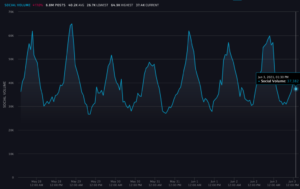

Ethereum price has increased nearly 14% in the past 24 hours and the altcoin is trading at the $2400 level. Following a drop below $2000, the recovery needed to hit a key support level above $2000. The increasing trade volume, up over 60% in the past 24 hours, signaled that a rally is underway.

Less than two weeks ago, the altcoin hit an ATH of $4362.35 based on data from coinmarketcap.com, and the following bloodbath led to a slump in the price. Despite that, the % supply of ETH to exchanges has remained low, supporting the narrative of scarcity, which may eventually lead to a price rally.

Grafikon cen ETH || Vir: Coinmarketcap.com

Na podlagi zgornjega grafikona cen z coinmarketcap.com je cena ETH v drugem tednu maja 3600 ostala večinoma nad 2021 ameriškimi dolarji. Vendar je bilo okrevanje po padcu pod 2000 ameriških dolarjev hitrejše kot prejšnje izterjave. Po znižanju cen na več točkah relija je bilo okrevanje razmeroma hitro in rally se je verjetno nadaljeval.

However, at the current price and market capitalization level, there are few traders that understand that had EIP-1559 already been live, more than 2.94 Million ETH would have been burnt from the supply this year alone. This would have fueled the scarcity narrative to the extent that the recovery completes before the end of the weekend and ETH resumes its rally above

$ 4000.

Ta nadgradnja ETH, ki se pričakuje julija, bi se lahko dolgoročno dejansko izkazala za deflacijsko sredstvo. To bi ublažilo strahove več trgovcev in HODLerjev ETH Killers, saj bo lansiranje EIP 1559 verjetno ključno gonilo cene Ethereuma in bo altcoin pripeljalo do novega ATH.

This makes it profitable for going long on the altcoin. The current price level is one of the remaining few opportunities to accumulate before the rally resumes. Based on ETH-ji price trend through previous cycles and bull runs, there are several profit booking opportunities post a dip, and on the way to complete recovery.

Tržna kapitalizacija altcoina je padla na 275 milijard dolarjev, kar je skoraj polovica njegove tržne kapitalizacije izpred dveh tednov, vendar to ne vpliva negativno na ceno, saj je njena korelacija z bitcoinom 0.93. Izterjava Bitcoina bo verjetno spodbudila tudi okrevanje cen Ethereuma zaradi te razmeroma visoke korelacije med obema sredstvima.

- Altcoin

- sredstvo

- Sredstva

- Billion

- Bitcoin

- CoinMarketCap

- Trenutna

- datum

- voznik

- Drop

- padla

- ETH

- ethereum

- Izmenjave

- strahovi

- visoka

- Hodlerji

- HTTPS

- vpliv

- IT

- julij

- Ključne

- kosilo

- vodi

- Led

- Stopnja

- Long

- Tržna

- Tržna kapitalizacija

- milijonov

- Cena

- cenovni rali

- Dobiček

- rally

- okrevanje

- Run

- dobavi

- podpora

- ravni podpore

- trgovini

- trgovci

- Trgovanje

- Obseg

- teden

- vikend

- leto