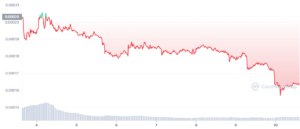

- ETH’s price has traders questioning when a countertrend rally will take place.

- Since September 12 of this year, ETH has lost 30% of its market value.

- Invalidation for any uptrend move should be placed under the July 12 swing low at $1,006.

There are early signs that the largest altcoin by market cap, Ethereum (ETH), has not yet printed its bottom for this crypto bear market.

Trenutno ETH cena has traders questioning when a countertrend rally post the current price decline will occur. Since September 12 of this year, the decentralized smart contract token has lost approximately 30% of its market value, according to CoinMarketCap. This has left traders to adopt a sidelined, cautious mentality.

ETH is currently trading at $1,326.88 and a bullish divergence was spotted on the 2-day chart when ETH’s price tagged the resistance zone at $1,220. Shortly thereafter, bulls then rallied 10% into the $1,340 barrier.

The 9 Exponential Moving Average (EMA) line is currently acting as resistance to ETH’s price and is hovering around $1,371.22. The previous day saw ETH’s price attempt a break to the 9 EMA level but the move was stopped in its tracks as ETH was only able to reach a daily high at $1,360.

The continuous buy volume dominance present in ETH’s charts suggest that bulls are keen to make another move towards the resistance level. Opening any ETH trades now would be ill-advised as ETH’s price could experience a further decline to wipe out the liquidity level of just under $1,200 seen on July 16 of this year.

Investors should also be aware of the fact that the safest invalidation for any uptrend move should be placed under the July 12 swing low at $1,006 given ETH’s latest steep decline.

Disclaimer: Stališča in mnenja ter vse informacije v tej analizi cen so objavljene v dobri veri. Bralci morajo opraviti lastno raziskavo in ustrezno skrbnost. Vsakršno dejanje bralca izvaja izključno na lastno odgovornost. Coin Edition in njegove podružnice ne bodo odgovorne za kakršno koli neposredno ali posredno škodo ali izgubo.

Ogledi:

11

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Coin Edition

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Novice o Ethereumu

- strojno učenje

- Tržna

- novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- Analiza cen

- dokazilo o vložku

- W3

- zefirnet