A review of the biggest macroeconomic developments that impacted bitcoin last year, and those that will shape it in 2022.

Oglejte si to epizodo na YouTubu

Poslušajte to epizodo:

V tej epizodi Bitcoin Magazine’s “Fed Watch” podcast, Christian Keroles and I recorded live on YouTube as part of the magazine’s near-daily live stream. This week, we reviewed the major trends and news items of 2021 and then dive into predictions for 2022 trends.

Bitcoin And Macro Review For 2021

Keep in mind that many things happened in Bitcoin this year, but these were the biggest trends and events from a currency/macroeconomic perspective.

First and foremost, we have El Salvador’s move to add bitcoin as legal tender alongside the U.S. dollar. It was announced at the Bitcoin 2021 conference in Miami and instantly drew applause from bitcoiners as well as criticism from traditional gatekeepers like the International Monetary Fund (IMF) and World Bank. We spent a few minutes discussing different aspects of the El Salvador news and President Bukele himself. If there was a “Bitcoin Man of 2021” it would probably be him.

The second most influential event of 2021 was the China Bitcoin ban. After years of flip-flopping with partial bans, the Chinese Communist Party (CCP) finally did it and banned bitcoin services and businesses in May. This led to an exodus of bitcoin miners from China, mainly to other countries in Central Asia and the U.S. The other half of this story therefore is the rise of the bitcoin mining industry in the U.S. The U.S. has always been home to many bitcoin miners, but now the U.S. is the largest mining country in the world; a title it likely won’t give up for decades to come.

Noben pregled leta 2021 ne bi bil popoln, če ne bi vključili vprašanj dobavne verige in tega, kar večina ljudi imenuje »inflacija«. To je bila vsekakor glavna tema v letu 2021 v makroekonomiji – gospodarstvo je doseglo vrhunec ob koncu prvega četrtletja, v preostalem delu leta pa sta prevladovala upočasnitev temeljnih vrednosti in rast cen.

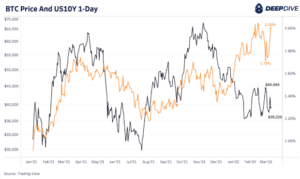

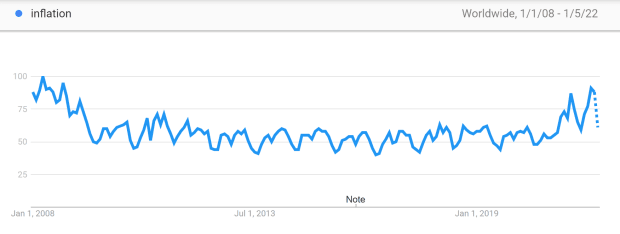

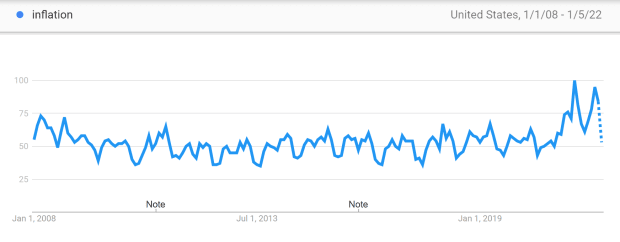

Hiter pogled na Google Trends od velike finančne krize (GFC) kaže, da je svetovno zanimanje za izraz »inflacija« doseglo najvišje od takrat, zlasti v ZDA pa je bila skrb glede inflacije večja od GFC, ko je začela centralna banka Federal Reserve. na tej trenutni poti kvantitativnega lajšanja (QE).

V drugi polovici leta v finančnih krogih težko bi preživeli dan, ne da bi bila glavna tema inflacija. Vendar ne pozabite, da je bila to tudi najhujša motnja dobavne verige v zadnjih 75 letih. Velik del sveta je bil v letih 2020 in 2021 mesece zaprt, ni čudno, da so se cene skromno zvišale. Presenetljivo pa je, da povišanje cen ni bilo bolj dramatično. Vse to je povzročilo nekaj mesecev blizu 1% inflacije?

Finally, for 2021 we discussed the trends in stablecoins and altcoins. Last year, we witnessed a clear decoupling in both of these areas. For stablecoins, we saw the Fed break with the European Central Bank (ECB) and other central banks by not demonizing stablecoins and stiff-arming central bank digital currencies (CBDCs). This highlights a fundamental conflict of interest arising between central banks around the world. As for altcoins, they have decoupled from the typical relationship with bitcoin. In previous eras, altcoins would pump and be dumped for bitcoin, however, NFTs, which are much less liquid than a currency-type altcoin, are not easily dumped for bitcoin. This traps value in scams and stops bitcoin from benefiting from the cycles of extreme speculation.

Bitcoin And Macro Predictions For 2022

Zdaj pa nekaj zabavnih stvari. Če ste redni poslušalec »Fed Watch«, vas marsikaj ne bo presenetilo. Tukaj so poudarki, vendar boste morali poslušati vse naše napovedi.

Menimo, da bo najbolj prevladujoč trend leta 2022 naraščajoča kriza v Evropi. Evropska dolžniška kriza se je začela zelo hitro po GFC, v trenutni finančni krizi pa pričakujemo evropsko dolžniško krizo 2.0. To je velika stvar, saj se odnosi Evrope z ZDA in Fed pokajo in se začenjajo kazati nekateri notranji zlomi.

Bolj specifična politična napoved, ki jo imamo za leto 2022, je, da se bodo mediji in politiki začeli premikati bolj v središče. To je v skladu s časovnico Fourth Turning, večgeneracijskim ciklom, ki se konča s politično vrnitvijo v središče in prenovo institucij in družbe. Tiste države, ki ne bodo sposobne »reformirati« (gledam vas, KPK in Bruselj), se bodo soočile z visoko stopnjo državljanskih nemirov ali revolucije. Leto 2022 je leto, ko bo to postalo jasno.

The coming year will also see at least one more country adopting bitcoin using the blueprint of El Salvador. We speculate on which countries this could be. I brought up the Latin American countries of Ecuador and Panama because they both use the USD similarly to El Salvador. Keroles brought up the African country of Tonga. There are many options, some of them already showing interest in bitcoin.

To je objava gosta Ansela Lindnerja. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj družbe BTC Inc oz Bitcoin Magazine.

Source: https://bitcoinmagazine.com/markets/macroeconomic-trends-impacting-bitcoin-in-2021-and-2022

- '

- 2020

- Afriški

- vsi

- Altcoin

- Altcoins

- Ameriška

- razglasitve

- Apple

- okoli

- asia

- Ban

- Banka

- Banke

- Prepovedi

- največji

- Bitcoin

- Bitcoin mining

- bitcoinerji

- Bruselj

- BTC

- BTC Inc.

- podjetja

- klic

- povzročilo

- CBDC

- Centralna banka

- digitalne valute centralne banke

- Centralne banke

- Kitajska

- kitajski

- Kitajska komunistična stranka

- prihajajo

- Konferenca

- konflikt

- države

- kriza

- plačila

- Trenutna

- dan

- ponudba

- Dolg

- DID

- digitalni

- digitalne valute

- Motnje

- Dollar

- olajšanje

- ECB

- Gospodarstvo

- konča

- Evropa

- Evropski

- Event

- dogodki

- Exodus

- Obraz

- Fed

- Zvezna

- zvezne rezerve

- končno

- finančna

- finančna kriza

- prva

- zabava

- Sklad

- Osnove

- Globalno

- google trendi

- veliko

- Gost

- Gost Prispevek

- tukaj

- visoka

- Domov

- HTTPS

- IMF

- Vključno

- Industrija

- inflacija

- Institucije

- obresti

- Facebook Global

- Mednarodni monetarni sklad

- Vprašanja

- IT

- Latinska Amerika

- Led

- Pravne informacije

- vrstica

- Tekočina

- Makro

- velika

- moški

- mediji

- Rudarji

- Rudarstvo

- mesecev

- premikanje

- novice

- NFT

- Komentarji

- možnosti

- Ostalo

- Panama

- ljudje

- perspektiva

- Podcast

- političnih

- napoved

- Napovedi

- Predsednik

- Cena

- Črpalka

- količinsko

- Kvantitativnega popuščanja

- REST

- pregleda

- prevare

- Storitve

- Počasi

- Društvo

- Spotify

- Stablecoins

- Začetek

- začel

- dobavi

- dobavne verige

- Napajalne verige

- presenečenje

- svet

- Trends

- nas

- ameriški dolar

- vrednost

- Watch

- teden

- Kaj je

- svet

- Svetovna banka

- leto

- let

- youtube