Are we witnessing the end of bitcoin’s typical four-year cycle? How does European adoption of the World Economic Forum’s agenda impact the euro?

Oglejte si to epizodo na YouTubu or Rumble

Poslušajte epizodo tukaj:

“Fed Watch” is the macro podcast for Bitcoiners. Each episode we discuss current events in macro from across the globe, with an emphasis on central banks and currency matters.

V tej epizodi podcasta "Fed Watch" sedim s Tone Vays, resnično Bitcoiner and long-time price and macro analyst of Bitcoin. Our discussion ranges from the current conditions to bitcoin cycles to broader macro topics including the state of U.S. politics, Europe and the euro.

Najdete lestvice za to epizodo tukaj.

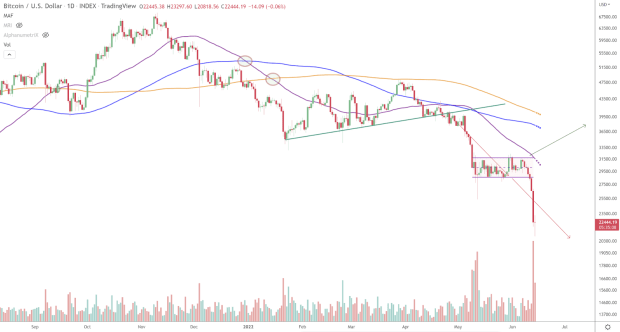

Current Bitcoin Market Conditions

In the first segment of the podcast, Vays talks about the psychological state of the bitcoin market.

“I was around for the last two bear markets. 2013 was the classic bubble chart, you were mentally prepared for what’s to come. 2017, again, the ICOs, it was an unreasonable exponential rise, so you were mentally prepared. I wasn’t mentally prepared for this one. Because, when the top came in April 2021, we had an incredible amount of good news. Michael Saylor, Elon Musk, Jack Dorsey leaving Twitter to go all in on Bitcoin with Square [now Block], El Salvador [legal tender law], then El Salvador buying bitcoin.

»To se je spremenilo v dogodek prodaje novic. 50% popravek, nič hudega. Vsi so bili psihično v redu s tem. Potem je tukaj vse odvisno od vašega duševnega stanja. Ko smo se novembra vrnili in podrli ta vrh, je bilo to o izbruh. Vsi so mislili, da gremo višje; Mislil sem, da greva višje. Tisto ponarejanje novembra je bilo psihično brutalno. Strmoglavili smo nazaj na najnižjo vrednost 30,000 $, padli na 20,000 $ in v zadnjih treh do šestih mesecih so bili ljudje zelo, zelo zaskrbljeni.

“This prolonged move has made people tighten their belts. Mentally, they feel like they were cheated and don’t think bitcoin should be at these lows. Bitcoin was built for this world we are seeing right now with all the uncertainty. They are stealing bank accounts from not just individuals, like in Canada, but from sovereign countries. Bitcoin was built for this, but the price keeps going down. People are starting to throw in the towel. Everyone is saying lower, lower, lower. This is where I have to believe that the majority is always wrong.”

Bitcoin cikli

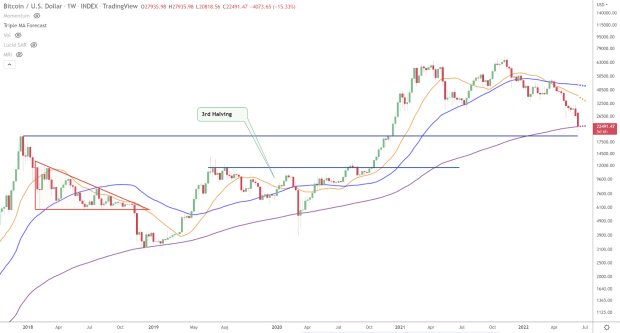

I asked Vays about bitcoin valuation models and four-year cycles. My question is whether they are all broken and if we need to find a new model.

Rekel je, da meni, da modeli vedno spodletijo. Stanje do pretoka je po Vaysovem mnenju teoretično pravilno, vendar ga ni mogoče uspešno uporabiti kot tehnični indikator. Kar zadeva štiriletni cikel razpolovitve, Vays meni, da je to delno posledica navdušenja in delno zaradi dejanskih šokov v ponudbi.

That is my position here on “Fed Watch” as well. The four-year halving cycle has its own hype cycle, completely separate from the overall bitcoin hype. Kind of similar to how altcoins try to hype their hard fork upgrades, bitcoin accomplishes that naturally through the halving.

Vendar menim, da se navdušenje z vsakim ciklom zmanjšuje, skupaj z vidikom šoka ponudbe. Zato zdaj verjamem, da imamo nekakšen dvoletni cikel. Manjši učinek razpolovitve, vendar še vedno povzroča odmev nekaj let pozneje.

Vays pronicljivo poudarja, da je veliko manj jasne razlike med bikovskimi in medvedjimi trgi. Gibanje cen v letih 2020 in 2021 ni primerno za jasno ločnico. V prihodnje bo te cikle težje razmejiti.

Evropska kriza in globalni makro

Začeli smo se izčrpavati s svojo težko časovno omejitvijo, preden smo se lotili sočnih stvari, tako da upajmo, da bomo lahko čez nekaj mesecev spet vključili Vays, da nadaljujemo to razpravo. Izvedeli pa smo njegovo mnenje o Evropi in evru.

»Rekel bom, da imam zelo nizko mnenje o Zahodni Evropi. Lepo je; greš tja in je varno. Lahko hodite po ulici; počutiš se dokaj varno. Ima ostanke propadajoče kapitalistične družbe, saj vso oblast predajajo Svetovnemu gospodarskemu forumu (WEF). Menim, da je WEF liberalna, socialistična organizacija. Imajo preveč nadzora nad politiko. Če citiram Klausa Schwaba, 'Prodrli smo v omare.' In imajo.

»Mislim, da je pot WEF zelo, zelo nevarna pot in kratim prihodnost zahodnih držav, ki kupujejo njegovo moč. Zato sem zelo nastrojen do Evrope. Mislim, da bo skupna valuta razpadla.«

We talk about so much more, from bitcoin’s correlation to stocks and altcoins, to monetary policy. This is one of my favorite episodes we’ve ever done on “Fed Watch,” so it is definitely a must-listen.

To je to za ta teden. Hvala bralcem in poslušalcem. Če vam je všeč ta vsebina, se naročite, pregledajte in delite!

To je gostujoča objava Ansela Lindnerja. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc. oz Bitcoin Magazine.

- 000

- 2020

- 2021

- a

- O meni

- čez

- Ukrep

- Sprejetje

- vsi

- Altcoins

- vedno

- znesek

- Analiza

- Analitik

- Apple

- april

- okoli

- Banka

- Banke

- Medvjedast

- ker

- postanejo

- pred

- meni

- med

- Bitcoin

- Bitcoin Cena

- Analiza cen Bitcoin

- bitcoinerji

- Block

- zlom

- BTC

- BTC Inc.

- bubble

- bull

- nakup

- Nakup

- Kanada

- vzroki

- Osrednji

- Centralne banke

- klasična

- kako

- Skupno

- popolnoma

- zaskrbljen

- Pogoji

- vsebina

- naprej

- nadzor

- države

- par

- kriza

- valuta

- Trenutna

- ciklov

- ponudba

- DID

- razpravlja

- navzdol

- vsak

- echo

- Gospodarska

- učinek

- El Salvador

- Elon Musk

- Poudarek

- Euro

- Evropa

- Evropski

- Event

- dogodki

- vsi

- izražena

- ponaredek

- konec

- prva

- vilice

- Naprej

- iz

- Prihodnost

- Globalno

- globus

- dogaja

- dobro

- Gost

- Gost Prispevek

- Razpolovitev

- trde vilice

- tukaj

- več

- Kako

- HTTPS

- ICO

- vpliv

- Inc

- Vključno

- posamezniki

- IT

- zakon

- Pravne informacije

- LIMIT

- vrstica

- Makro

- je

- Večina

- Tržna

- Prisotnost

- Zadeve

- duševne

- moti

- Model

- modeli

- Denarno

- mesecev

- več

- premikanje

- nujno

- novice

- Mnenje

- Komentarji

- Organizacija

- Splošni

- lastne

- ljudje

- prosim

- Podcast

- točke

- politika

- politika

- Stališče

- moč

- Cena

- Analiza cen

- vprašanje

- bralci

- odražajo

- pregleda

- tek

- varna

- Je dejal

- Salvador

- Segment

- prodaja

- Kratke Hlače

- Podoben

- SIX

- Šest mesecev

- So

- Društvo

- suvereno

- Spotify

- kvadrat

- začel

- Država

- Še vedno

- Zaloge

- ulica

- naročiti

- Uspešno

- dobavi

- Pogovor

- pogovori

- tehnični

- O

- svet

- 3

- skozi

- čas

- vrh

- Teme

- nas

- Negotovost

- Vrednotenje

- Watch

- teden

- WEF

- Zahodna Evropa

- ali

- svet

- Svetovni gospodarski forum

- let

- Vaša rutina za

- youtube