Inflacija v ZDA, ki je bila bolj vroča od pričakovane, je bitcoin potisnila pod 21,000 $, medtem ko je cena etra padla pod 1,600 $, saj je kripto sledila tradicionalnim finančnim trgom nižje.

Bitcoin se je na Coinbase trgoval pri 20,888 $, kar je približno 5.9 % manj v zadnjih 24 urah na datum iz izmenjave.

Tuesday’s losses followed higher-than-expected inflation Podatki iz ZDA, kar je medletno za 8.3 %, medtem ko se je skupna inflacija medmesečno povečala za 0.1 %, osnovna inflacija pa za 0.6 % medmesečno.

Ether’s losses over the past 24 hours are even greater than bitcoin’s, dropping more than 6% to $1,598, per Coinbase datum.

Višja inflacija ugotovimo would most likely result in further selloffs in the equity and crypto market, according to 21.co research associate Adrian Fritz. “Since this would lead to an even more hawkish Fed, that is expected to announce another interest rate hike next week,” he said.

The S&P 500 was down almost 3% at the time of writing, while the Nasdaq composite shed a little over 4%, with markets digesting the the surprise data with just eight days to go to the Fed’s next decision on interest rates.

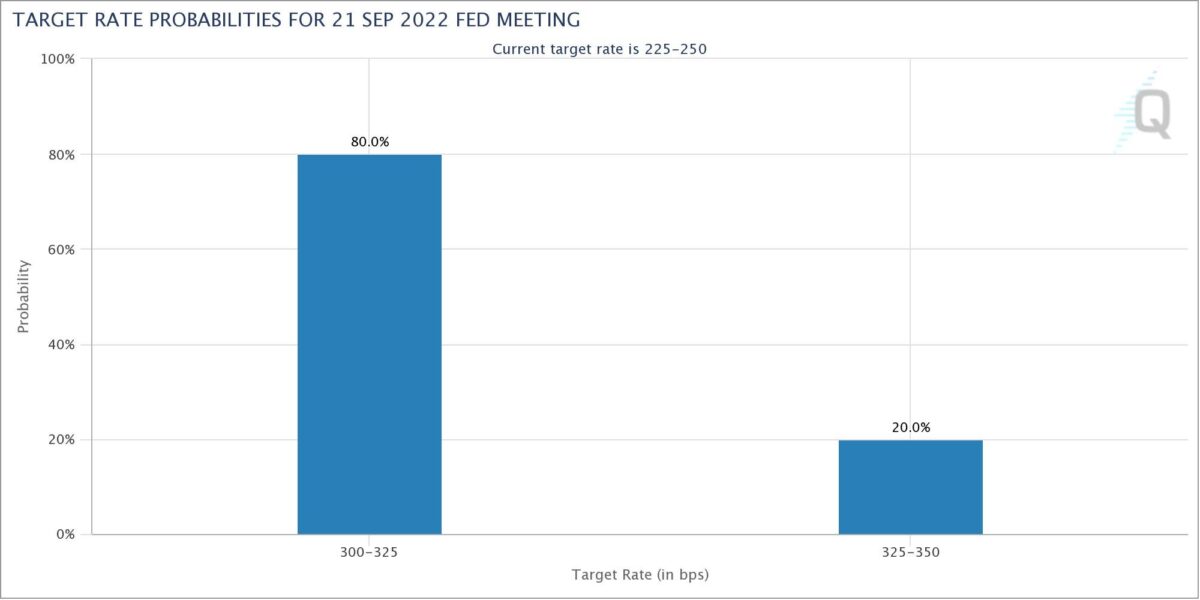

Ahead of the inflation news traders had been factoring in a hike of 75 basis points, however, according to the CME’s FedWatch dashboard the market is now predicting an 20% probability of a 100-basis-point hike at next week’s meeting.

Drugje pa DXY indeks, which measures the U.S. dollar relative to a basket of other foreign currencies, was back up, gaining 1.3%. FTX’s Sam Bankman-Fried je dejal that the dollar dominance and inflation has affected crypto markets this year, and today’s price movements appear to reinforce that assumption.

© 2022 The Block Crypto, Inc. Vse pravice pridržane. Ta članek je na voljo samo v informativne namene. Ni na voljo ali namenjen uporabi kot pravni, davčni, naložbeni, finančni ali drug nasvet.

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- BTC

- cena btc

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- Eter

- ethereum

- FTX

- graf

- strojno učenje

- Prisotnost

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Blok

- W3

- zefirnet