To many, bitcoin is the soundest money the world has ever seen. In this article we dive into Gresham’s law and discuss how bitcoin will eventually overtake the dollar, and all other fiat currencies. We cover what Gresham’s law is, how it relates to bitcoin, and whether bitcoin exhibits characteristics of good money as it relates to Gresham’s law.

Kaj je Greshamov zakon?

Investopedia states: “Gresham’s law is a monetary principle stating that ‘bad money drives out good.’ It is primarily used for consideration and application in valutnih trgih. Gresham’s law was originally based on the composition of minted coins and the value of the precious metals used in them. However, since the abandonment of metallic currency standards, the theory has been applied to the relative stability of different currencies’ value in global markets.”

V središču Greshamovega zakona je koncept dobrega denarja (denar, ki je podcenjen ali denar, ki je bolj stabilen po vrednosti) v primerjavi s slabim denarjem (denar, ki je precenjen ali hitro izgubi vrednost). Zakon pravi, da slab denar izžene dober denar v obtok. Slab denar je potem valuta, za katero se šteje, da ima enako ali manjšo notranjo vrednost v primerjavi z njeno nominalno vrednostjo. Medtem pa je dober denar valuta, za katero se domneva, da ima večjo notranjo vrednost ali več možnosti za večjo vrednost od njene nominalne vrednosti. Logično je, da se bodo ljudje odločili, da bodo poslovali z uporabo slabega denarja in imeli stanje dobrega denarja, ker ima dober denar potencial, da je vreden več od njegove nominalne vrednosti.

Kako je Greshamov zakon povezan z Bitcoinom?

Now that we have a fundamental understanding of Gresham’s law, let’s examine how it relates to bitcoin.

With the understanding that Gresham’s law states that “bad money drives out good money in circulation” we can then ask ourselves, “Is bitcoin exhibiting characteristics of good money or bad money as it relates to Gresham’s law?” To answer that question, we examine the following topics: spending versus saving bitcoin, spending versus saving dollars, and the cost of saving in bad money.

Spending Versus Saving Bitcoin

The overwhelming use case of bitcoin today is that of a store of value savings mechanism. The reasons for this are myriad and include: the growing network effects of adoption leading to rapid price appreciation of bitcoin, the tax treatment of bitcoin, and merchant adoption of accepting bitcoin for payment.

Z zgodovinski compound annual growth rate of over 200%, bitcoin holders have little incentive to spend their bitcoin. Couple that with the fact that bitcoin is classified as property by the Internal Revenue Service, meaning every transaction is a taxable event, and we can quickly understand why bitcoin is saved and not spent. As bitcoin continues along its expected path to becoming the global reserve currency, we can expect that eventually it will also be used more widely in everyday commerce. In fact, this is already beginning to happen in developing countries, as well as countries whose currencies are unstable, such as Venezuela, Argentina, Turkey, and others. Additionally, El Salvador became the first country to classify bitcoin as legal tender earlier this year, meaning that every merchant must now accept bitcoin as payment in El Salvador. This trend will continue in the coming years until bitcoin is accepted as payment just as widely as dollars are today.

Poraba proti varčevanju dolarjev

Contrast how bitcoin holders utilize bitcoin with that of how dollar holders utilize the dollar. The dollar does not have a fixed supply of units like bitcoin does. In fact, more dollars are created out of thin air whenever the government and Federal Reserve Board feel the need to create them. This fundamental difference is what has led to the dollar amortizira za več kot 90 % v zadnjih 100 letih. Zato je enostavno razumeti, zakaj ljudje raje porabijo dolarje, namesto da bi varčevali dolarje, saj ni logično, da bi shranili nekaj, kar je programirano tako, da se sčasoma zmanjša vrednost, in temu rečemo »varčevanje«. Nepremišljeno tiskanje denarja, ki se je zgodilo v zadnjih 18 mesecih (40% of all dollars in existence were printed in the past 18 months) has led more and more people to realize that they should be spending their dollars as fast as they can, and accumulating hard assets to save. Since bitcoin is the hardest asset in history, it makes sense that more and more people are turning to it as their preferred method of saving and storing value.

Stroški varčevanja v slabem denarju

Stroški varčevanja v slabem denarju v daljšem časovnem obdobju so ogromni in so lahko katastrofalni za neto vrednost. Predstavljajte si, če bi imeli večino svojega bogastva v dolarjih v zadnjih 100, 50, 20 ali 10 letih. V najboljšem primeru bi se vaša kupna moč v zadnjem desetletju zmanjšala za več kot 50 % zaradi denarnega znižanja vrednosti tiskanja denarja. Najslabši scenarij je, da je več kot 90 % vašega bogastva izhlapelo.

Now, let’s return to the question we set out to answer: “Is bitcoin exhibiting characteristics of good money or bad money as it relates to Gresham’s Law?”

Bitcoin exhibits all the characteristics of good money. The dollar on the other hand exhibits all the characteristics of bad money. People save in bitcoin and spend in dollars. The dollar is becoming exponentially worse money as time goes on and the speed with which it is debased increases. Conversely, bitcoin is becoming better money as time goes on and more people start to recognize its value as a means to store wealth safely into the future.

zaključek

Gresham’s law is an important monetary principle to understand. Simply put, bad money is like a hot potato and people are incentivized to get rid of it as fast as they can. Good money is like gold (digital gold in bitcoin’s case), and its monetary properties incentive saving over spending.

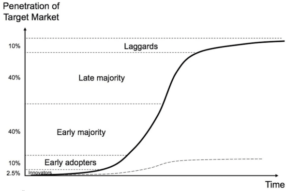

As time goes on, we will continue to see good money (bitcoin) being saved, and bad money (dollars) being spent. As the dollar continues its decline, more and more people will gravitate to bitcoin to store the value of their labor. Eventually, once the majority of people are saving in bitcoin, it will transition from primarily being used as a store of value to also being used as a medium of exchange. To get from here to there the value of bitcoin must continue its exponential increase. Buckle up, it’s going to be a fun ride.

To je Donova objava za goste. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc oz Revija Bitcoin.

Source: https://bitcoinmagazine.com/culture/how-does-greshams-law-relate-to-bitcoin

- "

- 100

- Sprejetje

- vsi

- uporaba

- Argentina

- članek

- sredstvo

- Sredstva

- BEST

- Bitcoin

- svet

- BTC

- BTC Inc.

- poslovni

- klic

- Kovanci

- prihajajo

- Trgovina

- Sestavljeni

- naprej

- se nadaljuje

- države

- par

- plačila

- valuta

- digitalni

- digitalno zlato

- Dollar

- dolarjev

- Event

- Izmenjava

- Obraz

- FAST

- Zvezna

- zvezne rezerve

- Fiat

- prva

- zabava

- Prihodnost

- Globalno

- Gold

- dobro

- vlada

- Pridelovanje

- Rast

- Gost

- Gost Prispevek

- tukaj

- zgodovina

- držite

- Kako

- HTTPS

- Povečajte

- Notranja davčna služba

- IT

- dela

- zakon

- vodi

- Led

- Pravne informacije

- Long

- Večina

- Prisotnost

- srednje

- Trgovec

- Denar

- mesecev

- net

- mreža

- Komentarji

- Ostalo

- Plačilo

- ljudje

- moč

- Plemenite kovine

- Cena

- nepremičnine

- Razlogi

- prihodki

- shranjevanje

- Občutek

- nastavite

- So

- hitrost

- preživeti

- Poraba

- Stabilnost

- standardi

- Začetek

- Države

- trgovina

- dobavi

- davek

- svet

- čas

- Teme

- transakcija

- Zdravljenje

- Turčija

- vrednost

- Venezuela

- Proti

- Wealth

- svet

- vredno

- leto

- let