Coinbase stock rebounded during the early U.S. trading hours on Aug.11 after it beat Wall Street forecasts for sales and revenues in the second quarter.

The cost to purchase one COIN share surged 4.7% to $282.34 at the New York opening bell. Later, bids for COIN rose to as high as $294 before pulling back to the current price at $279.72.

Močan zaslužek za drugo četrtletje za Coinbase

Coinbase poročali better-than-expected earnings in the second quarter of 2021and a net revenue of $2.3 billion. That came out to be 27% higher than the previous quarter and 1,042% up on a year-over-year basis.

Meanwhile, Coinbase’s net income rose from $32 million to $1.6 billion in the same period, surpassing earnings of older, more traditional exchange operators, including CME Group, which earned $510 million and made $1.2 billion in revenue in Q3, and the Intercontinental Exchange, which reported $1.3 billion in earnings.

The positive Coinbase results have arrived as različne entitete se še naprej kopičijo bitcoini (BTC), and the firm reported that its monthly transaction metric climbed to 8.1 million in Q2 from $6.1 million in Q1. Meanwhile, its trading volume rose to $462 billion from $335 billion in the same period.

During the earnings call, Coinbase CEO Brian Armstrong razpravljali plans to expand operations in the future.

Armstrong je dejal:

»Osredotočamo se tudi na mednarodno širitev, drugo obliko decentralizacije in samo naštevanje vse več sredstev. Želimo biti Amazon premoženja, našteti vsa sredstva v kripto, ki so zakonita. "

In a letter to shareholders, Coinbase shared plans to explore decentralized finance (DeFi), adding that mainstream customers and institutions would soon be using the technology, which cuts out traditional intermediaries from financial services, such as lending and borrowing.

Analitiki še vedno izražajo previdnost

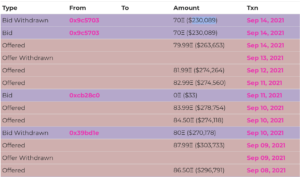

On the flip side, Coinbase warned that zmanjševanje volatilnosti na trgu kriptovalut that could impact its earnings in the year ahead.

The firm stated that its monthly transacting users (MTU) — retail traders that trade on exchanges at least once a month — surged 44% to 8.8 million at the end of Q2. However, the net MTU declined in July and August, prompting Coinbase to lower its annual-users estimate from 9 million to 8 million.

Declining trading volumes is another metric concerning analysts, and the figure was weaker in July, mostly due to Bitcoin’s price slumping below $30,000.

Po mnenju analitika Wedbush Securities Mosheja Katrija so COIN -ove primarne skrbi "večinoma povezane z regulativnim okoljem".

Katri is likely referring to the United States Senate odobritev približno 1 bilijona dolarjev vrednega zakona o infrastrukturi, a part of which requires digital asset brokers to report capital gains to the Internal Revenue Service. The bill aims to raise $28 billion in a decade by taxing the cryptocurrency sector, but it failed to define who it considers “brokers.”

Anne Fauvre, chief operating officer of data security firm Oasis Labs, said that the bill is too vague, fearing that it might end up covering entities that are neither brokers nor hold any personal information of their customers.

Fauvre told Cointelegraph that “Regulation should be seen as a way to create guardrails around industries” and that “This bill would stifle the next 20 years of innovation in the US as we know it.”

Adding to these regulatory concerns, Coinbase chief financial officer Alesia Haas Rekel CNBC that U.S. regulators and lawmakers need to know that not every cryptocurrency is a security. Armstrong said that Coinbase is investing in crypto advocacy the Crypto Council for Innovation to ensure “sensible regulation” in the United States.

Tehnični obeti COIN -a so pozitivni

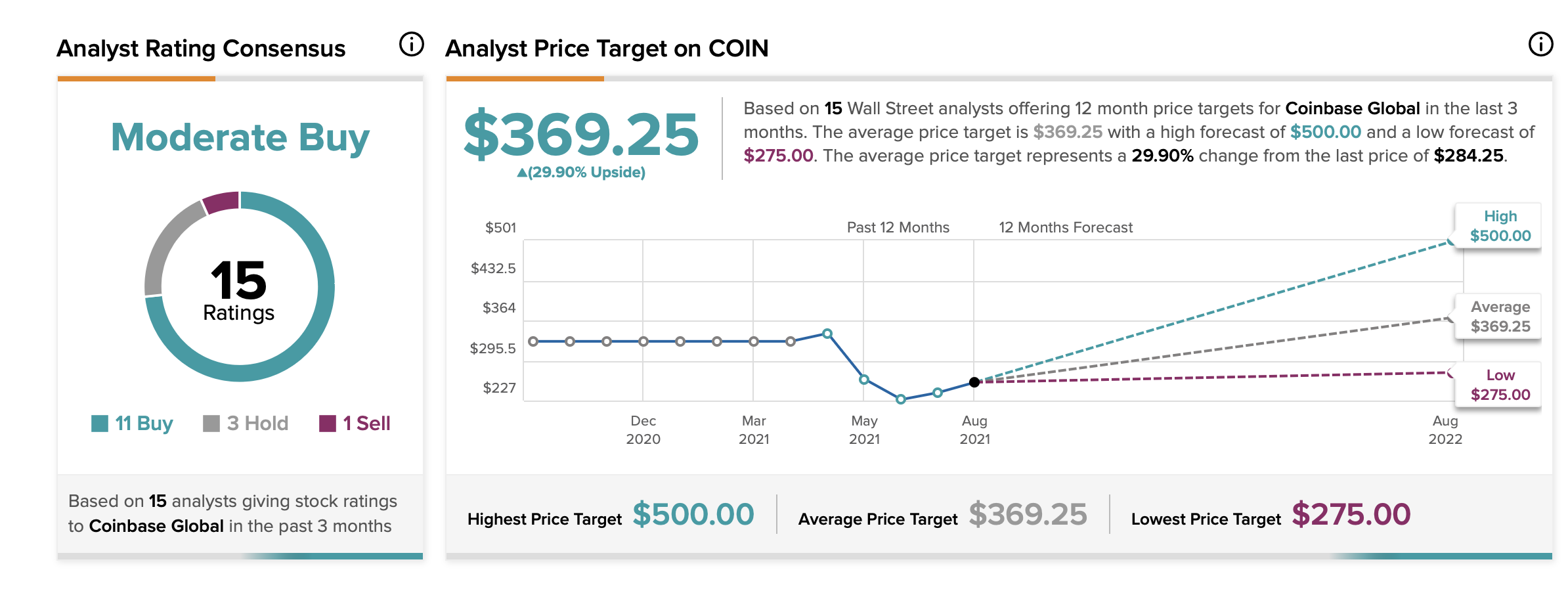

Katri ponovljeno a “buy” rating for Coinbase stock and suggested a rise to $300 in the next 12 months, which is a 3.03% upside estimate.

According to TipRanks, the average analyst soglasje for COIN was also “buy,” with a $369.25 price target per share by next year.

- "

- 000

- 11

- 9

- zagovorništvo

- Amazon

- Analitik

- okoli

- sredstvo

- Sredstva

- Avgust

- Bell

- Bill

- Billion

- Bitcoin

- Zadolževanje

- nakup

- klic

- Kapital

- ceo

- šef

- Glavni operativni direktor

- CM razširitev

- CNBC

- Coin

- coinbase

- Cointelegraph

- Soglasje

- meni

- naprej

- Svet

- kripto

- cryptocurrency

- Trenutna

- Stranke, ki so

- datum

- Varovanje podatkov

- decentralizacija

- Decentralizirano

- Decentralizirane finance

- Defi

- digitalni

- Digitalno sredstvo

- Zgodnje

- Plače

- okolje

- ocene

- Izmenjava

- Izmenjave

- Razširi

- Širitev

- Slika

- financiranje

- finančna

- finančne storitve

- Firm

- obrazec

- Prihodnost

- skupina

- visoka

- držite

- HTTPS

- vpliv

- Vključno

- prihodki

- industrij

- Podatki

- Infrastruktura

- Inovacije

- Institucije

- Notranja davčna služba

- Facebook Global

- vlaganjem

- IT

- julij

- Labs

- zakonodajalci

- Pravne informacije

- posojanje

- Seznam

- seznam

- Mainstream

- milijonov

- mesecev

- net

- NY

- Častnik

- deluje

- operacije

- Outlook

- Cena

- vlečenje

- nakup

- Q1

- dvigniti

- RE

- Uredba

- Regulatorji

- poročilo

- Rezultati

- Trgovina na drobno

- prihodki

- prodaja

- Vrednostni papirji

- varnost

- Senat

- Storitve

- Delite s prijatelji, znanci, družino in partnerji :-)

- deli

- Države

- zaloge

- ulica

- ciljna

- tehnični

- Tehnologija

- trgovini

- trgovci

- Trgovanje

- transakcija

- nas

- Velika

- Združene države Amerike

- us

- Uporabniki

- Volatilnost

- Obseg

- Wall Street

- WHO

- Yahoo

- leto

- let

- youtube