- Fidelity Investments has launched its brand new crypto trading product.

- The platform is launching commission-free crypto trading for its retail investors.

- The firm opened an early-access waitlist to its users this Thursday.

Financial services company Fidelity Investments officially announced the launch of its brand-new crypto trading product. The investment platform is launching commission-free kripto trgovanje for its retail investors. The launch is a sign of Fidelity’s interest in crypto.

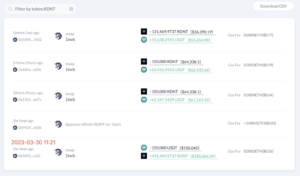

The firm opened an early-access waitlist to its users this Thursday. Investors will be able to purchase and sell Bitcoin (BTC) in Ethereum (ETH) using the service, known as Fidelity Crypto, as well as access the custodial and trading services offered by its subsidiary, Fidelity Digital Assets. However, to enjoy the services, users will be required to maintain a $1 minimum in their account.

A spokesperson for Fidelity reported in an interview:

A meaningful portion of Fidelity customers are already interested in and own crypto. We are providing them with tools to support their choice, so they can benefit from Fidelity’s education, research, and technology

Fidelity becomes the third company to provide commission-free crypto trading after Robinhood and Binance.US. The disclosure comes at a time when investors are doubting Coinbase’s and other exchanges’ capacity for generating income. Historically, they have relied on trading commissions as a source of income, but zero-fee trading in crypto is becoming inevitable.

In other news, Goldman Sachs is attempting to standardize how the financial sector discusses, monitors, and invests in the expanding universe of digital assets. According to executives at the three companies, the investment bank will soon introduce a data service it developed with global index provider MSCI and data provider Coin Metrics to categorize hundreds of digital coins and tokens so institutional investors can understand the new asset class.

Ogledi: 0

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Blockchain novice

- Coin Edition

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet