Protokol trgovanja z maržo brez dovoljenja EasyFi v verigi želi povečati rastoče posle na podlagi DEX

Etika brez dovoljenj in sestavljivosti prostora DeFi je omogočila ustvarjanje, kotacijo in trgovanje s skoraj 20000 žetoni in kovanci z različnimi stopnjami likvidnosti, obsega in rasti. Trgovanje s finančnim vzvodom pa je imelo svoj delež centralizacije z več kot 200 milijardami dolarjev vrednimi maržnimi posli, ki se dnevno dogajajo na številnih centraliziranih borzah. Na DEX-ih – ne toliko!

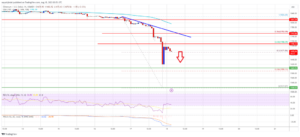

Trgov brez dovoljenj za trgovanje s finančnim vzvodom je bilo malo in tudi z minimalnim prodorom na trg in globino. Tisto, kar trg DeFi resnično potrebuje, je zadosten obseg, da zadosti povpraševanju po decentralizirani maržni trgovini, ki ga prikazuje.

Predstavljamo Electric

Na podlagi vizije #DoMoreWithDeFi pri EasyFi vam predstavljamo Electric – decentralizirano, brez dovoljenj, razširljivo, varno platformo za trgovanje s finančnim vzvodom, ki trgovcem omogoča najemanje kratkoročnih posojil za trgovanje s pozicijami marž iz javno pridobljene likvidnosti na različnih AMM / decentralizirane borze.

To se bo zgodilo v aplikaciji EasyFi, kjer lahko uporabniki na učinkovit in varen način opravljajo trgovanje z maržo na določenih trgovalnih parih.

Izkoristite na stotine žetonov na večverižnem izdelku za trgovanje z maržami EasyFi in izvajajte posle s finančnim vzvodom z integrirano likvidnostjo iz najboljših DEX-ov, kot so Uniswap, Sushiswap, PancakeSwap, QuickSwap in drugi, v več omrežjih blockchain.

Ključne funkcije

- Trades with Liquidity on DEXs – Will connect traders to trade with the most liquid decentralized markets / AMMs. We are exploring a collaboration with every AMM of repute.

- Risk-reward – Separate pools of different asset pairs will be created. This will allow lenders to invest understanding different risk and interest parameters. Lenders can invest based on the calculated risk-reward ratio

- Real-time AMM Price – Collateral ratio with real-time AMM price for any pair available from a DEX.

- On-Demand Oracle – Electric uses price feed oracles from Chainlink integrated into the lending protocol and the ones provided by the DEX to detect the market price and any manipulation whatsoever. This detection forces a price update that makes it trading and liquidation valid.

- UI/UX – EasyFi has been a pioneer in building simple, intuitive and user-friendly products. The interface and experience for Electric has been planned in a similar manner.

Vizija izdelka

Trgovanje parov – The trading pairs on Electric will be based on the isolated and independent lending pools that are available on Electric. We will start with a small set of tokens for the margin markets which will include both volatile and stable assets.

Posojilni bazeni – As of now, EasyFi will create all lending pools for Electric. We expect these decisions to be taken over by the community when we launch the EasyFi DAO.

Margin Markets – The margin markets to begin will start with a few pairs as mentioned above. Users who wish to trade on the margin trading markets will essentially have to first deposit a collateral directly on the Electric module.

Obresti za maržo – Margin interest incurred by leveraged traders is paid out to lenders. Lenders can earn higher yields by depositing assets into the lending pools, earning interest from borrowed assets and also receive other rewards, via some exclusive programs.

DEX Verige – We will essentially be connecting to top AMM / DEXs on Polygon, Ethereum & BNB Chain to begin with and slowly expand to others

Vključitev Skupnosti – The community will eventually own the decision-making process on proposals sent to Electric when the governance process on EasyFi DAO kicks-in. Decisions on lending collaterals, margin trading pairs, default interest rates, risk parameters, will eventually be the community’s prerogative in the long term.

Zagon testnega omrežja – The Testnet has been launched – it will enable the users to try and test the module to the hilt and so we can iron out any issues. In the Različica Testnet, we are opening testing of leveraged trading on MATIC, USDT, DAI & USDC – we will keep adding new trading pairs in due course for testing as well.

Prihaja naslednji

- Pogodbe Electric so bile uvedene v Polygon Mumbai Testnet s povezavo s QuickSwap Testnet kot integracija DEX

- Dovolj časa, da skupnost preizkusi in preizkusi ta protokol pred zagonom glavnega omrežja

- Partnerstvo z DEX-ji za integracijo z električnim protokolom

O EasyFi-ju

EasyFi Network je univerzalni večverižni protokol denarnega trga ravni 2 za digitalna sredstva s poudarkom na pridobivanju likvidnosti in kapitalski učinkovitosti za strukturirano posojanje na neskrbniški način. Protokol je trenutno v živo na Polygonu, Binance Smart Chain in Ethereumu.

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- novice podjetje

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- NoviceBTC

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet