To je tedenska vadnica o najprivlačnejših priložnostih pri kmetovanju, ki jo je napisal naš prijatelj DeFi oče, svetovalec The Defiant in vodja trženja in podpore portfelju pri Prestolnica četrte revolucije.

Disclaimer: All opinions expressed by DeFi Dad are solely his own opinion and do not reflect the opinion of 4RC or The Defiant. DeFi Dad disclosed he is in the Orion Saver stablecoin farm. He wishes to disclose this as he could benefit from future upside in an ORION token once it’s generated. This post is for informational purposes only and should not be relied upon as a basis for investment decisions. Please do not follow any opinion as a specific strategy.

Ozadje protokola: Poklican nov protokol DeFi Orionov denar aims to build a cross-chain stablecoin bank for saving and lending. What’s clever about Orion is that it’s bridging demand from two different DeFi communities: the Anchor Rate available on Terra blockchain and the outsized amount of stablecoin liquidity and demand to earn yield on Ethereum. If you’re unfamiliar with the Anchor Rate, think of it as the target APY that Anchor protocol seeks to pay out to depositors of UST. This Anchor Rate isn’t fixed, but is designed to be stable, currently about 19.55% APY.

If you have a reliable source to earn a stable 19-20% yield on stablecoins on one blockchain (Terra) and a larger pool of stablecoin lenders on Ethereum, what happens when you bring the two together? Orion Money addresses this by allowing stablecoin lenders to remain on Ethereum, while lending one of many stablecoins such as DAI, USDC, and UST to earn with the Anchor Rate.

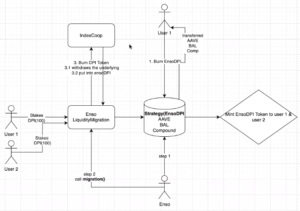

Tukaj je, kako to deluje:

- Orion users deposit ERC20 stablecoins on Ethereum (USDT, USDC, DAI, wrapped UST, FRAX, BUSD).

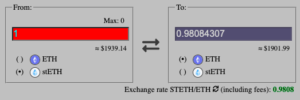

- Under the hood, Orion Money swaps the stablecoins for wrapped UST using curve.fi/ust and then bridges the wrapped UST to native UST on Terra. There are some higher gas fees to pay and potential slippage to impact anyone’s deposits/withdrawals.

- Lastly, the UST is used to earn the Anchor UST rate, currently at 19.55% APY.

I’m not sure there’s a better example today of cross-chain DeFi than this. Someone depositing stablecoins on Ethereum benefits from yield earned on Terra. Also, like most blue chip DeFi protocols on Ethereum, there’s cover already available at 2.6% APR for Orion deposits, thanks to Zavarovanje, or at least there was cover until it sold out recently.

Keep in mind, this is simply the first phase of a rollout to support lending stablecoins on Orion Money. Here’s a few milestones ahead:

- In September, the team will facilitate an IDO prior to token generation of ORION.

- Eventually after ORION is created, Orion users will have the option of being paid interest denominated in their deposited stablecoins or a higher interest rate in ORION.

- Additionally, any depositor can earn higher interest for staking ORION. When users stake more ORION, they earn a higher APY, similar to the model used by centralized crypto lenders Celsius and Nexo.

- Different from those CeFi lenders, all net revenue from Orion Money will end up in an ORION staking pool for ORION stakers.

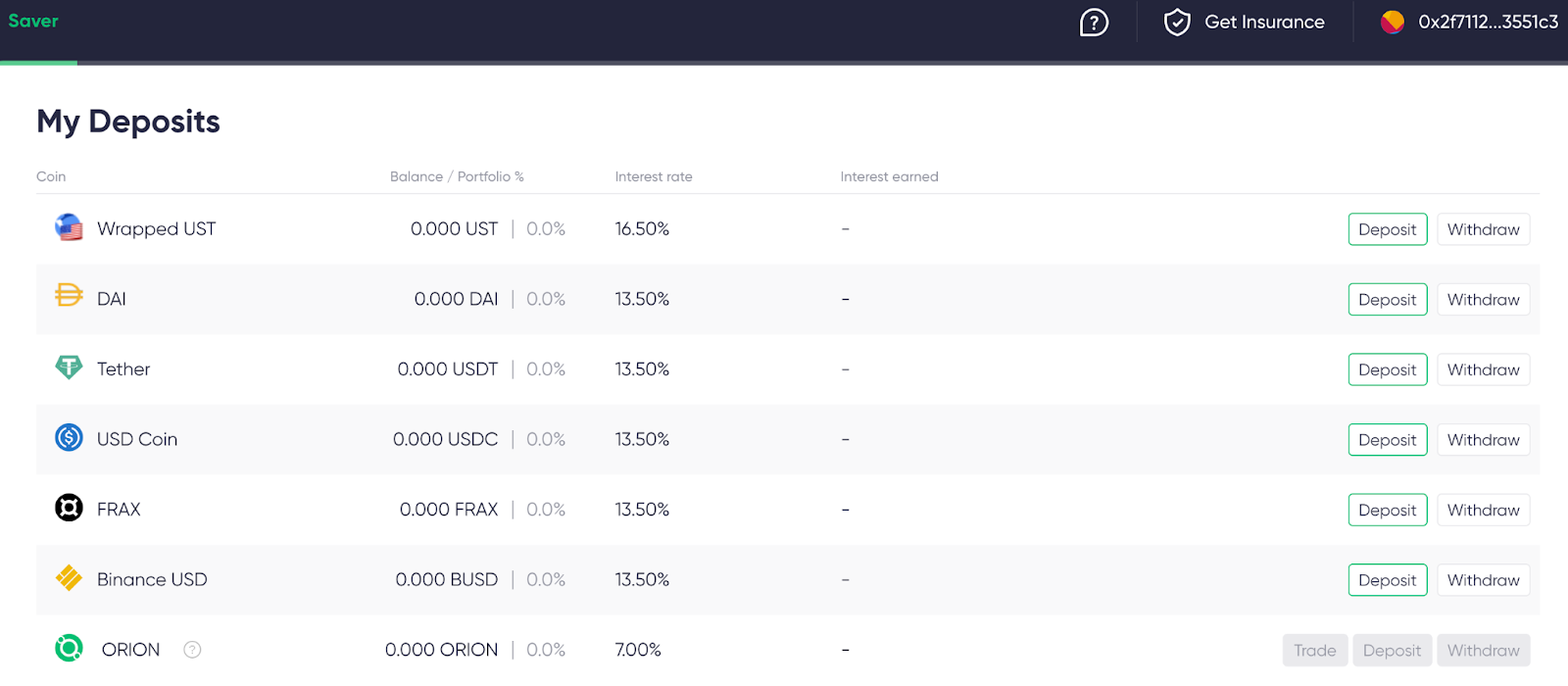

Priložnost: Today, I will share how I can earn 16.5% APY with UST or 13.5% APY with DAI, USDC, USDT, BUSD, or FRAX.

Čas za dokončanje: 10 minut, če plačate priporočeno ceno goriva FAST ali višjo gasnow.org.

Predvideno trajanje programa nagrajevanja: These pools are only getting started. The rates will actually rise to between 15-25% APY after the ORION token is generated in September, following some future IDO. For now, the rates are fixed at 13.5% for all stablecoins or 16.5% APY for UST.

Pristojbine za plin + protokol: Glede na cene goriva med 30–60 Gwei na Ethereumu bi moralo sodelovanje stati 40–90 USD.

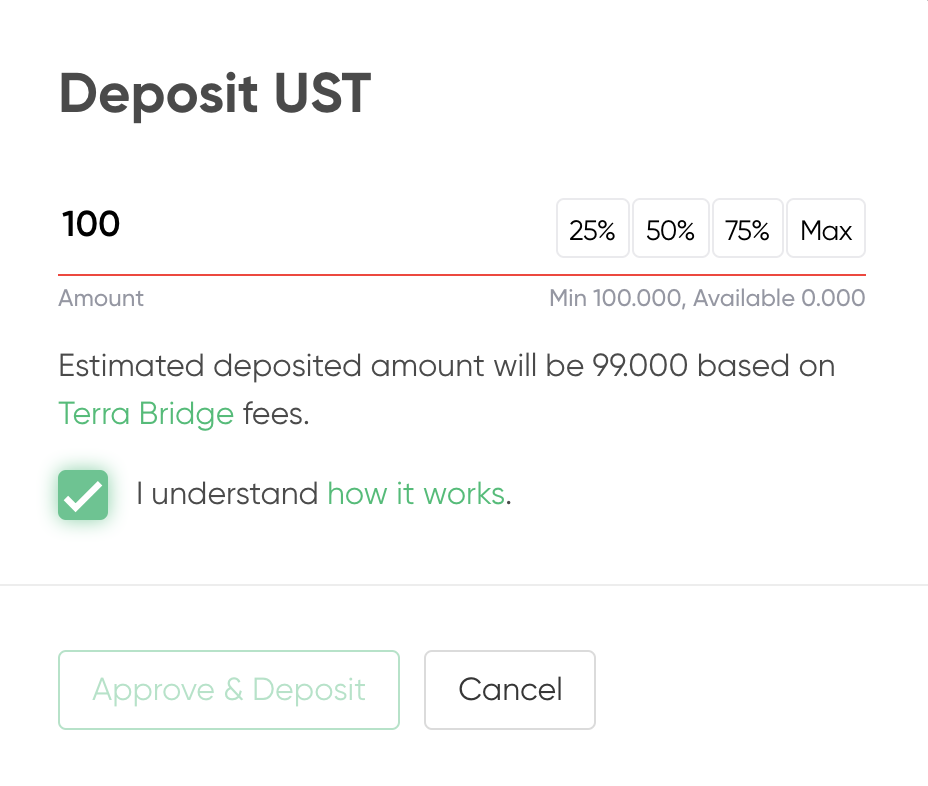

Pristojbine: Other than the usual Ethereum network fees you pay as gas, it’s worth noting that with Orion, users are paying for a convenience to not have to bridge money to Terra. For this service, Orion takes a cut. For example, I can earn 19.55% APY with the Anchor Rate but I’m earning 16.5% APY with UST on Orion. In the future, after ORION token is generated, these rates will rise to an expected 20-25% APY if I stake ORION and choose to be paid interest in ORION tokens. Also for withdrawing from Orion, be aware it involves a transfer between Terra and Ethereum handled by Terra Bridge (Shuttle) which imposes a fee of maximum of $1 or 0.1% of the total amount.

Tveganja: Kot vedno, to ni finančni nasvet, zato morate opraviti lastno raziskavo. Pri sodelovanju v tej priložnosti so navedena naslednja tveganja.

- Smart contract risk in Orion Money, Anchor, and Curve (if depositing stablecoins other than UST).

- Napaka Oracle

- Likvidnostna kriza

- Sistemsko tveganje v DeFi

- Vezana sredstva, kot so stabilni kovanci, lahko odstranijo vezavo

Vaje:

- Najprej grem na Orion Money app here, connect my Ethereum wallet via MetaMask or WalletConnect, assuming I have one of the six listed stablecoins.

- In order to save gas, if I have multiple types of stablecoins, I might consider swapping them for a single kind of stablecoin ahead of time.

- If I have wrapped UST on Ethereum, I will notably save money on gas since it doesn’t require Orion to swap to UST via Curve before bridging to Terra.

- Btws, ignore the ORION token option at the bottom.

- Next, I choose whichever token to deposit, in my case UST, and click Deposit v zeleni barvi.

- Sledim navodilom za Approve & Deposit, which will require 2 transactions on MetaMask.

- I’m done! Now, I can track my Zaslužene obresti pod My Deposits. I could also return here to deposit other stablecoins.

O avtorju: DeFi oče je DeFi super-uporabnik, izobraževalec in investitor. On in njegova ekipa pri 4RC (Fourth Revolution Capital) vlagajo v ekipe, ki gradijo naslednji odličen protokol ali aplikacijo v DeFi, NFT in Web3. Na njegov YouTube kanal se lahko naročite na defidad.com in mu sledite na Twitterju.

- &

- nasveti

- svetovalec

- vsi

- Dovoli

- aplikacija

- uporaba

- Sredstva

- Banka

- blockchain

- MOST

- izgradnjo

- Building

- BUSD

- Kapital

- Celzija

- čip

- skupnosti

- Naročilo

- kripto

- krivulja

- DAI

- Defi

- Povpraševanje

- ERC20

- ethereum

- omrežje ethereum

- kmetija

- kmetovanje

- FAST

- pristojbine

- finančna

- prva

- sledi

- Prihodnost

- GAS

- pristojbine za plin

- veliko

- Zelen

- Glava

- tukaj

- Kako

- Kako

- HTTPS

- vpliv

- obresti

- naložbe

- Investitor

- IT

- posojanje

- likvidnostno

- Trženje

- MetaMask

- Model

- Denar

- net

- mreža

- nexo

- NFT

- Mnenje

- Komentarji

- Priložnosti

- Priložnost

- Možnost

- Da

- Ostalo

- Plačajte

- bazen

- Bazeni

- Portfelj

- Cena

- Program

- Cene

- Raziskave

- prihodki

- Nagrade

- Tveganje

- shranjevanje

- Delite s prijatelji, znanci, družino in partnerji :-)

- SIX

- prodaja

- stabilno

- Stablecoins

- delež

- Staking

- začel

- Strategija

- podpora

- ciljna

- Zemlja

- čas

- žeton

- Boni

- sledenje

- Transakcije

- USDC

- USDT

- Uporabniki

- denarnica

- Web3

- Tedenski

- deluje

- vredno

- donos

- youtube