- Mixed session as traders await Wednesday’s inflation report

- Fed’s quarterly loan survey showed continued tightening of credit and weaker business loan demand

- Biden’s debt meeting scheduled for Tuesday at 4pm

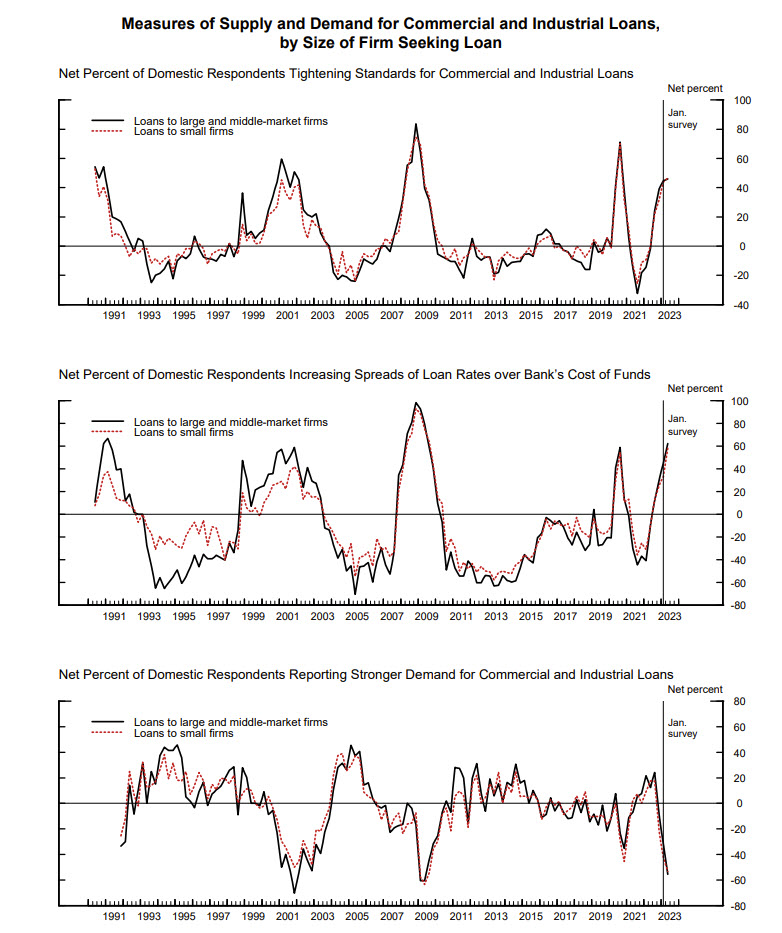

US stocks wavered after a quarterly loan survey showed a first quarter filled with overall tighter credit conditions and much weaker business loan demand. The quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices – SLOOS, for short did not deliver any major surprises with the exception of an uglier picture for loan demand. This survey showed the broadest share of banks had weaker loan demand since 2009. The share of banks tightening credit rose from 44.8% to 46.0%.

The report highlighted that, “Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023.”

With an extra bank holiday for King Charles III’s coronation, it was a slow start to the trading week. Wall Street was excited as many traders were first going to pay attention to the Fed’s Senior Loan Officer Opinion Survey for the first time. Stocks were little changed as it was not a SLOOS Fest, rather a snooze fest that confirmed the grim outlook for the economy.

A couple key takeaways from the Fed survey were that the commercial real estate space is going to feel more pain soon and as banks expect to tighten standards across all loan categories for the remainder of the year. This key survey should support recessionary calls for the third quarter.

Investors will shift the focus back to inflation, with a close look at core services, excluding shelter. This inflation report might prove to be sticky and that could help delay Fed rate cut bets.

Vsebina je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno družbe OANDA Business Information & Services, Inc. ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Če želite reproducirati ali ponovno distribuirati katero koli vsebino, ki jo najdete na MarketPulse, nagrajeni storitvi spletnega mesta z novicami in analizami forexa, blaga in globalnih indeksov, ki jo proizvaja OANDA Business Information & Services, Inc., dostopajte do vira RSS ali nas kontaktirajte na info@marketpulse.com. Obiščite https://www.marketpulse.com/ izvedeti več o utripu svetovnih trgov. © 2023 OANDA Business Information & Services Inc.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoAiStream. Podatkovna inteligenca Web3. Razširjeno znanje. Dostopite tukaj.

- Kovanje prihodnosti z Adryenn Ashley. Dostopite tukaj.

- Kupujte in prodajajte delnice podjetij pred IPO s PREIPO®. Dostopite tukaj.

- vir: https://www.marketpulse.com/newsfeed/hardly-a-sloos-fest/emoya

- :ima

- : je

- :ne

- :kje

- 20

- 2023

- 7

- a

- O meni

- nad

- dostop

- čez

- Prednost

- nasveti

- podružnice

- po

- vsi

- an

- Analiza

- Analitik

- in

- kaj

- SE

- AS

- sredstvo

- povezan

- At

- pozornosti

- Avtor

- Avtorji

- čakati

- Nagrada

- nazaj

- Banka

- likvidnost banke

- Banke

- temeljijo

- BE

- spodaj

- Stave

- Bloomberg

- Pasovi

- posredniki

- poslovni

- nakup

- by

- poziva

- Kariera

- kategorije

- Osrednji

- Centralna banka

- Politike centralne banke

- spremenilo

- Charles

- praksa

- razredi

- Zapri

- CNBC

- zavarovanje

- COM

- komercialna

- poslovne nepremičnine

- Blago

- Skrbi

- Pogoji

- POTRJENO

- kontakt

- vsebina

- naprej

- Core

- Corporate

- Korporativne novice

- stroški

- bi

- par

- Tečaj

- pokritost

- kredit

- cryptocurrencies

- Cut

- datum

- Dolg

- zamuda

- poda

- Povpraševanje

- oddelki

- depozit

- DID

- Direktorji

- Gospodarska

- Economics

- Gospodarstvo

- ed

- element

- nepremičnine

- dogodki

- izjema

- razburjen

- izključuje

- pričakovati

- Pričakuje

- pričakovati

- izkušnje

- strokovno znanje

- dodatna

- Fed

- fed anketa

- občutek

- napolnjena

- financiranje

- finančna

- Najdi

- prva

- prvič

- Všita

- stalni prihodek

- Osredotočite

- za

- Forbes

- forex

- Forex trgovanje

- je pokazala,

- lisica

- Fox Business

- pogosto

- iz

- Financiranje

- FX

- splošno

- geopolitične

- Globalno

- svetovnih trgih

- dogaja

- grim

- Gost

- imel

- he

- pomoč

- Poudarjeno

- njegov

- drži

- počitnice

- HTTPS

- if

- in

- Inc

- Vključno

- prihodki

- indeksi

- inflacija

- Podatki

- naložbe

- IT

- ITS

- Revija

- jpg

- Ključne

- King

- kralj Charles

- vodi

- posojanje

- Leži

- kot

- likvidnostno

- malo

- v živo

- posojila

- Poglej

- velika

- več

- Tržna

- Analiza trga

- tržna reakcija

- MarketPulse

- Prisotnost

- MARKETWATCH

- max širine

- srečanja

- morda

- več

- Najbolj

- MSN

- veliko

- nujno

- omrežij

- Novo

- NY

- New York Times

- novice

- of

- Častnik

- uradniki

- on

- samo

- Mnenje

- Komentarji

- or

- ven

- odtoki

- Outlook

- več

- Splošni

- bolečina

- zlasti

- Plačajte

- slika

- platon

- Platonova podatkovna inteligenca

- PlatoData

- prosim

- politike

- portfelji

- Stališče

- vaje

- pritisnite

- Proizvedeno

- Dokaži

- če

- publikacije

- namene

- kakovost

- četrtletje

- območje

- Oceniti

- precej

- reakcija

- pravo

- nepremičnine

- Razlogi

- Pred kratkim

- Zmanjšanje

- redni

- redno

- preostanek

- Priznan

- poročilo

- Raziskave

- REST

- Reuters

- Tveganje

- ROSE

- rss

- Univerza Rutgers

- načrtovano

- Vrednostni papirji

- prodaja

- višji

- Storitev

- Storitve

- Zasedanje

- več

- Delite s prijatelji, znanci, družino in partnerji :-)

- delitev

- Shelter

- premik

- Kratke Hlače

- shouldnt

- saj

- spletna stran

- Nebo

- počasi

- Rešitev

- rešitve

- nekaj

- Vesolje

- standardi

- Začetek

- lepljiv

- Zaloge

- ulica

- taka

- podpora

- presenečenj

- Anketa

- Takeaways

- Skupine

- televizija

- kot

- da

- O

- Fed

- The New York Times

- njihove

- tretja

- ta

- zategovanje

- tesnejši

- čas

- krat

- do

- toleranca

- trgovci

- Trgovanje

- zaupa

- Torek

- tv

- univerza

- us

- v1

- Vrednote

- ogledov

- obisk

- Wall

- Wall Street

- Wall Street Journal

- je

- teden

- so bili

- široka

- Širok spekter

- bo

- zmago

- z

- delal

- svetu

- bi

- leto

- york

- Vi

- zefirnet