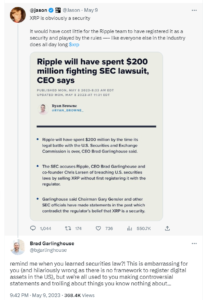

- Gary Gensler’s SEC tenure is under scrutiny amid a fraught regulatory landscape for cryptocurrencies.

- An imminent Bitcoin spot ETF approval could significantly alter the crypto market’s dynamics.

- Political factors and the upcoming 2024 election may influence Gensler’s regulatory approach to crypto.

Ron Hammond of the Blockchain Association weighed in on pivotal cryptocurrency industry questions during a dialogue on Thinking Crypto.

Preberite CRYPTONEWSLAND naprej novice o Googlu

Most notably, the anticipation around a potential Bitcoin spot ETF is reaching a fever pitch, especially given Grayscale’s triumphs and an increasing pool of contenders. The atmosphere is so charged that many envisage the SEC giving the green light in this year’s last quarter.

However, the spotlight also beams on Gary Gensler, SEC Chair, whose decision on this critical matter could unleash a tempest of public distrust and legal strife. Hammond points out that a denial without airtight justification might ignite a contentious legal imbroglio, casting a pall over the SEC’s standing.

Furthermore, political undercurrents could destabilize Gensler’s position. With the looming 2024 election, Democrats may persuade him to mollify his stance should they feel it imperils their electoral prospects.

Amidst this turbulence, the future of Bitcoin spot ETFs seems luminous, likely to usher in a transformative phase for cryptocurrency investments.

Preberite tudi:

Omejitev odgovornosti Preberi več

Dežela kripto novic (cryptonewsland.com) , skrajšano tudi »CNL«, je neodvisen medijski subjekt – nismo povezani z nobenim podjetjem v industriji blokovnih verig in kriptovalut. Naš cilj je zagotoviti svežo in ustrezno vsebino, ki bo pomagala zgraditi kriptoprostor, saj verjamemo v njen potencial, da vpliva na svet na bolje. Vsi naši viri novic so verodostojni in točni, kot vemo, čeprav ne jamčimo glede veljavnosti njihovih izjav in njihovih motivov za njimi. Čeprav skrbimo za dvojno preverjanje verodostojnosti informacij iz naših virov, ne dajemo nobenih zagotovil glede pravočasnosti in popolnosti kakršnih koli informacij na našem spletnem mestu, kot jih zagotavljajo naši viri. Poleg tega zavračamo vse informacije na naši spletni strani kot naložbene ali finančne nasvete. Vse obiskovalce spodbujamo, da opravijo lastno raziskavo in se posvetujejo s strokovnjakom za ustrezno temo, preden sprejmejo kakršno koli naložbeno ali trgovalno odločitev.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- ChartPrime. Izboljšajte svojo igro trgovanja s ChartPrime. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://cryptonewsland.com/challenges-sec-chair-gary-gensler-faces-in-the-crypto-space-expert-weighs-in/

- : je

- :ne

- $GOR

- 10

- 14

- 150

- 2023

- 2024

- 22

- 26%

- 33

- 36

- 54

- 7

- a

- natančna

- nasveti

- Pridružen

- Cilj

- vsi

- Prav tako

- Čeprav

- Sredi

- an

- in

- pričakovanje

- kaj

- pristop

- odobritev

- SE

- okoli

- AS

- Združenje

- At

- atmosfera

- avatar

- pred

- zadaj

- Verjemite

- Boljše

- Bitcoin

- Bitcoin spot etf

- blockchain

- izgradnjo

- Gumb

- by

- litje

- Stol

- izzivi

- zaračuna

- Collapse

- podjetje

- Kongres

- vsebina

- bi

- verodostojno

- kritično

- kripto

- Kripto novice

- kripto prostor

- cryptocurrencies

- cryptocurrency

- Industrija kriptovalut

- Datum

- Odločitev

- demokratov

- Dialog

- nezaupanje

- do

- med

- dinamika

- Volitve

- vgrajeni

- spodbujanje

- entiteta

- zlasti

- ETF

- ETF

- strokovnjak

- obrazi

- dejavniki

- false

- občutek

- finančna

- finančno svetovanje

- tekočina

- za

- sveže

- iz

- Prihodnost

- prihodnost Bitcoina

- Gary

- Gary Gensler

- Gensler

- dana

- Giving

- novice o Googlu

- Zelen

- zelena luč

- hammond

- pomoč

- visoka

- ga

- njegov

- HTTPS

- Ikone

- Ignite

- neizbežna

- vpliv

- in

- narašča

- Neodvisni

- Industrija

- vplivajo

- Podatki

- naložbe

- naložbe

- IT

- ITS

- jpg

- Vedite

- Država

- Pokrajina

- Zadnja

- Pravne informacije

- light

- Verjeten

- statve

- Znamka

- Izdelava

- več

- Martin

- Matter

- max širine

- Maj ..

- mediji

- morda

- minut

- več

- Poleg tega

- motivira

- premikanje

- novice

- Naslednja

- predvsem

- of

- on

- or

- naši

- ven

- več

- lastne

- ŽOGA

- faza

- fotografija

- PHP

- Smola

- ključno

- platon

- Platonova podatkovna inteligenca

- PlatoData

- točke

- političnih

- bazen

- Stališče

- potencial

- možnosti

- zagotavljajo

- če

- javnega

- četrtletje

- vprašanja

- dosegli

- Preberi

- predpisi

- regulatorni

- regulativno pokrajino

- pomembno

- Raziskave

- pregled

- SEC

- sec stol

- Zdi se,

- september

- shouldnt

- bistveno

- saj

- So

- Viri

- Vesolje

- Komercialni

- spot etf

- Spotlight

- stabilno

- predpisi stabilnega valuta

- Izjave

- predmet

- Preverite

- SVG

- da

- O

- Prihodnost

- svet

- njihove

- jih

- Razmišljanje

- ta

- do

- Trgovanje

- transformativno

- Res

- turbulenca

- pod

- sprostiti

- prihajajoče

- Obiskovalci

- we

- Spletna stran

- Dobro

- medtem

- katerih

- bo

- z

- brez

- svet

- Vaša rutina za

- youtube

- zefirnet