O altcine that suffered a drop in price offer several opportunities for buying the dip. Among top 25, Cardano, Dogecoin, XRP and Uniswap price has dropped in double digits over the past week.

Recovery for most other altcine was overnight at the current volatility and momentum. Bitcoin’s dominance has increased ever so slightly, now at 41.5% and several altcoins have recovered from the drop, posting upwards of 15% in gains like Kusama (+20%) and Helium (+18%)

Vsi trgovci na drobno zdaj opazujejo znake okrevanja cen Bitcoinov in Ethereuma v tem tednu. Čas za nakup dip še ni končan, saj se obe sredstvi trgujeta pod ključnimi nivoji podpore. Cena Bitcoinov je bila na podlagi podatkov coinmarketcap.com nižja od 35000 USD, Ethereum pa pod 2600 USD.

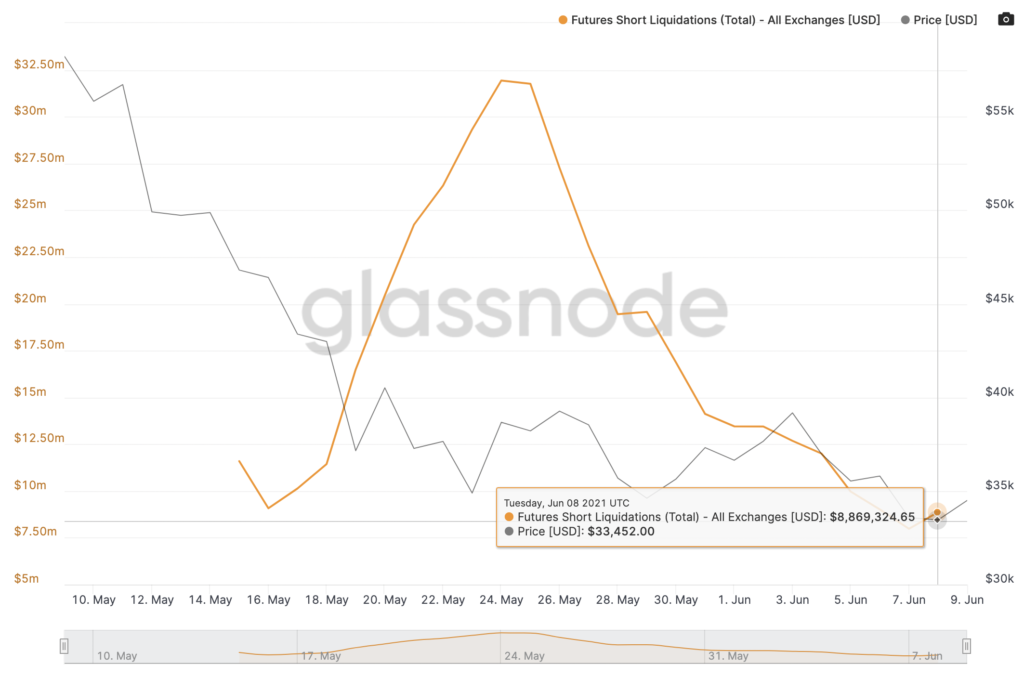

BTC Futures shorts liquidation | Source: stekleno vozlišče

Based on the above chart from Santiment, BTC futures short liquidation dropped consecutively in the past week. The trend showed that peak of futures liquidations corresponds with a recovery in price. The last time shorts’ liquidation hit a peak was in the last week of May 2021 and the price recovered, edging closer to the $40000 level. The current dip in the chart, therefore, signaled a bullish recovery in the following two weeks.

Based on on-chain metrics, and the current narrative for Dogecoin and Ethereum, a price rally is more likely. Further, Bitcoin's on-chain activity suggested that Bitcoin’s address activity was near one-year lows, and Ethereum’s was the same. This was reflected in the price drop over the past week. Thus the narrative of buying the dip is now more relevant than ever, and at the current price level, 85% of addresses are in profit based on data from Glassnode.

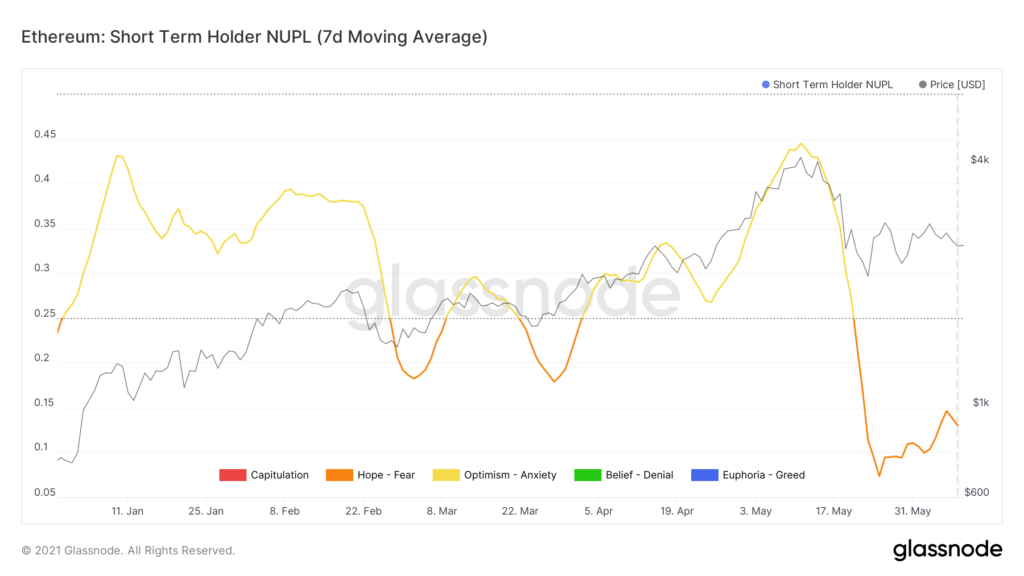

V primeru Ethereuma je kratkoročni grafikon neto nerealizirane izgube dobička pokazal, da trenutno razpoloženje temelji na strahu, ki temelji na dejavnosti trgovcev.

vir: stekleno vozlišče

Strah ustreza okrevanju, kot je bilo omenjeno v prejšnjih primerih; enako je bilo opaženo v zadnjem tednu marca 2021. Verjetno bo po stalnem upanju na strah cena v drugem tednu junija 4000 dosegla raven 2021 USD. V obeh primerih je nakup dip bolj verjeten v naslednjih dveh tednih donosna kot kratkoročno.

- Altcoins

- med

- Sredstva

- Bitcoin

- Bikovski

- nakup

- Nakup

- Cardano

- bližje

- CoinMarketCap

- Trenutna

- datum

- števk

- Dogecoin

- Drop

- padla

- ethereum

- Terminske pogodbe

- stekleno vozlišče

- HTTPS

- IT

- Ključne

- Stopnja

- Likvidacija

- likvidacije

- marec

- Meritve

- Momentum

- Blizu

- net

- Novice

- ponudba

- Ostalo

- Cena

- cenovni rali

- Dobiček

- rally

- Obnovi

- okrevanje

- Trgovina na drobno

- sentiment

- Kratke Hlače

- Kratek

- kratke hlače

- Znaki

- So

- Strategija

- podpora

- čas

- vrh

- trgovci

- Trgovanje

- Odklopite

- Volatilnost

- teden

- xrp