Spodaj je iz nedavne izdaje Deep Dive, glasila o premijskih trgih revije Bitcoin. Če želite med prvimi prejeti te vpoglede in drugo analizo trga bitcoin na verigi neposredno v svoj nabiralnik, naročite se zdaj.

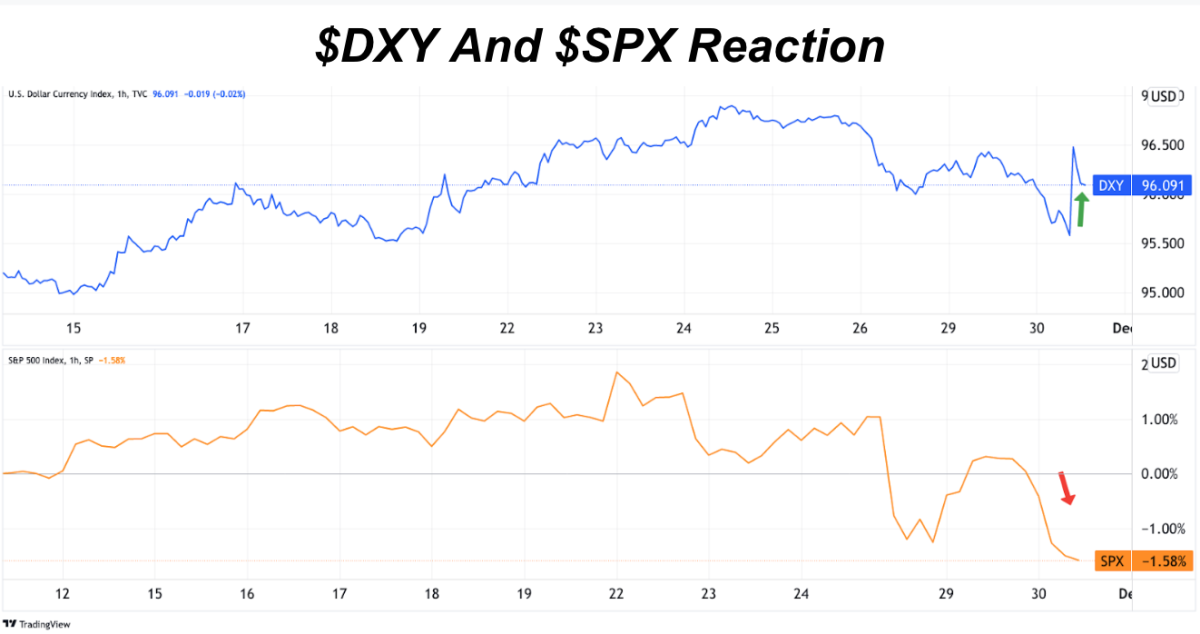

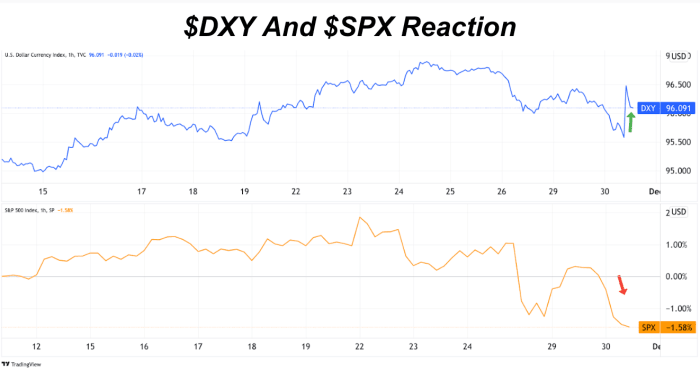

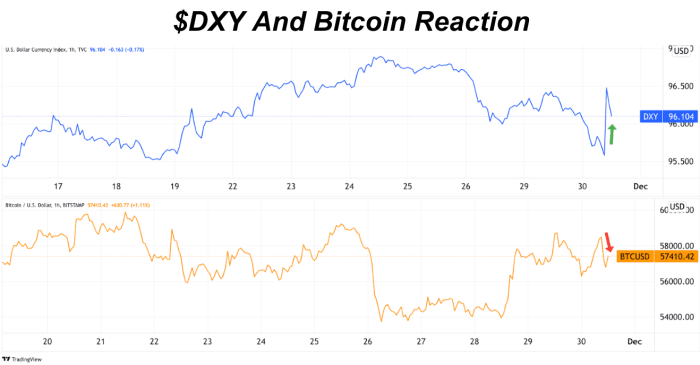

v Dnevni potop #102, we highlighted the rising DXY (U.S. Dollar Currency Index) in 2021 and the negative impact it can have on bitcoin’s price. Today, with Federal Reserve Board Chair, Jerome Powell, talking about the rising risk of persistently high inflation in the United States and a potential accelerated taper, DXY, SPX and bitcoin markets immediately reacted. The DXY jumped over 1% with both the S&P 500 Index and bitcoin falling in tandem.

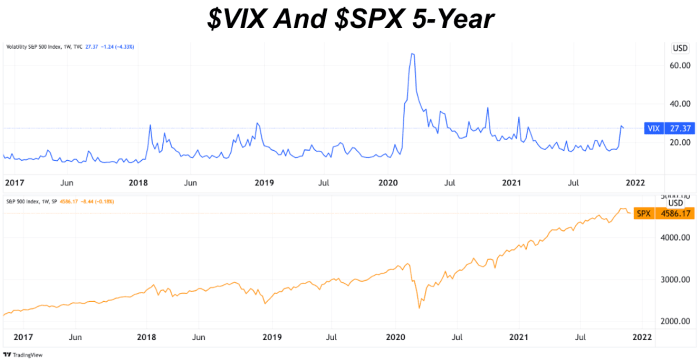

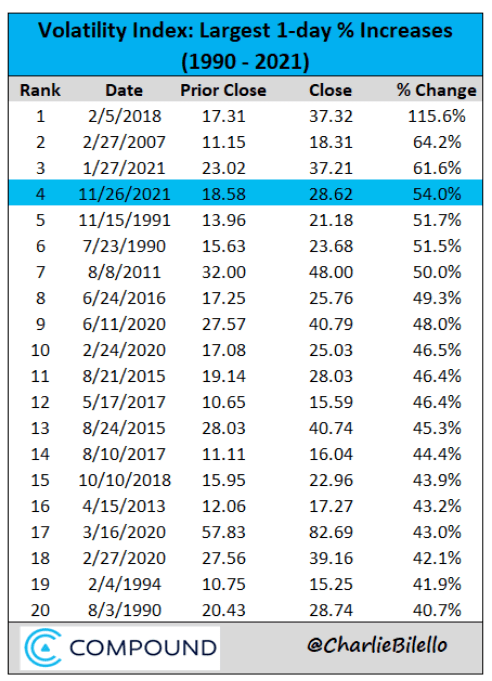

V zadnjih nekaj dneh opažamo naraščajočo in povišano nestanovitnost trga, saj je VIX prejšnji petek poskočil za več kot 54 %, kar je četrto največje enodnevno odstotno povečanje v njegovi zgodovini. To je previden znak za vlagatelje, da v bližnji prihodnosti pričakujejo nestanovitnost.

Položaj Federal Reserve je neverjetno težaven: izbira med reševanjem trga obveznic ali ohranjanjem ameriškega gospodarstva. Pospešeno zniževanje nas približuje zvišanju obrestnih mer, ki so edini način za pomoč vlagateljem s fiksnim donosom, ki so obsedeni z resničnimi negativnimi donosnostmi dolga ZDA, saj inflacija preseže 6%.

On the other hand, expectations of accelerated tapering with plans for interest rate hikes will drive down asset prices as extra liquidity in the system winds down and the cost of capital increases, negatively affecting current equity valuations. The SPX fell 1% in 15 minutes on yesterday’s announcement.

- "

- med

- Analiza

- Objava

- sredstvo

- Bitcoin

- svet

- zlom

- Kapital

- predsednik

- bližje

- komentarji

- valuta

- Trenutna

- datum

- Dolg

- Podatki

- Dollar

- Gospodarstvo

- pravičnost

- Event

- Zvezna

- zvezne rezerve

- prva

- Za vlagatelje

- Petek

- visoka

- Poudarjeno

- zgodovina

- Kako

- HTTPS

- slika

- vpliv

- Povečajte

- Indeks

- inflacija

- vpogledi

- obresti

- Vlagatelji

- IT

- likvidnostno

- Tržna

- Analiza trga

- Prisotnost

- mediji

- Meta

- Blizu

- Novice

- Ostalo

- Premium

- Cena

- Reagirajo

- Tveganje

- S&P 500

- shranjevanje

- Velikosti

- Države

- sistem

- pogovor

- nas

- Ameriško gospodarstvo

- Velika

- Združene države Amerike

- us

- Vrednote

- Volatilnost