V četrtek (25. avgusta) Cumberland, which is “a specialized cryptoasset trading company within DRW, a diversified principal trading firm”, commented on the crypto market in general, and in particular about the potential ramifications of Ethereum’s upcoming “Merge” upgrade, which marks the transition from proof-of-work (PoW) to proof-of-stake (PoS).

Evo, kako Ethereum Foundation razlaga združitev, ki naj bi se zgodila okoli 15. septembra:

"Združitev predstavlja združitev obstoječega izvršilnega sloja Ethereuma (glavnega omrežja, ki ga uporabljamo danes) z njegovim novim konsenznim slojem za dokaz deleža, Beacon Chain. Odpravlja potrebo po energetsko intenzivnem rudarjenju in namesto tega zavaruje omrežje z vstavljenim ETH. Resnično razburljiv korak pri uresničevanju vizije Ethereuma – več razširljivosti, varnosti in trajnosti.

"Pomembno si je zapomniti, da je bila Beacon Chain na začetku dobavljena ločeno od Mainneta. Ethereum Mainnet – z vsemi svojimi računi, stanjem, pametnimi pogodbami in stanjem verige blokov – je še naprej zavarovan z dokazom o delu, čeprav Beacon Chain teče vzporedno z uporabo dokaza o deležu. Bližajoče se spajanje je takrat, ko se ta dva sistema končno združita in dokazilo o delu trajno nadomesti dokazilo o deležu.

"Razmislimo o analogiji. Predstavljajte si, da je Ethereum vesoljska ladja, ki še ni povsem pripravljena na medzvezdno potovanje. Z Beacon Chain je skupnost zgradila nov motor in utrjen trup. Po obsežnem testiranju je skoraj napočil čas za vročo zamenjavo novega motorja za starega vmesnega motorja. To bo nov, učinkovitejši motor združilo z obstoječo ladjo, ki bo pripravljena vložiti nekaj resnih svetlobnih let in prevzeti vesolje."

Earlier today, Cumberland vzel na Twitter to comment on the crypto market:

- "As the summer winds down, many markets are at a crossroads: equities have stalled as recession indicators reemerge, most commodities have rebounded on tighter forward supply concerns, and all eyes are on the Fed for some signaling about the near term directionality of rates."

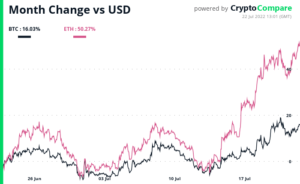

- "Even before these clouds emerged, digital assets had underperformed the recent risk-on move – a cause for concern. Thus, if the macro picture continues to tighten/deteriorate, it’s hard to see crypto outperforming."

- "That said, we think the crypto-specific liquidations have largely concluded, and so price action is probably going to continue chopping violently with macro for the time being. The benefit of this volatility is that it has likely shaken out the ‘Merge frontrunners.'"

- "Thus, the Merge (if completed successfully) is now a real catalyst: the impact of removing ~$20M/day of miner selling is impossible to ignore. Thus, it will take significant macro headwinds to offset the impact of that flow’s sudden disappearance."

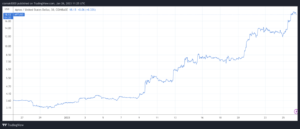

In case you are wondering why Cumberland believes that currently (i.e. pre Merge) there is roughly $20 million a day of $ETH selling pressure from miners, here is some data from YCharts:

As you can see, yesterday (August 24), $ETH miners received as mining rewards 13087.94 ETH, which is worth roughly $22.39 million at the of writing (12:30 p.m. UTC on August 25). And of course, if we have a successful Merge upgrade on the Ethereum, block mining rewards will be gone since we will have PoS consensus.

Kredit za slike

Predstavljena slika preko pixabay

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- CryptoGlobe

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet