Okrožni sodnik ZDA je obsodil Stefana He Qina na več kot sedem let zapora zaradi njegovega sodelovanja v kripto goljufiji.

After being convinced of his crimes back in February, Stefan He Qin has zdaj obsojen by the United States Attorney Office of the Southern District of New York. According to the U.S. Attorney’s Office, Qin was given a sentence of seven and a half years in state prison along with the confiscation of more than $54 million. The ruling was handed down by U.S. District Judge Valerie E. Caproni.

24-letni kitajski avstralski državljan je bil obtožen, da je napačno poročal o prihodkih iz svojega hedge sklada za financiranje razkošnega načina življenja. Zadevni sklad je v nekem trenutku nadzoroval več kot 90 milijonov dolarjev sredstev vlagateljev. Qin je na koncu priznal krivdo za obtožbe.

Qinovi zločini

Qin founded a pair of cryptocurrency investment funds in 2016 when he was just 19-years old, Virgil Sigma and VQR. According to court documents, both companies were located in NY, New York.

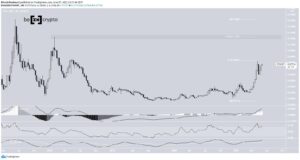

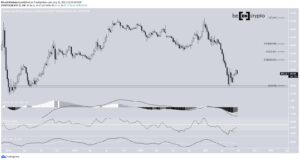

Virgil Sigma was set up to “employ a strategy to earn profits from arbitrage opportunities in the cryptocurrency market,” according to the Attorney’s Office. The office also reports that since the very beginning, Qin has engaged in a scheme to skim assets from the fund and goljufali vlagatelje who trusted Virgil Sigma. Qin did this by investing capital from Virgil Sigma into personal accounts to be used for “purposes other than the purported arbitražno trgovanje strategy.” The majority of these funds were used for personal expenses such as food and a New York Penthouse apartment.

Qin also defrauded investors of his VQR fund, which “employed a variety of strategijami trgovanja and was poised to make or lose money based on the fluctuations in the value of cryptocurrency and was not market neutral.” Qin was the sole owner of VQR and was unable to meet several redemption requests from the fund back in Dec. 2020. Qin apparently tried to funnel money from VQR to personal accounts so that he could first pay off similar redemption requests from Virgil Sigma investors. Redemptions he was unable to fulfill because the funds had already been stolen by Qin himself. He did this against the advice of senior traders who eventually ceded control of the fund to Qin.

Vsak sklad je od takrat prenehal delovati, sodišče pa je začelo likvidacijo in razdeljevanje premoženja.

Kaj menite o tej temi? Pišite nam in nam povejte!

Zavrnitev odgovornosti

Vse informacije na našem spletnem mestu so objavljene v dobri veri in zgolj za splošne informacije. Vsako dejanje, ki ga bralec izvede na podlagi informacij na naši spletni strani, je izključno na lastno odgovornost.

Vir: https://beincrypto.com/hedge-fund-manager-sentenced-to-7-years-for-crypto-fraud/

- 2016

- 2020

- Ukrep

- nasveti

- vsi

- Analiza

- arbitražo

- Sredstva

- bari

- Kapital

- Stroški

- kitajski

- Podjetja

- Sodišče

- Zločini

- kripto

- kripto prevare

- cryptocurrency

- trg kripto valute

- DID

- Dokumenti

- Stroški

- izrazit

- prva

- hrana

- Forbes

- goljufija

- Izpolnite

- Sklad

- Skladi

- Igre na srečo

- splošno

- dobro

- HTTPS

- Podatki

- vlaganjem

- naložbe

- Investitor

- Vlagatelji

- Novinar

- Justice

- razkošno

- način življenja

- Likvidacija

- ljubezen

- Večina

- Tržna

- mediji

- milijonov

- Denar

- NY

- novice

- Priložnosti

- Ostalo

- Lastnik

- Plačajte

- Osebnost

- zapor

- Bralec

- Poročila

- Tveganje

- nastavite

- So

- Južna

- Šport

- Država

- Države

- Statistika

- ukradeno

- Strategija

- trgovci

- nas

- Velika

- Združene države Amerike

- us

- vrednost

- Spletna stran

- WHO

- delo

- pisanje

- let