation ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Trgovanje z vzvodom je visoko tveganje in ni primerno za vse. Lahko izgubite vsa vložena sredstva.

- AUD

- AUD / USD

- Avstralsko NAB poslovno zaupanje

- Australia Westpac Consumer Confidence

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Centralne banke

- Kitajska

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Evropska energetska kriza

- FX

- strojno učenje

- MarketPulse

- Novice dogodkov

- Novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Tehnična analiza

- TradingView

- Vmesne volitve v ZDA

- ameriški dolar

- W3

- zefirnet