Daily, people’s lives are becoming increasingly automated as millions of algorithms make decisions and take actions on consumers’ behalf. The shift toward autonomous finance services starts with automated investment management, savings, and payments. Algorithm-based

services lower the cognitive burden on users and strive to enhance financial results.

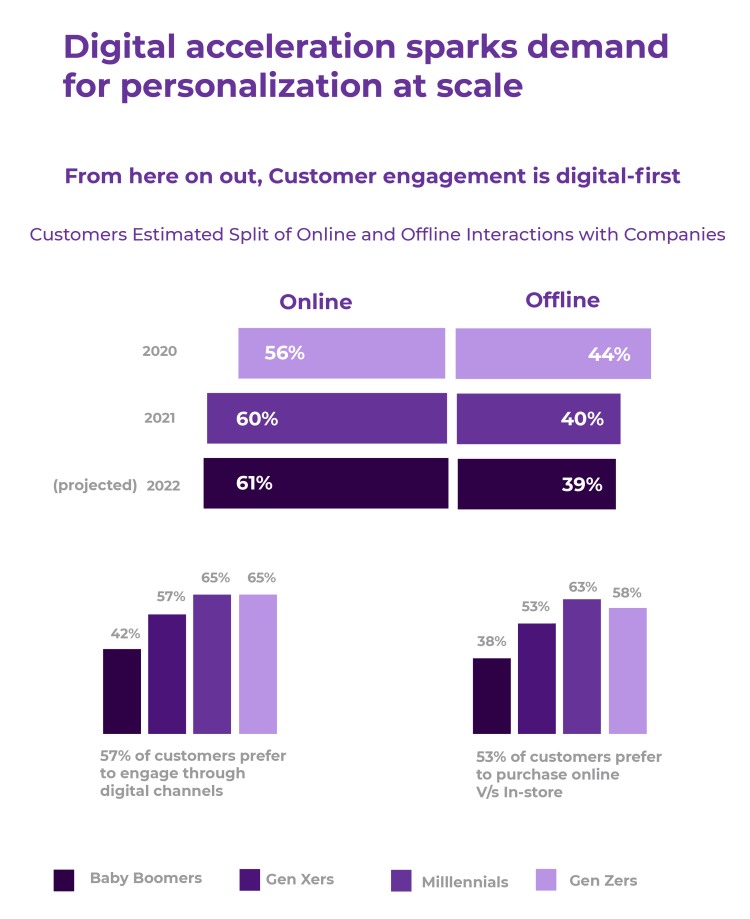

The customer experience (CX) has always been a priority for Financial Service Institutions (FSIs). However, in the wake of COVID-19, it has become a survival imperative and deprioritised CX, given the sudden impending need for digital services from clients.

The FSIs set on the end of “business-as-usual” has left financial institutions scuffling with the twin challenge of conserving the financial health of their clients and preserving their own in a long period of financial uncertainty.

Ustanove za finančne storitve se pripravljajo na prihodnje leto in večina se zaveda, da je podpiranje zadrževanja strank pametna stava. Raziskave kažejo, da je potrebna izgradnja digitalne finančne institucije, osredotočene na kupce, saj osredotočen na kupca

FSIs zasenčijo svoje bolj tradicionalne kolege. Toda na katere druge trende naj bodo še posebej pozorni, da bodo izstopali in poskrbeli, da bodo njihove stranke zadovoljne?

- 89% of financial services leaders acknowledge that the first FSIs to deploy autonomous finance will carve out a sizeable competitive advantage

and a niche for themselves; - 60% finančnih institucij predpostavlja, da avtonomne finance izboljšujejo personalizacijo in izboljšujejo uporabniško izkušnjo (CX).

- Kot trenutno stojijo stvari, konec 50% of the finance and accounting activities are largely automated: processing transactions, procurement,

preparing financial reports, planning/forecasts, etc.

Forrester raziskave opredeljuje autonomous finance as algorithm-driven financial services that make decisions or take action

on a customer’s behalf.

Vrzeli v tehnologiji in pričakovanjih strank

O tem smo razpravljali v prejšnjem blogu kako neobanke redefinirajo prihodnost bančništva and how many traditional banks struggle to convert most of their offline services to digital

ones. Traditional banks tied down with inflexible underpinnings have it even more difficult. Customers slowly begin to move towards fintech solutions that integrate their bank accounts with the facilitating neobank and provide all banking functions in one

mesto.

“42 % of bank executives polled said that they were unsure about how to integrate and streamline office functions effectively from back to front, and 46 % said they are unsure how to embrace open banking, orchestrate the ecosystem or become a truly data-driven

organisation.” - Poročilo Svetovne banke 2021.

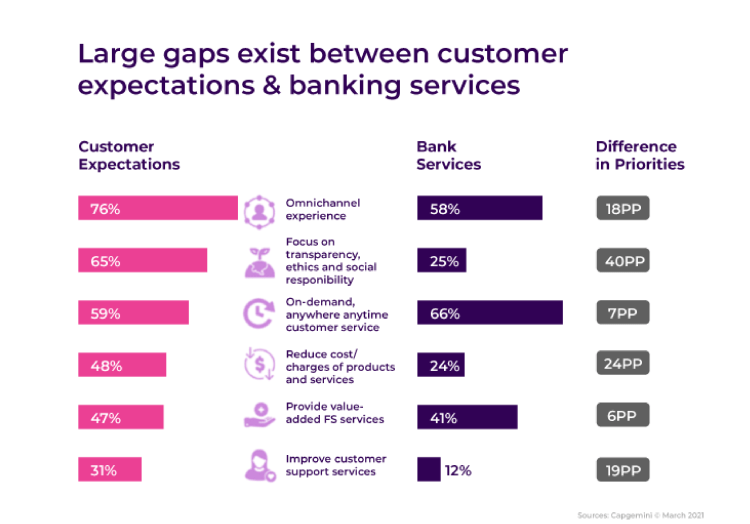

Many customers switched as they felt that the traditional banks, with the immense resources available at their beck and call, could have given improved personalised services. The gap between the services offered by conventional banks and what customers expected

from them widened.

Neobanks such as Chime, Open, and Affirm provide personalised solutions with the help of their partner banks. Partner banks such as Celtic Bank, ICICI Bank, and Green Dot Bank currently lead the pack in working with neobanks to deliver banking solutions.

They are doing well by implementing autonomous finance to some extent; many, however, still struggle to capture the importance of serving excellent customer experience for long and sustainable growth. The pandemic has only made the gap between expectations

and services offered.

Vir: Salesforce Research

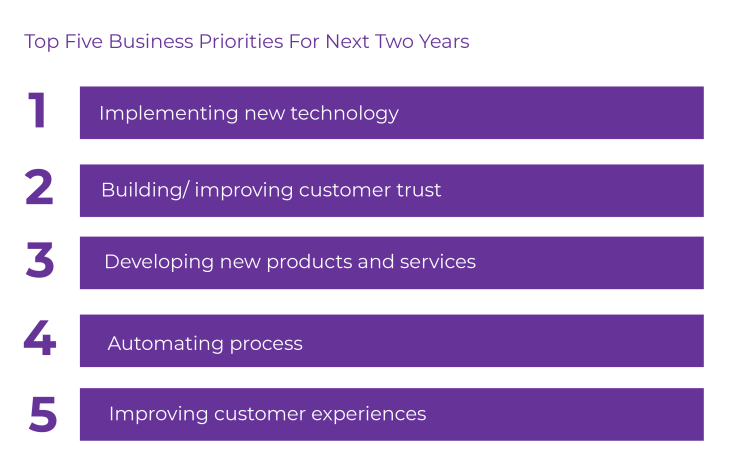

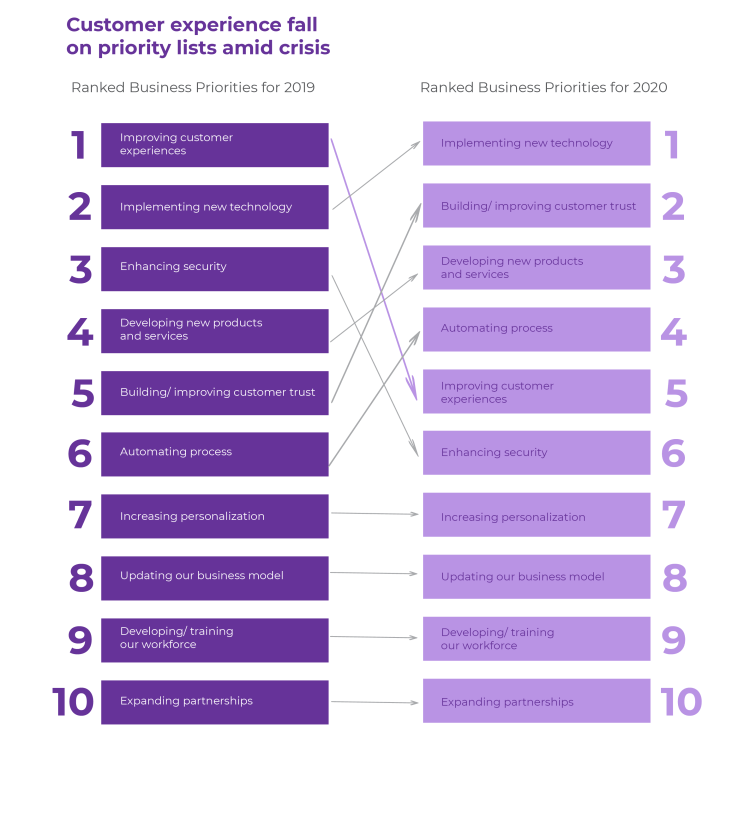

According to Salesforce, 68 % of customers’ expectations from digitally capable FSIs grew during Covid-19, yet many FSIs failed to meet the expectations. While rushing to meet customers’ fast-rising demands for digital services, FSIs pushed customer experience

aside to implement new technologies to improve customer trust.

Med pandemijo je uporabniška izkušnja pri bankah padla z vrha na 5. mesto. Vir: Salesforce Research

Zapolnjevanje vrzeli CX: dolgoročni proti kratkoročnim ciljem

Business priorities change with time, but FSIs cannot ignore what customers want. Post-pandemic, customers have become increasingly critical of their expectations of the service the banks deliver and have become creators and critics who dictate what they

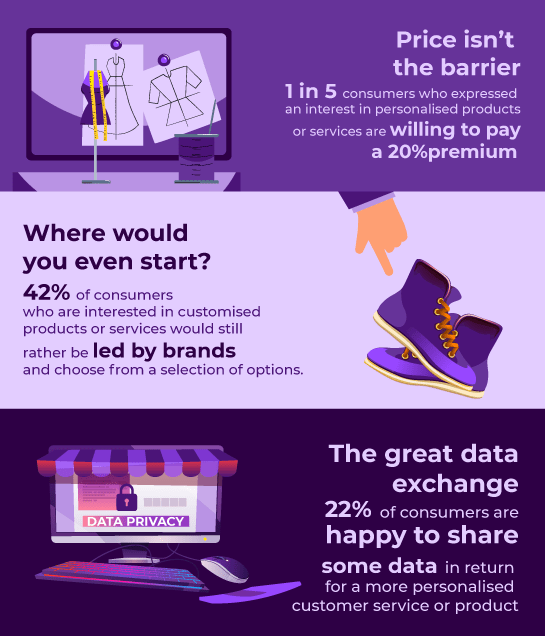

want. Most customers are willing to pay a small premium to get personalised attention and services that cater to their needs.

Vir: The Deloitte Consumer Review, Made-to-order: The rise of mass personalization

Businesses need to understand that customers love attention like most other people. A puppy or a child would do anything to get attention from its parent, from messing around to throwing tantrums. Customers will do it by slowly ignoring the concerned business,

which can cost them a lot in the long term. Therefore, companies must balance their short-term and long-term goals and activities and give customers well-deserved attention.

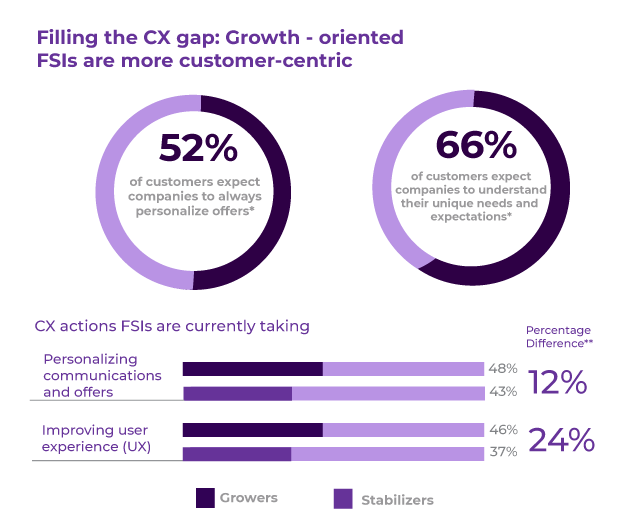

Vir: Stanje povezanih strank, 5. izdaja, Salesforce

FSI se primarno dosledno predajajo dvema vrstama dejavnosti:

- Stabilizatorji FSI se nagibajo k kratkoročnim aktivnostim, ki zmanjšujejo tveganja nujne narave, in se osredotočajo na kratkoročne zmage.

- FSI, usmerjeni v rast osredotočiti se na dejavnosti, ki gradijo dolgoročne odnose s strankami.

Nekateri FSI so bolj osredotočeni na kratkoročne cilje kot na dolgoročne.

Pandemija je na primer prinesla drastične spremembe v obsegu zahtevkov za storitve za stranke za številne FSI. Po navedbah Azijski bankir, velik

banks witnessed a 43.3 % increase in call volumes in 2020’s first quarter alone, with wait times averaging over 40 minutes. On average, customers use approximately devet channels, such as social media, web chats, emails, calls, etc., to connect with

the FSIs to communicate their challenges. There are two ways to deal with it:

- Odpravite težavo, jo zabeležite in shranite na varno. Potem pozneje pozabi na to. (Stabilizatorji)

- Odpravite težavo, jo registrirajte, učite se iz nje in naredite spremembe sistema, pripravljene za prihodnost, tako da se nihče nikoli ne sooči z enakimi izzivi. (usmerjeno v rast)

A type of fix FSIs choose for a problem is a choice they make based on their end goals which are again based on the mindset of the key stakeholders. Growth is something that all FSIs look for, but there are only a few that implement it. Comparing the stabilisers

vs growth-oriented FSIs, the latter were 22 % more inclined to invest in omnichannel services and 15 % more likely to expand their support capabilities to new channels. Growth-oriented FSIs are 12% more likely than Stabilisers to personalise outreach and 24%

more likely to improve their UX(Trends in Financial Services Report 2021, Salesforce).

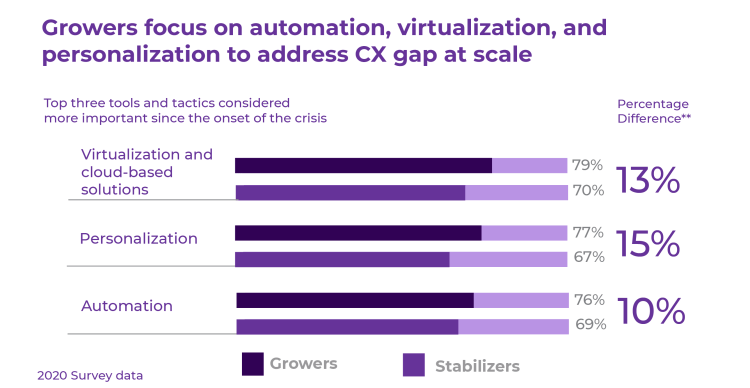

FSI, usmerjeni v rast, so dali prednost vlaganju v personalizacijo, avtomatizacijo, virtualizacijo in rešitve v oblaku, da bi zagotovili intimno uporabniško izkušnjo vsaki stranki v velikem obsegu.

Avtonomne finance: zapolnitev vrzeli CX

Providing the best-personalised communication with highly customised UX for a better user experience for every customer at a scale can be challenging. Still, it’s not just a pipe dream for FSIs anymore. Even though FSIs invest heavily in the aforementioned

technological capabilities, will autonomous finance be enough to bridge the CX gap created during these trying times?

Larger FSIs sit on a treasure trove of enormous amounts of valuable customer data, from buying histories to lending information to travel and medical information. Even with the newer data regulations about ownership, financial institutions are well placed

to evolve into highly personalised data brokers in customers’ lives, even beyond financial services, and play a more profound role in tomorrow’s society. In this context, rebuilding trust is key to the bright future of financial services. Through autonomous

finance, FSIs can learn and understand each customer’s behaviour.

Financial services should integrate more and more seamlessly with consumers’ lifestyles and devices, and organisations can use artificial intelligence to calculate personalised value analyses. The systems and technologies involved need to be highly trustworthy

to succeed. The FSIs must understand that they must embrace customers’ goals more closely rather than solely focus on becoming a profit and growth powerhouse.

"Motnja ne bo enkraten dogodek, temveč stalen pritisk za inovacije, ki bodo oblikovale vedenje strank, poslovne modele in dolgoročno strukturo industrije finančnih storitev." - Svetovni gospodarski forum.

Growth-oriented FSIs are inclined to leverage customer data for autonomous finance. It is powered by artificial intelligence to analyse consumer behaviour, mitigate fraud risk, and recommend relevant products and services to enhance customer experience.

AI-powered bots will be available 24×7 and continuously feed on customer data to increase intelligence to deliver the right products and services to gain consumer trust. Even if scaling personalised offerings is challenging, autonomous finance can aid in bridging

the gap between expectations and offerings.

"Avtonomne finance so organska konvergenca vseh tehnoloških inovacij, ki smo jim bili priča v preteklih letih, od umetne inteligence do dostopa do podatkov brez primere." - Rachid Molinary, višji podpredsednik za digitalno strategijo in inovacije pri Banco Popular.

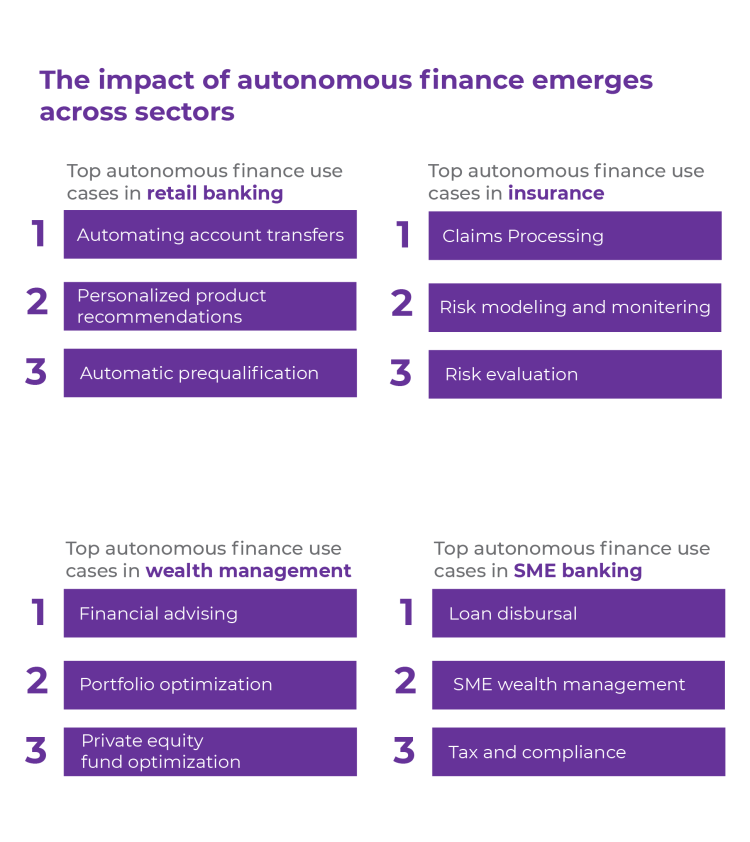

Pričakovanja strank se razlikujejo glede na ponudbo izdelkov FSI. Avtonomne finance lahko uporabijo svoje zmogljivosti za sprejemanje avtomatiziranih odločitev za stranke.

- Bančniki na drobno so osredotočeni na samodejne prenose računov. Na podlagi vedenja strank lahko umetna inteligenca določi pogostost in znesek prenosov glede na ravnotežje in razpoložljivost za zastavljanje ciljev.

- Glavni primer uporabe vodilnih v zavarovalništvu je obdelava zahtevkov, kar lahko potencialno zmanjša ročne napake in potrebna sredstva.

- Za FSI, ki upravljajo premoženje, bo avtonomno financiranje pomagalo predvideti optimizacijo naložb s samodejnim varčevanjem, ponovnim uravnoteženjem portfeljev, ponovnim vlaganjem dividend ali strategijami pobiranja davkov.

- SME banking can use it to automate fund allocation of a business by understanding departmental expenses, automatic timely tax payments with required paperwork submission, reinvesting profits in various avenues of growth, pre-approve and automatic business

loan disbursal and multiple other functionalities.

Prednosti avtonomnih financ

Prednosti avtonomnega financiranja za stranke, ki so bile doslej poudarjene, so, da neposredno obravnavajo pomanjkljivosti uporabniške izkušnje, ki so se poslabšale zaradi pandemije. Šest od 10 FSI meni, da je boljša personalizacija največja možna uporaba uveljavljanja nove zmogljivosti.

Moreover, autonomous finance strives to break down the complexity to produce better outcomes at scale. In times of economic turbulence, solutions that streamline financial decisions – like automated micro-savings tools – could be a blessing for consumers

skimming through ways to increase their savings acquiescently.

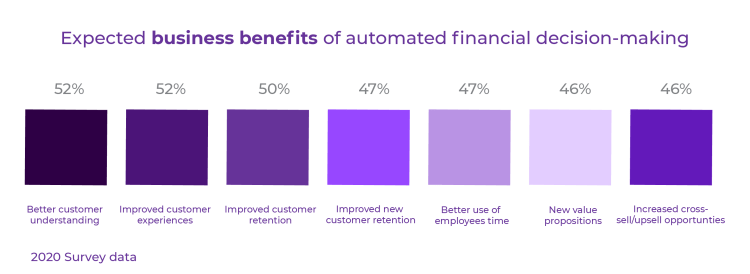

Poslovne koristi, o katerih so poročali, so neposredno povezane tudi s stranko: največja poslovna prednost avtonomnih financ je povezana z izboljšanjem uporabniške izkušnje in zagotavljanjem podjetjem boljšega vpogleda v njihove potrošnike.

Vir: Salesforce Research

Prihodnost avtonomnih financ

Consumers have become increasingly demanding from financial services providers, and there is a near consensus in the industry that autonomous finance will be a significant differentiator soon. According to 89% of financial services leaders, the first financial

services companies to implement autonomous finance successfully will gain a substantial competitive edge.

While today’s top use cases concentrate on drastically improving process efficiencies, the next generation has the prospect of unlocking entirely new value-creation chains. Autonomous finance usage will gradually shift from operational refinements to net-new

customer requisitions as the use evolves.

In the future, insurers could present new value propositions like modularising policies or creating and insuring new risk genera. For example, retail banks could instinctively pick and dispense budgets for higher education to the savings accounts of young

parents. Similarly, for SME banking, banks can disburse pre-approved business loans at the time of need by understanding the business’s paying power or financial health.

- ant finančni

- blockchain

- blockchain konferenca fintech

- chime fintech

- coinbase

- coingenius

- kripto konferenca fintech

- FINTECH

- fintech aplikacija

- fintech inovacije

- Fintextra

- OpenSea

- PayPal

- paytech

- plačilna pot

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- trak

- tencent fintech

- fotokopirni stroj

- zefirnet