The Canadian dollar is in positive territory on Thursday. In the North American session, USD/CAD is trading at 1.3363, down 0.16%. Earlier, USD/CAD fell as low as 1.3303, its lowest level in two months.

BoC delivers dovish hike

The Bank of Canada raised rates on Wednesday for the eighth time since March 2022, continuing its aggressive rate-tightening cycle. However, the rate hike of 25 basis points was the smallest since March and brought the cash rate to 4.50%. The move was widely expected, but the Canadian dollar has posted gains.

BoC Governor Macklem was crystal clear about his plans, saying after the meeting that the Bank is likely to pause rate hikes, although he cautioned that this would be a “conditional pause”, dependent on data conforming with the central bank’s outlook.

The BoC has now tightened by some 400 basis points since March, but inflation has fallen modestly, from a high of 8.1% in June to 6.3% in December. This is much higher than the Bank’s inflation target of 2%, but the BoC is expecting a more rapid downtrend. The Bank’s Monetary Policy report, released at yesterday’s meeting, projected that inflation will fall as low as 3% by the end of 2o23 and drop to 2% in 2024.

The US released strong numbers today, highlighted by GDP for Q4, which was better than expected. GDP expanded by 2.9%, beating the forecast of 2.6% and following a 3.2% gain in Q3. Unemployment claims fell to 186,000, down from 192,000 and below the consensus of 205,000. As well, Durable Goods Orders shot up 5.6% in December, rebounding from -2.1% in November and ahead of the 2.5% forecast. The solid data will boost expectations that the Fed could still pull off a soft landing, but consumer spending will have to rebound for that to happen. In December, retail sales came in at -1.1% and that will have to improve if the US economy is to avoid a recession.

.

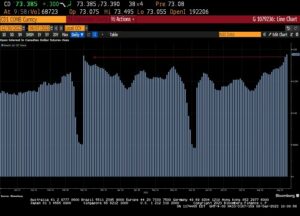

USD / CAD tehnični

- USD/CAD tested support 1.3314 earlier today. 1.3248 is the next support line

- 1.3418 in 1.3484 sta naslednji črti upora

Ta članek je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno korporacije OANDA Corporation ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Trgovanje z vzvodom je visoko tveganje in ni primerno za vse. Lahko izgubite vsa vložena sredstva.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://www.marketpulse.com/20230126/canadian-dollar-rises-on-sharp-us-numbers/

- 000

- 1

- 2%

- 2012

- 2022

- 2024

- a

- O meni

- nad

- nasveti

- podružnice

- po

- agresivni

- naprej

- vsi

- Alpha

- Čeprav

- Ameriška

- Analiza

- Analitik

- in

- članek

- Avtor

- Avtorji

- Banka

- banka Kanade

- temeljijo

- Osnova

- spodaj

- Boljše

- BoC

- povečanje

- Pasovi

- široka

- prinesel

- nakup

- Kanada

- Kanadski

- kanadski dolar

- Denar

- Osrednji

- terjatve

- jasno

- COM

- Blago

- Soglasje

- Potrošnik

- nadaljevati

- prispeva

- KORPORACIJA

- bi

- Ovitki

- Crystal

- vsak dan

- datum

- december

- daje

- odvisno

- deponiran

- Direktorji

- Dollar

- Dovish

- navzdol

- Drop

- prej

- Gospodarstvo

- Osmi

- Lastniški vrednostni papirji

- razširiti

- pričakovanja

- Pričakuje

- pričakovati

- izkušen

- Padec

- Fallen

- Fed

- finančna

- Finančni trg

- Osredotočite

- po

- Napoved

- forex

- iz

- temeljna

- Skladi

- Gain

- zaslužek

- BDP

- splošno

- blago

- Guverner

- Guverner Macklem

- se zgodi

- visoka

- več

- Poudarjeno

- zelo

- Pohod

- Pohodi

- Vendar

- HTTPS

- izboljšanje

- in

- Vključno

- inflacija

- Podatki

- vlaganjem

- naložbe

- Izrael

- IT

- pristanek

- Stopnja

- Verjeten

- izgubiti

- nizka

- najnižji nivo

- Macklem

- velika

- marec

- Tržna

- MarketPulse

- Prisotnost

- max širine

- srečanja

- Denarno

- Monetarna politika

- mesecev

- več

- premikanje

- nujno

- Naslednja

- sever

- november

- številke

- uradniki

- na spletu

- Komentarji

- naročila

- Outlook

- načrti

- platon

- Platonova podatkovna inteligenca

- PlatoData

- točke

- politika

- pozitiven

- objavljene

- Prispevkov

- napovedane

- publikacije

- objavljeno

- namene

- Q3

- postavljeno

- območje

- hitro

- Oceniti

- Oceni pohod

- stopnje povišanj

- Cene

- odboj

- recesija

- sprosti

- poročilo

- Odpornost

- Trgovina na drobno

- Prodaja na drobno

- Dvigne

- Tveganje

- prodaja

- Vrednostni papirji

- iskanju

- Iščem Alpha

- prodaja

- Zasedanje

- več

- delitev

- oster

- saj

- Soft

- trdna

- Rešitev

- nekaj

- Poraba

- Še vedno

- močna

- primerna

- podpora

- ciljna

- O

- Fed

- čas

- do

- danes

- Trgovanje

- brezposelnosti

- us

- Ameriško gospodarstvo

- USD / CAD

- Sreda

- ki

- pogosto

- bo

- delo

- bi

- Vi

- Vaša rutina za

- zefirnet