This op-ed originally appeared as “In defence of stablecoins” on the Financial Times spletna stran on Monday, August 8, 2022, and in the newspaper’s print edition on Tuesday, August 9, 2022.

Crypto critics are using the collapse of dollar-pegged virtual currency Terra as ammunition to attack stabilni kosi in kriptoindustrijo kot celoto.

Lost in the conversation is, however, the root cause of the turmoil. A better understanding of what went wrong — and why — could help protect consumers while safeguarding innovation.

It’s important first to clarify terms. A stablecoin is cryptocurrency whose price is nominally “pegged” to a stable asset such as the U.S. dollar. People commonly blame the recent blow-up on so-called “algorithmic stablecoins,” which are typically programmed to automatically incentivize the creation and destruction of coins to maintain the price peg.

The attack on them is off the mark. Putting aside that TerraUSD should never have been considered a “stablecoin,” the real issue here has little to do with computer code and everything to do with a concept as old as finance itself: collateralization, or the use of assets to underpin value.

It is a crucial point that policymakers across the world need to consider as they draft legislation to prevent future Terra-like collapses. If legislators believe algorithms are to blame, they risk enacting counter-productive, innovation-stifling regulations. Poorly designed laws could disrupt markets, encourage regulatory arbitrage, and diminish Western democracies’ influence in the rising, decentralized internet economy known as web3.

The promise of decentralized finance — Defi — rests largely on the breakthrough ability of blockchains to execute transparent, algorithmic contracts with instant finality.

Amid the recent market volatility, the vast majority of “decentralized” stablecoins backed by blockchain assets such as bitcoin and ether performed superbly, handling extreme price fluctuations and unprecedented redemptions without fail. Generally speaking, algorithms aren’t the issue with modern stablecoins. Instead, essentially all risk now arises from their collateral design.

The riskiest stablecoins are readily apparent: they are significantly under-collateralized (less than $1 of collateral is required to mint $1 of stablecoin), and they rely on “endogenous” collateral (collateral created by the issuer such as governance tokens that give holders voting powers on a blockchain’s rules and procedures).

Endogenous collateral enables dangerous, explosive growth: when an issuer’s governance token appreciates, users can mint many more stablecoins. That sounds fine until one considers the flipside: When the price declines — as is practically guaranteed during a bank run — cascading collateral liquidations to meet redemptions trigger a death spiral. See TerraUSD as an example.

Regulation is necessary to prevent similar breakdowns, but overly restrictive rules are not. The truth is enforcement actions under existing securities laws and anti-fraud statutes could have curtailed the proliferation of nearly every failed stablecoin to date.

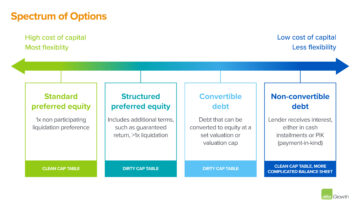

Even so, additional, targeted regulation could be beneficial. While it is difficult to pinpoint exactly where regulators should establish collateralization requirements, it’s clear that without guardrails, stablecoin issuers may once again take on unreasonable amounts of risk.

Well-tailored rulemaking could support the crypto ecosystem and protect consumers. Wholesale changes — such as prohibiting the use of algorithms and digital assets as collateral altogether — would place an enormous burden on the burgeoning DeFi industry, disrupt digital asset markets, and hinder web3 innovation.

This is because stablecoins can, indeed, be stable if they manage their collateral properly. For “centralized” stablecoins backed by real-world assets, the liquidity and transparency of reserves may be low, so collateral should include less volatile assets like cash, treasuries, and bonds. Regulators can establish parameters regarding these types of collateral and require regular audits.

For “decentralized” stablecoins, the almost exclusive use of blockchain assets such as bitcoin or ether as collateral has trade-offs. Digital assets, while often volatile, are also highly liquid and can be transparently and algorithmically managed. Liquidity can happen nearly instantaneously, enabling much more efficient systems. As a result, decentralized stablecoins could, ultimately, be more resilient than centralized ones.

Algorithmic stablecoins present a unique opportunity to make all sorts of assets productive and drive digital commerce around the globe. Placing guardrails around their collateral could help unlock that potential.

Urednik: Robert Hackett @rhhackett

***

Tukaj izražena stališča so stališča posameznega citiranega osebja družbe AH Capital Management, LLC (»a16z«) in niso stališča družbe a16z ali njenih podružnic. Nekatere informacije, vsebovane tukaj, so bile pridobljene iz virov tretjih oseb, vključno s portfeljskimi družbami skladov, ki jih upravlja a16z. Čeprav so vzeti iz virov, za katere menijo, da so zanesljivi, a16z ni neodvisno preveril takšnih informacij in ne daje nobenih zagotovil o trenutni ali trajni točnosti informacij ali njihovi ustreznosti za dano situacijo. Poleg tega lahko ta vsebina vključuje oglase tretjih oseb; a16z ni pregledal takšnih oglasov in ne podpira nobene oglaševalske vsebine v njih.

Ta vsebina je na voljo samo v informativne namene in se je ne smete zanašati kot pravni, poslovni, naložbeni ali davčni nasvet. Glede teh zadev se morate posvetovati s svojimi svetovalci. Sklici na katere koli vrednostne papirje ali digitalna sredstva so samo v ilustrativne namene in ne predstavljajo naložbenega priporočila ali ponudbe za zagotavljanje investicijskih svetovalnih storitev. Poleg tega ta vsebina ni namenjena nobenim vlagateljem ali bodočim vlagateljem niti ji ni namenjena in se nanjo v nobenem primeru ne smete zanašati, ko se odločate za vlaganje v kateri koli sklad, ki ga upravlja a16z. (Ponudba za vlaganje v sklad a16z bo podana le z memorandumom o zasebni plasiranju, pogodbo o vpisu in drugo ustrezno dokumentacijo katerega koli takega sklada in jo je treba prebrati v celoti.) Vse naložbe ali portfeljske družbe, omenjene, navedene ali opisane niso reprezentativne za vse naložbe v vozila, ki jih upravlja a16z, in ni nobenega zagotovila, da bodo naložbe donosne ali da bodo imele druge naložbe v prihodnosti podobne značilnosti ali rezultate. Seznam naložb skladov, ki jih upravlja Andreessen Horowitz (razen naložb, za katere izdajatelj ni dal dovoljenja a16z za javno razkritje, ter nenapovedanih naložb v digitalna sredstva, s katerimi se javno trguje), je na voljo na https://a16z.com/investments /.

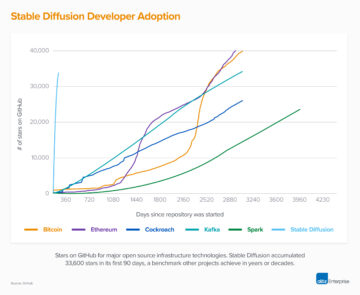

Grafi in grafi, ki so navedeni znotraj, so izključno informativne narave in se nanje ne bi smeli zanašati pri sprejemanju kakršnih koli investicijskih odločitev. Pretekla uspešnost ni pokazatelj prihodnjih rezultatov. Vsebina govori samo od navedenega datuma. Vse projekcije, ocene, napovedi, cilji, obeti in/ali mnenja, izražena v tem gradivu, se lahko spremenijo brez predhodnega obvestila in se lahko razlikujejo ali so v nasprotju z mnenji, ki so jih izrazili drugi. Za dodatne pomembne informacije obiščite https://a16z.com/disclosures.

- a16z kripto

- Andreessen Horowitz

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- Kripto in splet3

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- Politika in ureditev

- poligon

- dokazilo o vložku

- W3

- zefirnet