Kot Bitcoin (BTC) continues trading sideways inside the $30,000–$40,000 range, new data is emerging about the potential for a bullish breakout.

Ali se Bitcoin tiho pripravlja na preboj kot v četrtem četrtletju 4?

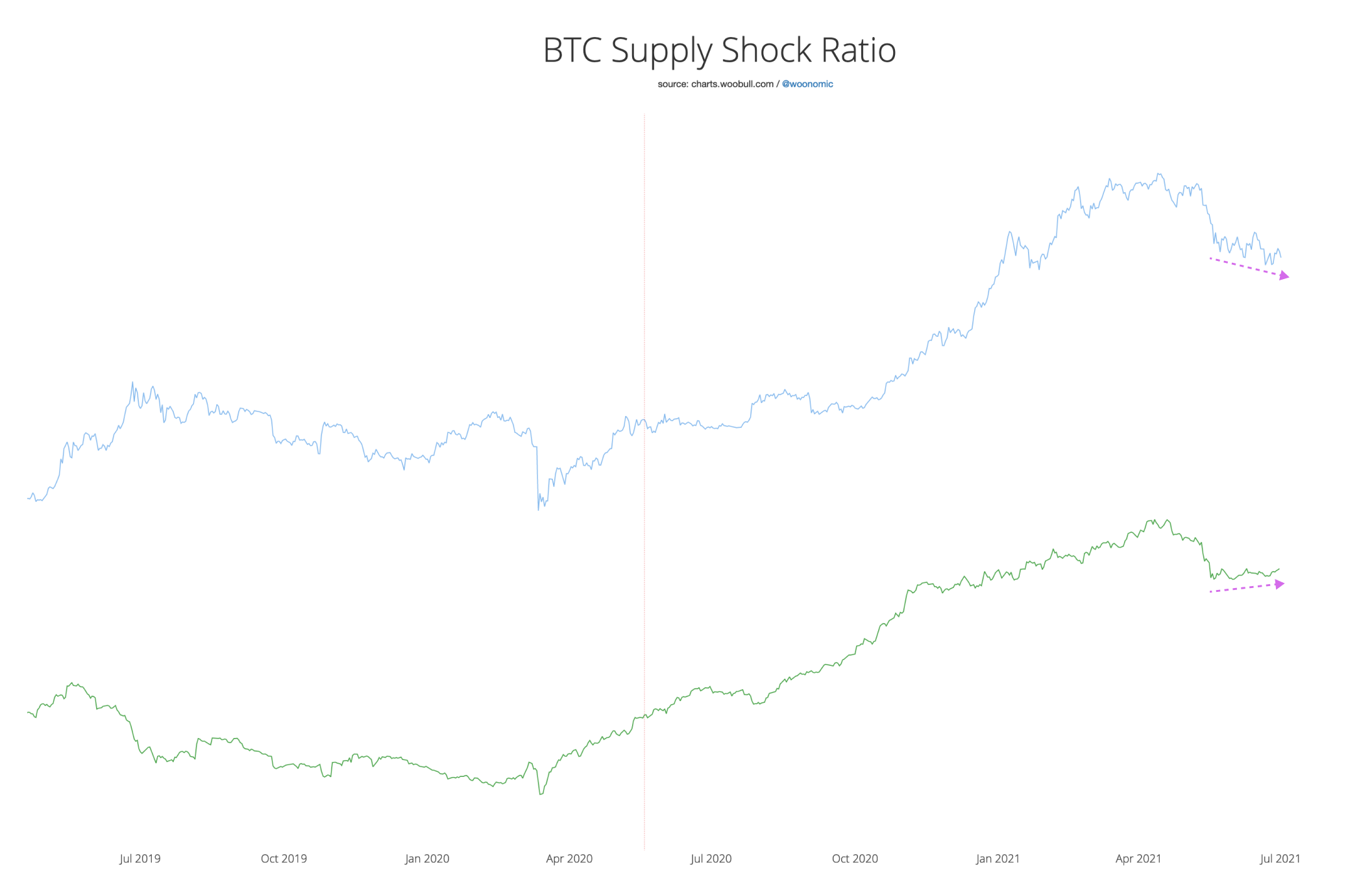

Willy Woo, verižni analitik, pričakuje a potential supply shock in the Bitcoin market, as long-term holders continued raking BTC supply from short-term ones. Woo stated in his Friday newsletter that the process might push more Bitcoin out of circulation.

The analyst referred to the ratio of Bitcoin held by strong hands versus weak hands — also known as Bitcoin Supply Ratio — noting that the former is actively absorbing selling pressure from whales who have been dumping their crypto holdings since February.

"Spominja me na dobavni šok, ki ga trg v četrtem četrtletju ni opazil," je zapisal Woo. "Strokovnjaki so razpravljali, ali je BTC varovanje pred inflacijo v svetu po COVID-u, ko so podatki kazali na dolgoročne vlagatelje, ki so BTC hitro nalagali."

“The price subsequently went on a tear, very quickly de-coupling from its tight correlation with stocks.”

Novi aktivni uporabniki naraščajo

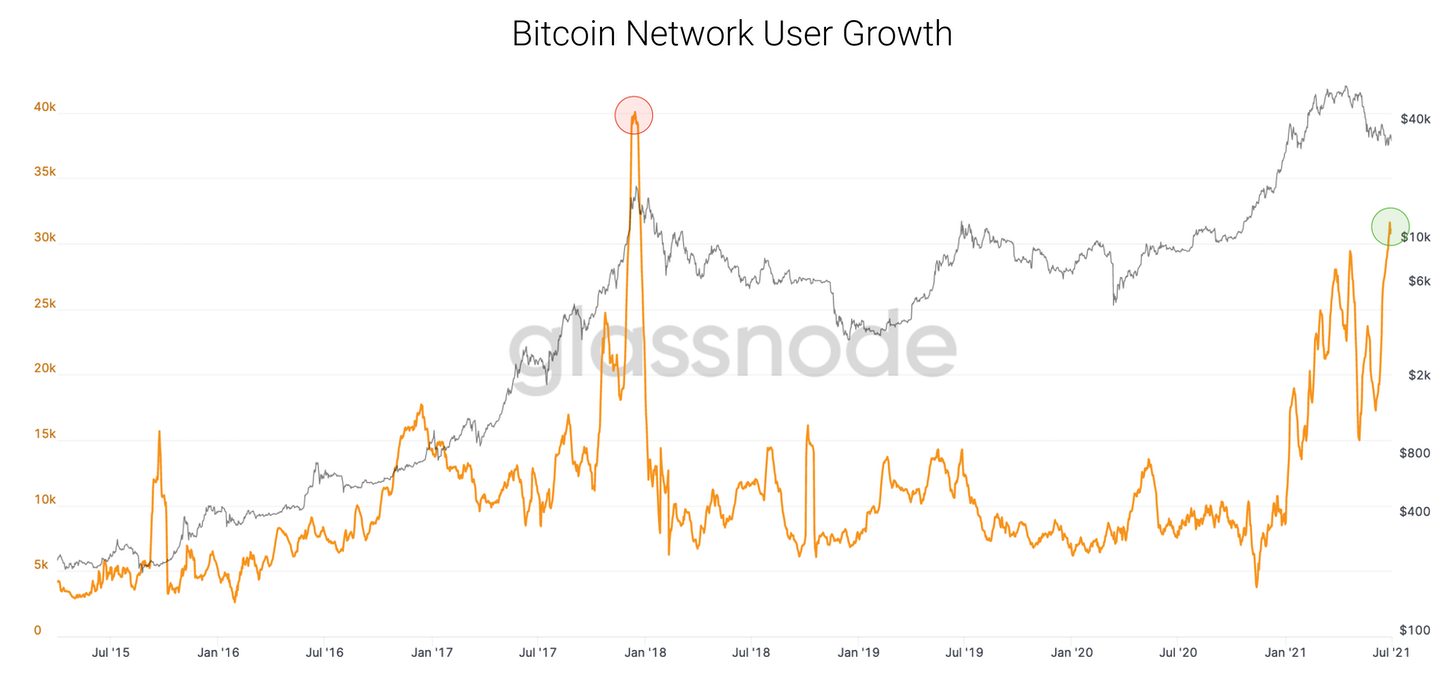

Glassnode, another on-chain data analytics service, also boosted Bitcoin’s booming adoption prospects. The portal revealed that the Bitcoin network has been onboarding an average of 32,000 new users every day, which is a new high for 2021.

The Bitcoin Network User Growth metric last topped in January 2018, hitting approximately 40,000 before correcting lower alongside the prices. It showed that new users stopped coming to the Bitcoin network as its price crashed from the $20,000 top in January 2018 to as low as $3,200 in December 2020.

"To trenutno ni naša struktura," je pojasnil Woo. »Novi uporabniki ob tej priložnosti kupujejo dip; prihajajo z najvišjo stopnjo, ki smo jo videli leta 2021. "

“Again, another example of on-chain data showing divergence to the price action.”

V času objave je Bitcoin trenutno zataknjen pod 34,000 ameriških dolarjev, kar je za 17.52% več kot prejšnja najnižja raven v višini 28,800 USD 22. junija.

Meanwhile, Petr Kozyakov, co-founder and CEO of crypto-enabled payment network Mercuryo, believes that Ether (ETH) may steal the limelight from Bitcoin in the near term as the London hard fork approaches.

"Predlagani začetek nadgradnje London Hard Fork in končna selitev na Ethereum 2.0 pomagata obnoviti zaupanje vlagateljev," je dodal. "Ko se hype poravna, se lahko Bitcoin v kratkoročni in srednjeročni perspektivi premakne na 50,000 USD."

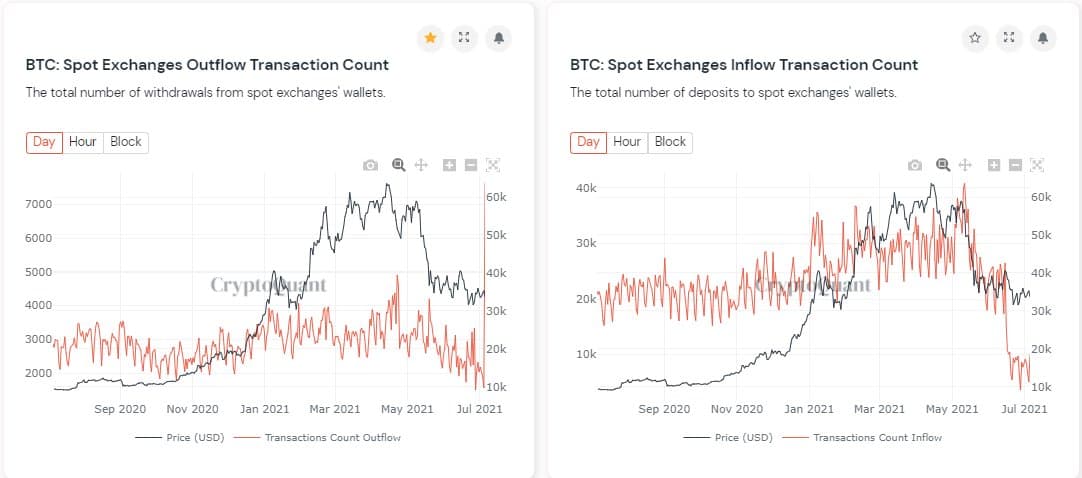

Transakcije umika Bitcoinov so dosegle eno leto

Podjetje za podatkovno analitiko CryptoQuant poročali prej v torek, da je število transakcij neto odliva Bitcoinov s promptnih borz prvič v letu prešlo mejo 60,000. Medtem se je skupno število Bitcoin depozitov na denarnicah promptnih borz zmanjšalo na pod 20,000.

The BTC withdrawal rate jumped in the period that also saw regulators increasing their scrutiny over cryptocurrency trading platforms. For instance, the United Kingdom Financial Conduct Authority (FCA) has prepovedana Binance — the world’s largest cryptocurrency exchange by volume — from operating regulated activity in the country “without the prior written consent.”

On Monday, Barclays obveščen its clients that they could no longer transfer funds to Binance, citing the FCA’s order. However, the London-based bank said clients could withdraw funds from Binance to their banking accounts.

Prej v torek je bila tudi Ljudska banka Kitajske je ukrepal proti lokalnemu podjetju for allegedly trading cryptocurrencies on the side of their regular business activities. Beijing had effectively prohibited all kinds of cryptocurrency-related activities in May, effectively forcing the world’s largest crypto mining community in its regions to either shut down or move their operations abroad.

Generally, a run-up in Bitcoin withdrawal rates is seen as traders’ intention to hold the cryptocurrency instead of trading it for other assets, including rival cryptocurrencies and fiat money. Therefore, with overall BTC withdrawals hitting a one-year high, expectations remain higher as Bitcoin is preparing for another upside run on the so-called “hodling” sentiment.

Ne. Zdi se, da se maloprodaja vrača in #HODLING!

- Johan Kirsten (@ JohanKirsten1) Julij 6, 2021

But the total Bitcoin reserves held by exchanges have remained relatively stable since May, indicating that the latest spike in withdrawals has had little impact on the overall exchange balance as of Wednesday.

Omeniti velja, da se stanja BTC na borzah lahko zelo razlikujejo glede na njihovo geografsko prevlado.

Na primer, trgovalne platforme, ki so povezane s Kitajsko in kitajskimi trgovci, so poročale o upadu stanja svojih Bitcoinov. Vključujejo Binance, katerega rezerve BTC so se v zadnjem tednu zmanjšale za 7,214.97 enot, in Huobi, ki je v istem časovnem okviru obdelal dvig 4,398.63 BTC. Stanja na OKEx BTC so upadla za samo 1,357.53 BTC.

However, United States-based Kraken added 6,751.98 BTC to its vaults, the highest among the non-Chinese exchanges, in the previous seven days, while Coinbase’s reserves increased by 168.88 BTC.

Tu stališča in mnenja so izključno avtorja in ne odražajo nujno stališč Cointelegraph.com. Vsaka naložbena in trgovalna poteza vključuje tveganje, pri odločitvi morate opraviti lastno raziskovanje.

- 000

- 2020

- 7

- Ukrep

- aktivna

- dejavnosti

- Sprejetje

- vsi

- domnevno

- med

- Analitik

- analitika

- Sredstva

- razpoložljivost

- Banka

- Bank of China

- Bančništvo

- Peking

- binance

- Bitcoin

- Povečana

- zlom

- BTC

- Bikovski

- poslovni

- nakup

- ceo

- Kitajska

- kitajski

- So-ustanovitelj

- Cointelegraph

- prihajajo

- skupnost

- zaupanje

- Soglasje

- se nadaljuje

- kripto

- kripto rudarstvo

- cryptocurrencies

- cryptocurrency

- Zamenjava kripto valute

- trgovanje kriptokovno

- datum

- Podatkovna analiza

- dan

- padla

- Eter

- ethereum

- ethereum 2.0

- Izmenjava

- Izmenjave

- FAST

- FCA

- Fiat

- Fiat denarja

- finančna

- Firm

- prva

- prvič

- vilice

- Petek

- Skladi

- Zelen

- Rast

- trde vilice

- tukaj

- visoka

- držite

- HTTPS

- Huobi

- vpliv

- Vključno

- inflacija

- naložbe

- Vlagatelji

- IT

- Kraken

- Zadnji

- kosilo

- vodi

- Stopnja

- lokalna

- London

- Long

- Izdelava

- Tržna

- Rudarstvo

- Ponedeljek

- Denar

- premikanje

- Blizu

- net

- mreža

- Novice

- OKEx

- Na vkrcanje

- deluje

- operacije

- Komentarji

- Priložnost

- Da

- Ostalo

- Plačilo

- Kitajska narodna banka

- perspektiva

- Platforme

- Portal

- Cena

- Založništvo

- območje

- Cene

- Regulatorji

- Raziskave

- Trgovina na drobno

- Tveganje

- Tekmec

- Run

- poravna

- Komercialni

- Zaloge

- dobavi

- čas

- vrh

- trgovci

- Trgovanje

- Trgovanje s kriptovalutami

- transakcija

- Transakcije

- Velika

- Anglija

- Uporabniki

- Proti

- Obseg

- Denarnice

- teden

- WHO

- svet

- vredno

- leto