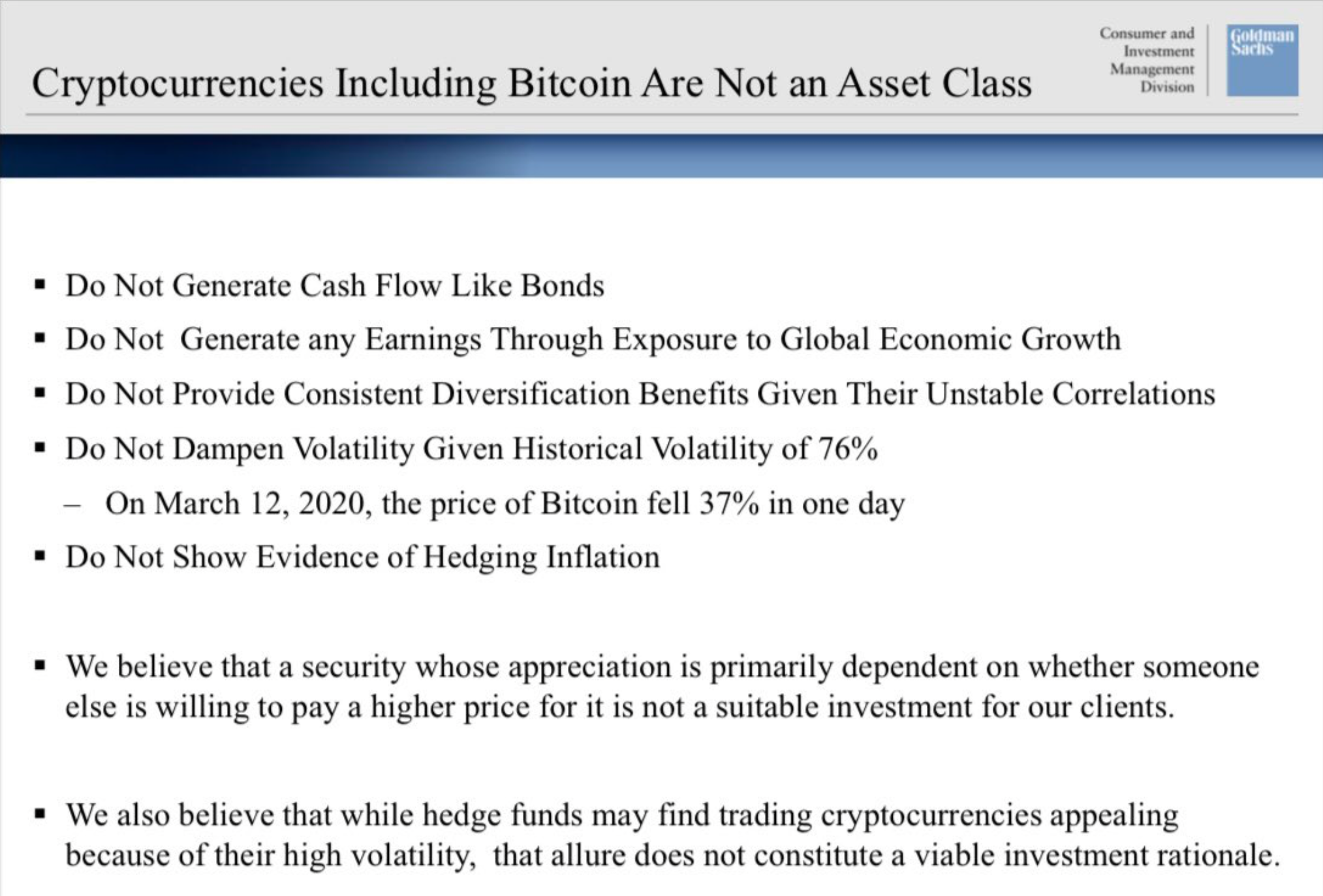

The craze around cryptocurrencies has had many former skeptics announce their change of hearts. Institutions now are openly expressing their interest, not only in Bitcoin, but other altcoins as well. Irrespective of one coin’s specific growth in popularity, however, Sprejetje has also significantly increased in 2021.

The same was the case with respect to blockchain adoption as well, with a Deloitte Raziskava last year observing that over 55% of the respondents believe the tech to be critical to the future.

Goldman Sachs is one of the latest institutions to make such a u-turn, with its recent “then vs now” analysis underlining the evolution of cryptocurrency adoption rates over time.

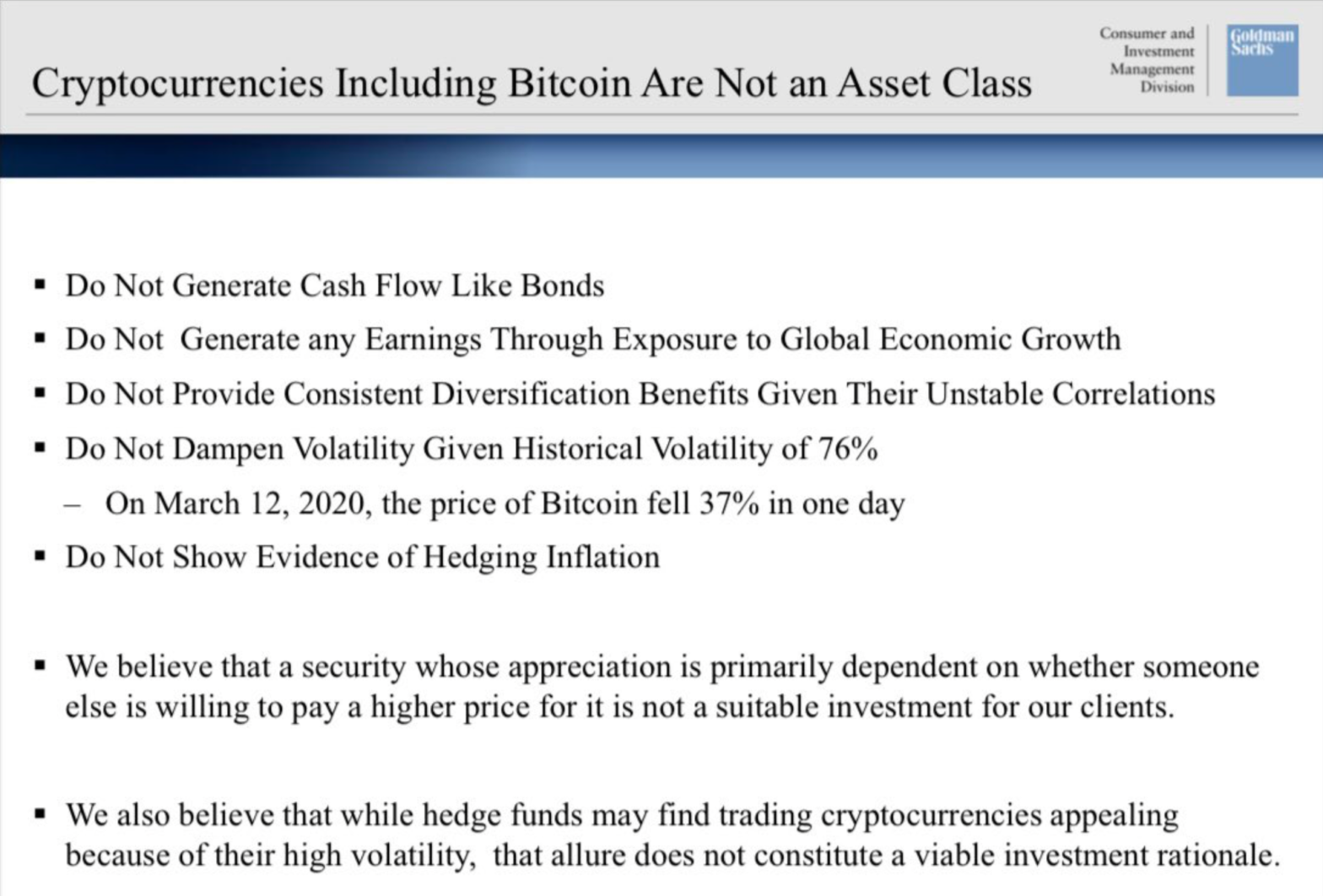

Lansko poročilo (maj 2020)

A report published the previous year was largely bearish about Bitcoin and other crypto-assets. As per the firm’s slideshow, there were various different reasons why Bitcoin could not be considered an asset class, including its association with nedovoljen dejavnosti.

vir: Goldman Sachs

Hitro naprej do leta 2021 ...

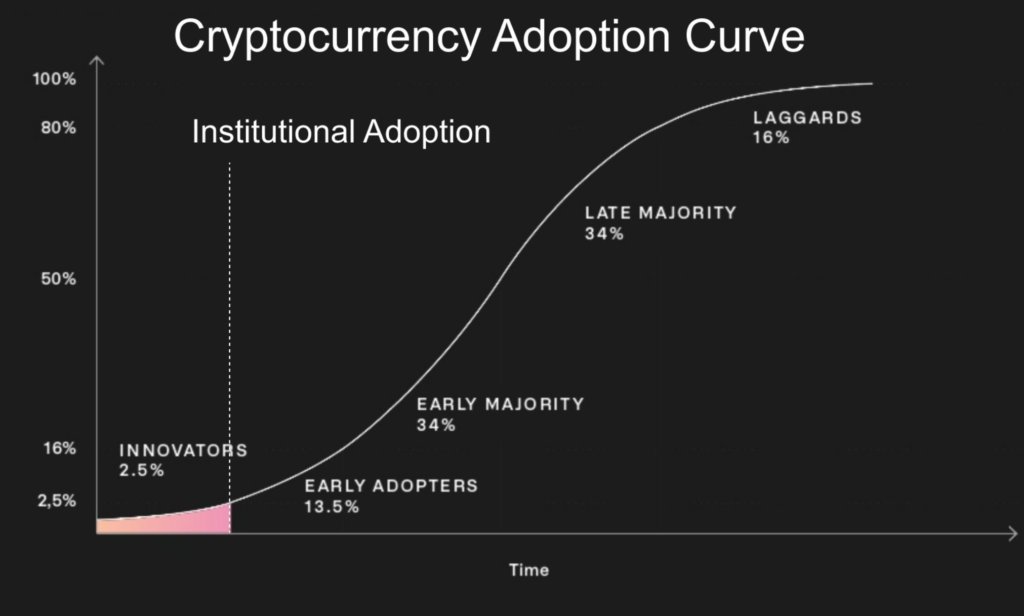

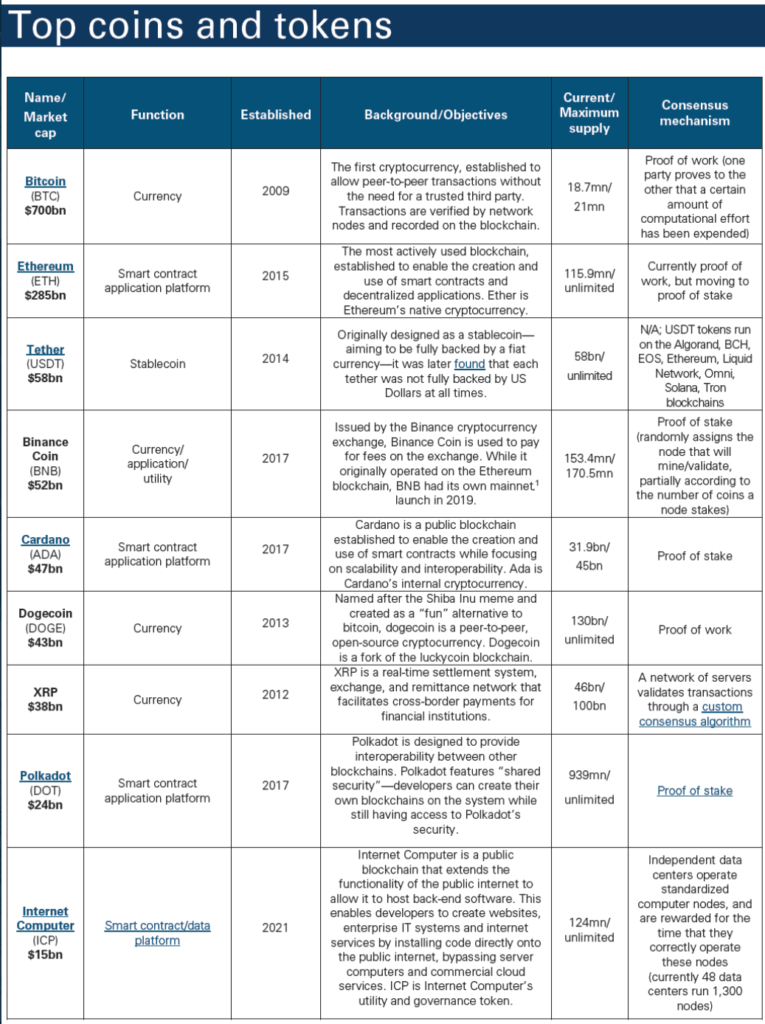

V poročilu z naslovom 'Crypto: nov razred sredstev?' banka je preučevala Bitcoin in pojav večjega kriptotrga kot razreda premoženja, kar je v nasprotju s tem, kar je podjetje trdilo pred letom dni. Alex Krüger, ekonomist, trgovec s kripto in ustanovitelj podjetja za upravljanje premoženja Aike Capital je na svoji platformi družbenih omrežij delil nekaj posnetkov zaslona glede istega.

Crypto, nov razred premoženja - Goldmanovo izčrpno poročilo. pic.twitter.com/FP2sewJCTx

- Alex Krüger (@krugermacro) Maj 21, 2021

Ni treba posebej poudarjati, da so različni strokovnjaki, vključno s tako zagovorniki kot tudi skeptiki, hitro delili svoja stališča o najnovejšem poročilu podjetja Goldman Sachs.

Michael Novogratz, founder and CEO of crypto-investment firm Galaxy Digital Holdings, said,

"Že samo dejstvo, da kritična masa verodostojnih vlagateljev in institucij zdaj sodeluje s kripto sredstvi, je utrdilo njihov položaj uradnega razreda sredstev."

Supporting the same cause was Michael Sonnenshein, Predsednik uprave Sivine, ki je ponovil,

“Institutional investors now generally appreciate that digital assets are here to stay, with investors increasingly attracted to the finite quality of assets like bitcoin—which is verifiably scarce—as a way to varovanje pred inflacijo and currency debasement, and to diversify their portfolios in the pursuit of higher risk-adjusted returns.”

vir: Twitter

Nasprotno, Nouriel Roubini, an Economics professor at NYU and popular crypto-skeptic, provided a contrasting viewpoint,

"Ne strinjam se z mislijo, da je nekaj, kar nima dohodka, uporabnosti ali razmerja z ekonomskimi osnovami, sploh mogoče šteti za hranilnik vrednosti ali sredstva."

Zanimivo je, da je isto poročilo poleg Bitcoina obravnavalo tudi funkcije kriptovalut, ki temeljijo na uporabnosti. To kaže na to, da za mnoge subjekte v glavnem toku, kot je GS, Bitcoin ni edina kriptovaluta, ki jim pade v oči. Institucionalno sprejetje največje kriptovalute na svetu in bikovski tek večjega trga sta prispevala k obsegu in širini najnovejšega poročila podjetja Goldman Sachs.

Alex Kruger Twitter| Raziskave Goldman Sachs

Vir: https://ambcrypto.com/heres-what-cemented-bitcoins-position-as-an-official-asset-class/

- 2020

- 9

- dejavnosti

- Sprejetje

- alex

- vsi

- Altcoins

- Analiza

- okoli

- sredstvo

- upravljanje premoženja

- Sredstva

- Banka

- Medvjedast

- Bitcoin

- blockchain

- sprejetje blockchaina

- Bik

- Kapital

- wrestling

- Vzrok

- ceo

- spremenite

- prispevali

- kripto

- kriptovalute

- cryptocurrencies

- cryptocurrency

- valuta

- deloitte

- digitalni

- Digitalna sredstva

- Gospodarska

- Economics

- evolucija

- Strokovnjaki

- oči

- Firm

- Naprej

- Ustanovitelj

- Osnove

- Prihodnost

- Galaxy Digital

- goldinar

- Goldman Sachs

- Rast

- tukaj

- HTTPS

- Ideja

- Vključno

- prihodki

- Institucionalna

- Institucionalno sprejetje

- Institucije

- obresti

- Vlagatelji

- Zadnji

- LINK

- Pogledal

- Mainstream

- upravljanje

- mediji

- Uradni

- Ostalo

- platforma

- Popular

- kakovost

- Cene

- Razlogi

- poročilo

- vrne

- Run

- Delite s prijatelji, znanci, družino in partnerji :-)

- deli

- socialna

- družbeni mediji

- bivanje

- trgovina

- študija

- tech

- čas

- pripomoček

- vrednost

- WHO

- leto