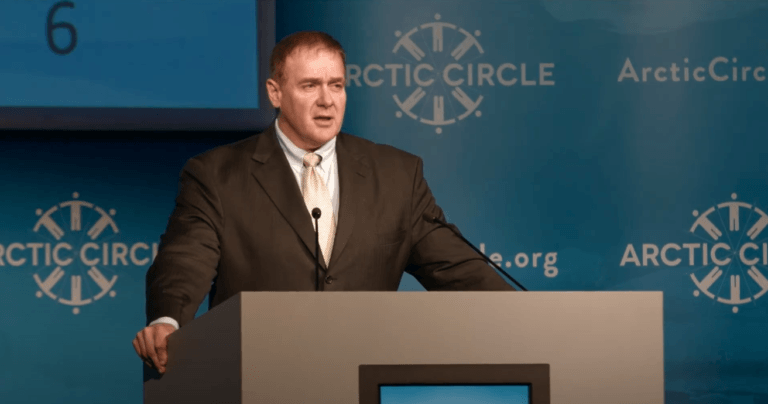

Last week, during an interview, Scott Minerd, Global Chief Investment Officer of Guggenheimovi partnerji, the man who said last December that “Bitcoin should be worth about $400,000”, talked about silver, gold, and crypto.

Guggenheim Naložbe je »globalni oddelek za upravljanje premoženja in investicijsko svetovanje družbe Guggenheim Partners in ima več kot 233 milijard dolarjev skupnih sredstev v zvezi s fiksnim donosom, kapitalom in alternativnimi strategijami.« Osredotoča se na "potrebe po donosnosti in tveganju zavarovalnic, korporativnih in javnih pokojninskih skladov, državnih premoženjskih skladov, dotacij in fundacij, upravljavcev premoženja in vlagateljev visoke neto vrednosti."

27. novembra 2020 je glede na vložitev dopolnitev ameriške SEC po uveljavitvi postalo znano, da eden od vzajemnih skladov s stalnim donosom Guggenheim Investments (»Macro Opportunities«) razmišlja o vlaganju v Bitcoin. per podatkih Financial Timesa, je bil ta sklad ustanovljen 30. novembra 2011, njegova skupna neto sredstva pa so znašala 4.97 milijarde USD (od 31. oktobra 2020).

O Vložitev SEC izdelano 27. novembra 2020 je znano kot "SEC POS AM« (tudi »sprememba, ki začne veljati po uveljavitvi«). Ta vrsta prijave "omogoča podjetju, registriranemu pri SEC, posodobitev ali spremembo svojega prospekta."

V tej vlogi je navedeno, da sklad razmišlja o tem, da bi bil nekoliko izpostavljen kriptovaluti:

"Kriptovalute (imenovane tudi "virtualne valute" in "digitalne valute") so digitalna sredstva, zasnovana kot menjalno sredstvo. Sklad Guggenheim Macro Opportunities Fund lahko poskuša pridobiti naložbeno izpostavljenost bitcoinom posredno z vlaganjem do 10 % svoje neto vrednosti sredstev v Grayscale Bitcoin Trust (»GBTC«), zasebno naložbeno sredstvo, ki vlaga v bitcoin."

Then, on 16 December 2020, after the Bitcoin price had finally broken through the $20,000 level on all crypto exchanges to set a new all-time high, Minerd, the Guggenheim CIO, talked about Bitcoin during an intervju na Bloomberg TV.

Intervju, ki ga je začel vodja informatike Guggenheima, ko ga je Scartlet Fu, višja urednica oddelka za trge Bloomberg TV, vprašala o Guggenheimovem skladu Macro Opportunities Fund in odločitvi njegovih menedžerjev, da vložijo »do 10 % svoje čiste vrednosti sredstev v Grayscale Bitcoin Trust .” Zlasti so ga vprašali, ali je Guggenheim že začel kupovati Bitcoin in koliko je bila ta odločitev "vezana na izjemno politiko Feda."

Minerd je odgovoril:

"Če odgovorim na drugo vprašanje, Scarlett, jasno je, da sta Bitcoin in naše zanimanje za Bitcoin povezana s politiko Feda in nenavadnim tiskanjem denarja, ki se dogaja. Kar zadeva naš vzajemni sklad, veste, še nismo učinkoviti pri SEC. Torej, veste, še vedno čakamo.

"Seveda smo se odločili, da začnemo dodeljevati v Bitcoin, ko je Bitcoin znašal 10,000 $. S trenutno ceno, ki je blizu 20,000 $, je malo bolj zahtevno. Neverjetno, saj veste, v zelo kratkem časovnem obdobju smo dosegli, kako velik zalet smo imeli, toda glede na to naše temeljno delo kaže, da bi moral biti Bitcoin vreden približno 400,000 $. Tudi če bi imeli možnost, da to storimo danes, bomo spremljali trg in videli, kako poteka trgovanje, kakšno oceno bomo morali na koncu kupiti."

Nato je pojasnil, kako so prišli do vrednosti 400 tisoč dolarjev za Bitcoin:

"Temelji na pomanjkanju in relativnem vrednotenju, kot so stvari, kot je zlato kot odstotek BDP. Torej, veste, Bitcoin ima dejansko veliko lastnosti zlata in ima hkrati neobičajno vrednost v smislu transakcij."

Nato je 11. januarja, kmalu po tem, ko se je cena Bitcoina znižala na 32,475 $ na Coinbase, Minerd opozoril trgovce, da je Bitcoin morda šel preveč prehitro navzgor in da je morda čas za nekaj dobička.

On February 2, the Guggenheim CIO was interviewed by CNN anchor Julia Chatterley, who asked him what he thinks about Bitcoin.

Minerd je odgovoril:

"We’ve been looking at Bitcoin for almost 10 years and the size of the market just wasn’t big enough to justify institutional money. As the total market cap of Bitcoin got bigger, around $10,000, it started to look very interesting and my view is we get a lot of fundamental research and if you consider the supply of Bitcoin relative let’s say to the supply of gold in the world and what the total value of gold is, if Bitcoin were to go to those kinds of numbers, you’d be talking about four hundred to six hundred thousand dollars per Bitcoin.

"Now, I’m not saying we’ll ultimately get there, but that’s an indication of what might be a measure of fair value. Tthat gives you a lot of room to run, but then when you consider that within a course of a month, we went from $20,000 to $40,000 on Bitcoin, that smacks of short-term speculation… now the air’s coming out of that speculative run, and so the money is migrating into other places…

"I don’t really see the institutional support today, which is just coming online from the likes of people like BlackRock and Guggenheim and other large institutional investors being big enough to support the valuation at its current levels… Bitcoin has had a lot of times where it’s had setbacks of 50% from its highs. I wouldn’t be surprised to see that happen again…

"I think that cryptocurrency has come into the realm of respectability and will continue to become more and more important in the global economy."

On April 7, Minerd was again interviewed by CNN’s Julia Chatterley, who wanted to know what would happen to the crypto space if there was a pullback in the price of Bitcoin.

Minerd je odgovoril:

"Ko sem dal izjavo o 400,000 $, jo gledam v obdobju od 10 do 20 let. Seveda se je trg razmahnil. Najprej sem začel razmišljati o nakupu Bitcoina po 10,000 USD. Danes ne vem več kje smo. Tako hitro je postal tako bogat, morda okoli 50,000 $, vendar se je očitno zapletel v špekulativni balon, v katerega je vstopil GameStop in številne druge delnice.

"I think when we get a risk-off moment, we could be seeing Bitcoin pullback to somewhere between $20,000 and $30,000, but I think for long-term investors that’ll be a great entry point."

On May 19, however, Minerd appeared to be much more bearish on crypto in general.

Well, on May 25, the Guggenheim CIO was razgovor by CNBC’s “Worldwide Exchange“, where he shared his latest thoughts on Bitcoin, gold, and silver.

Glede na poročilo by Kitco News published on May 26, this is what he had to say:

"As money leaves crypto and people are still looking for inflation hedges, gold and silver are going to be much better places to go."

Minerd expects gold to reach as high as $10K per ounce in the long term:

"This is ultimately is in the cards. Silver traditionally lags. It is the poor man’s gold, and it’s the one that will have the largest move on a percentage basis. It is the high-beta version of gold."

As for his long-term outlook on crypto, although he thinks that Bitcoin and Ethereum will remain popular, he thinks the ultimate winner might be a crypto project that we have not seen yet:

"AOL was the winner. Yahoo was the winner. Then Google and other players came along. We are going to find out that some new crypto comes long, which can overcome some of the issues we are facing right now with the cost of mining, all the carbon production. And it will be a superior form of crypto, and that will become the dominant crypto."

DISCLAIMER

Pogledi in mnenja, ki jih je izrazil avtor ali osebe, omenjene v tem članku, so zgolj informativne narave in ne predstavljajo finančnega, naložbenega ali drugega nasveta. Pri vlaganju v kriptoasete ali trgovanju z njimi obstaja tveganje finančne izgube.

- 000

- 11

- 2020

- 7

- oglasi

- nasveti

- svetovanje

- vsi

- april

- okoli

- članek

- sredstvo

- upravljanje premoženja

- Sredstva

- avto

- Medvjedast

- Billion

- Bitcoin

- Bitcoin Cena

- Blackrock

- Bloomberg

- nakup

- Nakup

- ogljika

- ujete

- šef

- CIO

- bližje

- CNBC

- CNN

- coinbase

- prihajajo

- Podjetja

- podjetje

- vsebina

- naprej

- kripto

- Kriptovalute

- cryptocurrency

- plačila

- Trenutna

- Povpraševanje

- digitalni

- Digitalna sredstva

- dolarjev

- Gospodarstvo

- urednik

- Učinkovito

- pravičnost

- ethereum

- Izmenjava

- Izmenjave

- pričakuje

- s katerimi se sooča

- sejem

- FAST

- Fed

- končno

- finančna

- prva

- obrazec

- Sklad

- Skladi

- BDP

- splošno

- Globalno

- Globalno gospodarstvo

- Gold

- Sivine

- veliko

- visoka

- Kako

- HTTPS

- prihodki

- inflacija

- Institucionalna

- institucionalni vlagatelji

- zavarovanje

- obresti

- Intervju

- vlaganjem

- naložbe

- Vlagatelji

- Vprašanja

- IT

- velika

- Zadnji

- Stopnja

- Long

- Makro

- moški

- upravljanje

- Tržna

- Market Cap

- Prisotnost

- merjenje

- srednje

- Rudarstvo

- Denar

- premikanje

- Blizu

- net

- novice

- številke

- Častnik

- na spletu

- Komentarji

- Ostalo

- Outlook

- nastanitev

- ljudje

- politika

- slaba

- Popular

- PoS

- Cena

- proizvodnja

- Projekt

- javnega

- Raziskave

- Tveganje

- Run

- SEC

- nastavite

- Neuspeh

- deli

- Delnice

- Kratke Hlače

- Silver

- SIX

- Velikosti

- So

- Vesolje

- Začetek

- začel

- Izjava

- Zaloge

- dobavi

- podpora

- pogovor

- ciljna

- tehnični

- čas

- trgovci

- Trgovanje

- Transakcije

- Zaupajte

- tv

- nas

- Nadgradnja

- Vrednotenje

- vrednost

- vozilo

- Poglej

- Ranljivi

- Wealth

- teden

- WHO

- v

- delo

- svet

- vredno

- Yahoo

- leto

- let

- youtube