Oracle iz Omahe Warren Buffet je nekoč rekel: "Bodite prestrašeni, ko so drugi požrešni, in bodite pohlepni, ko se drugi bojijo." Zavzemanje nasprotnega položaja je lahko zastrašujoče, vendar pogosto vodi do velikih finančnih priložnosti.

Ali bi morali biti pozorni na altcoine?

It can be argued that over the past few weeks, the price appreciation recorded by some altcine has overshadowed Bitcoin's own growth. Consider this – Altcoins račun for about 33% of the total cryptocurrency market. That is up from just 22% at the beginning of August. And yet, the surge in altcoins’ market dominance has some like JPMorgan‘s analysts raising red flags.

V nedavno Upoštevajte to their clients, JPMorgan analysts cautioned users about the August trading boom. This surge saw spot market trading volumes surpass the $1T mark. The blog opozoriti,

“That buying frenzy in stocks also spilled over into “altcoins” in August as investors piled into non-fungible tokens. The prenapetost in NFTe in Defi activity has helped not only Ethereum, but also cryptocurrencies that facilitate smart contracts such as Solana, Binance Coin, and Cardano to soar.”

Ni treba posebej poudarjati, Solana, Cardano saw a huge bump in their price rallies. Especially the former, with Solana up by more than 7,000% year-to-date at press time. Looking into NFTs, OpenSea, one of the largest NFT marketplaces, has seen trading volumes on its platform increase by več odstotkov 76,000 since the beginning of 2021. In fact, just recently, its trading volume presegli 4 milijarde dolarjev.

Na enak način je treba opozoriti na zanimiv vidik. Po podatkih banke je

»... neto tokovi vlagateljev na drobno v ameriške delnice so julija dosegli rekordnih skoraj 16 milijard dolarjev, avgusta pa so znašali približno 13 milijard dolarjev. Prejšnji rekord je bil junija lani 10 milijard dolarjev. "

Reddit-inspired day traders certainly igral a crucial role in moving the market as well, the firm added.

V luči omenjene "norosti" so vodstvo JPMorna ocenili,

"Trgi kriptovalut [so] spet videti peneči"

Zapisek se je zaključil,

"Delež altcoinov je po zgodovinskih merilih precej zvišan in po našem mnenju je bolj verjetno odraz pene in" manije "malih vlagateljev kot odraz strukturnega naraščajočega trenda."

Ali obstaja razlog za skrb? Čeprav je obseg pohodov mnoge presenetil, bi večina trdila, da so za pohodništvo Cardano in Solana dobri razlogi. Prvi se na primer bliža dogodku Alonzo HFC, ki vključuje pametne pogodbe. Slednji, čeprav je bil eden najmočnejših avgustovskih kriptovalut, je presegel tudi večino sprememb na frontah razvoja in družbenega razpoloženja.

Ali strah in pohlep igrata vlogo na kripto trgu?

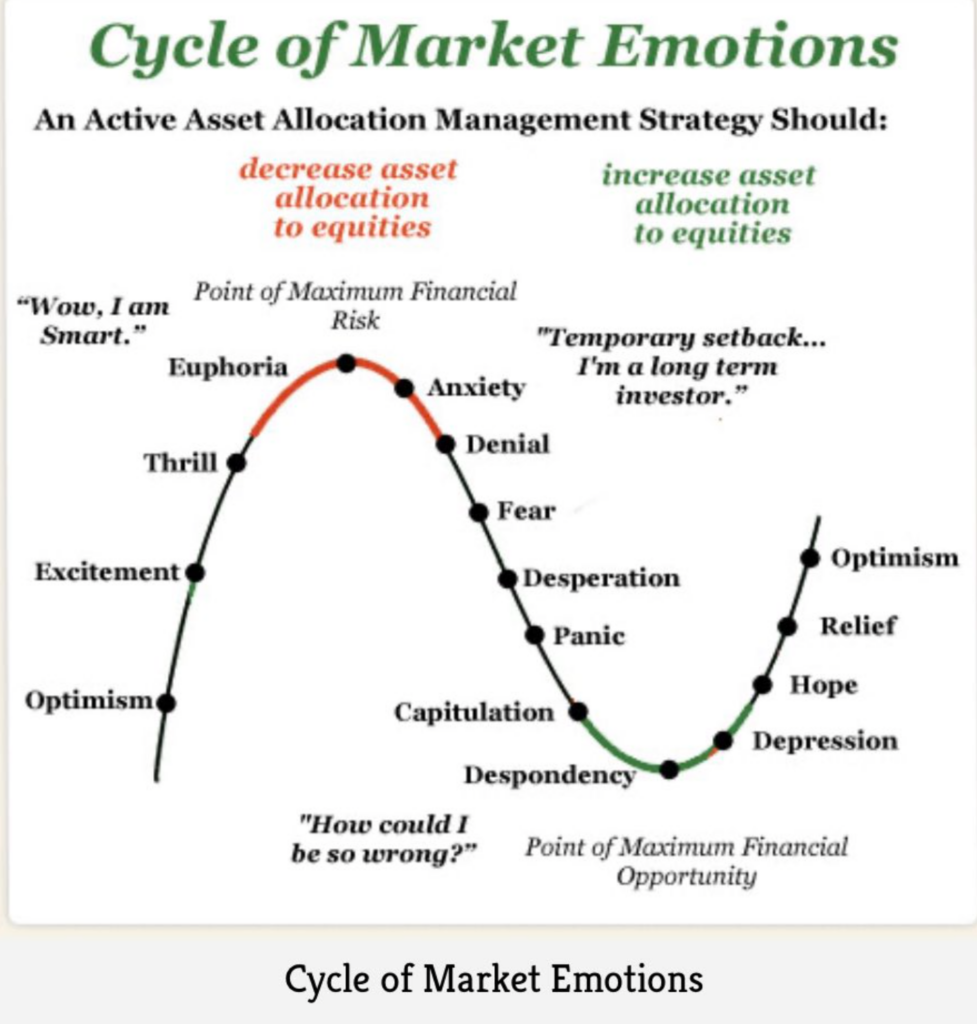

History, perhaps, gives us the best response to the aforementioned question. Each time the crypto-market’s Fear and Greed index has fallen below 20, the market has undergone a reversal. Why? Because sentiments of “despondency” are often seen to be points of “Maximum Financial Opportunity.”

vir: Twitter

Nasprotno, ko so trgi pohlepni, je večina trgovcev na "točki največjega finančnega tveganja".

Ali bodo ta opozorila vlagateljem in zlasti trgovcem preprečila hiter dobiček od altcoinov? Res ne.

Kam vlagati?

Naročite se na naše e-novice

- 7

- Altcoins

- Avgust

- Banka

- BEST

- Billion

- binance

- Binance Coin

- Blog

- boom

- Nakup

- Cardano

- Coin

- Posoda

- pogodbe

- cryptocurrencies

- cryptocurrency

- trg kripto valute

- dan

- Razvoj

- DID

- Event

- vodstvo

- finančna

- Firm

- dobro

- veliko

- Rast

- visoka

- HTTPS

- velika

- Povečajte

- Indeks

- Investitor

- Vlagatelji

- IT

- JPMorgan

- julij

- light

- Izdelava

- znamka

- Tržna

- Prisotnost

- net

- NFT

- NFT

- neželezni žetoni

- Mnenje

- Priložnosti

- Priložnost

- Oracle

- platforma

- pritisnite

- Cena

- Dobiček

- Razlogi

- Odgovor

- Trgovina na drobno

- Tveganje

- Lestvica

- sentiment

- Delite s prijatelji, znanci, družino in partnerji :-)

- pametna

- Pametne pogodbe

- socialna

- Solana

- Komercialni

- standardi

- Zaloge

- prenapetost

- presenečenje

- čas

- Boni

- trgovci

- Trgovanje

- us

- Uporabniki

- Obseg

- Warren

- Warren Buffet