A contrarian take on the current market structure suggesting that the bitcoin bottom is near and the Federal Reserve will reverse its hawkish course.

Oglejte si ta video na YouTubu or Rumble

Poslušajte epizodo tukaj:

In this episode of the “Fed Watch” podcast, Christian Keroles and I, along with the livestream crew, discuss macro developments relevant to bitcoin. Topics include the recent 50 bps rate hike from the Fed, a consumer price index (CPI) preview — the episode was recorded live on Tuesday, before the CPI data was released — and a discussion on why owners’ equivalent rent is often misunderstood. We wrap up with an epic discussion of the bitcoin price.

This could be a pivotal episode in the history of “Fed Watch,” because I’m on the record saying that bitcoin is “in the neighborhood” of the bottom. This is in stark contrast to the mainstream uber-bearishness in the market right now. In this episode, I rely heavily on charts that didn’t always line up during the video. Those charts are provided below with a basic explanation. You can see the celoten diapozitiv, ki sem ga uporabil tukaj.

“Fed Watch” is a podcast for people interested in central bank current events and how Bitcoin will integrate or replace aspects of the traditional financial system. To understand how bitcoin will become global money, we must first understand what’s happening now.

Federal Reserve in gospodarske številke za ZDA

Na tem prvem grafikonu opozarjam na zadnji dve dvigi obrestnih mer Fed na grafikonu S&P 500. Napisal sem v a objava v blogu ta teden, “What I’m trying to show is that the rate hikes themselves are not the Federal Reserve’s primary tool. Talking about hiking rates is the primary tool, along with fostering the belief in the magic of the Fed.” Remove the arrows and try to guess where the announcements were.

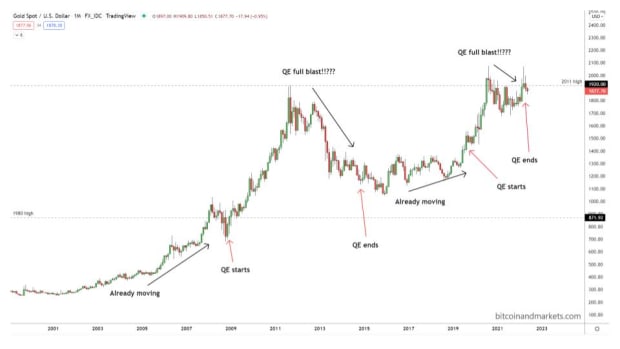

Enako velja za naslednji grafikon: zlato.

Lastly, for this section, we looked at the bitcoin chart with quantitative easing (QE) and quantitative tightening (QT) plotted. As you can see, in the era with “No QE,” from 2015 to 2019, bitcoin experienced a 6,000% bull market. This is almost the exact opposite of what one would expect. To summarize this section, Fed policy has little to do with major swings in the market. Swings come from the unknowable complex ebbs and flows of the market. The Federal Reserve only tries to smooth the edges.

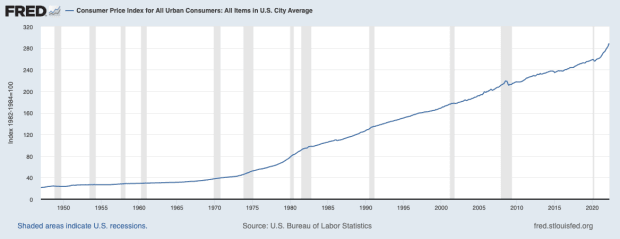

CPI Zločin

Težko je napisati dober povzetek tega dela podcasta, ker smo bili v živo en dan pred padcem podatkov. V podcastu pokrivam CPI v evroobmočju nekoliko višji, na 7.5 % aprila medletno (YoY), pri čemer je medmesečna stopnja spremembe padla z osupljivih 2.5 % marca na 0.6 % aprila. To je zgodba, ki jo večina pogreša pri CPI: spremembe iz meseca v mesec so se aprila hitro upočasnile. V podcastu sem pokrival tudi napovedi CPI za ZDA, zdaj pa imamo trdne podatke za april. Skupni CPI v ZDA je padel z 8.5 % marca na 8.3 % aprila. Mesečna sprememba je padla z 1.2 % marca na 0.3 % aprila. Spet velik upad stopnje rasti CPI. CPI je lahko zelo zmeden, če pogledamo medletne številke.

Zdi se, da je bila inflacija v aprilu izmerjena pri 8.3 %, v resnici pa le 0.3 %.

Next topic we cover in the podcast is rent. I very often hear misunderstandings of the CPI measure on shelter and specifically owners’ equivalent rent (OER). For starters, it’s very hard to measure the impact of increases to housing costs on consumers in general. Most people do not move very often. We have 15- or 30-year fixed-rate mortgages that are not affected at all by current home prices. Even rental leases are not renewed every month. Contracts typically last a year, sometimes more. Therefore, if a few people pay higher rents in a certain month, that does not affect the average person’s shelter expenses or the average landlord’s revenue.

Taking current market prices for rentals or homes is a dishonest way to estimate the average cost of housing, yet not doing so is the most often-quoted critique of the CPI. Caveat: I’m not saying CPI measures inflation (money printing); it measures an index of prices to maintain your standard of living. Of course, there are many layers of subjectivity in this statistic. OER more accurately estimates changes in housing costs for the average American, smooths out volatility and separates pure shelter costs from investment value.

Analiza cen Bitcoin

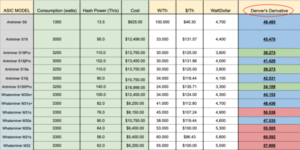

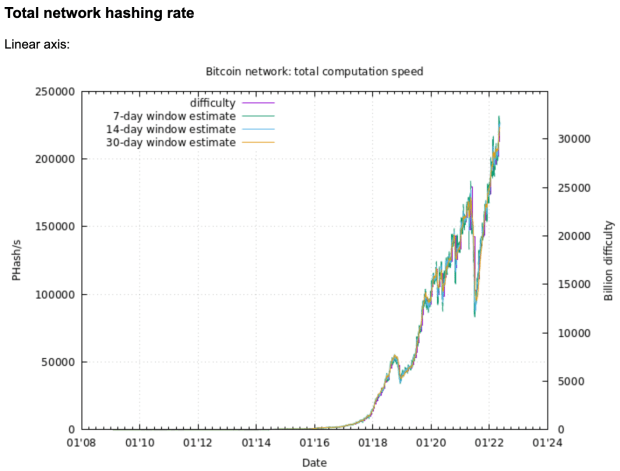

The rest of the episode is talking about the current bitcoin price action. I start my bullish rant by showing the hash rate chart and talking about why it is a lagging and confirming indicator. With the hash rate at all-time highs and consistently increasing, this suggests that bitcoin is fairly valued at its current level.

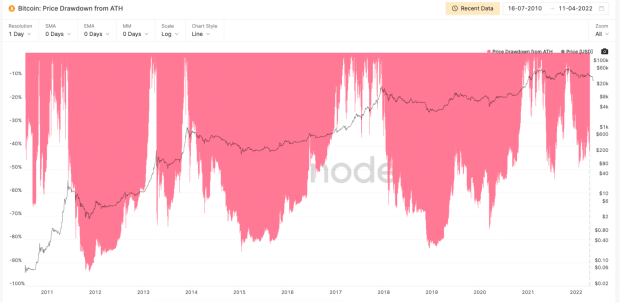

V zadnjih letih smo bili priča krajšim, manjšim dvigom in krajšim, manjšim padcem. Ta grafikon nakazuje, da je 50-odstotno črpanje namesto 85-odstotnega novo normalno.

Now, we get into some technical analysis. I concentrate on the Relative Strength Index (RSI) because it is very basic and a fundamental building block of many other indicators. Monthly RSI is at levels that typically signal cycle bottoms. Currently, the monthly metric shows that bitcoin is more oversold than at the bottom of the corona crash in 2020. Weekly RSI is equally as oversold. It is as low as the bottom of the corona crash in 2020, and before that, the bottom of the bear market in 2018.

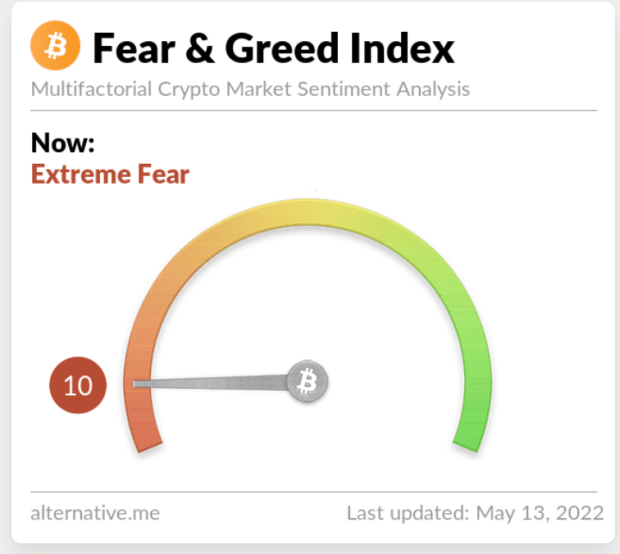

Indeks strahu in pohlepa je prav tako izjemno nizka. Ta ukrep kaže »ekstremen strah«, ki se običajno zabeleži na relativnem dnu in pri 10, kar je najnižja ocena od zloma COVID-19 leta 2020.

Če povzamem, moj nasprotni (bikovski) argument je:

- Bitcoin is already at historic lows and could bottom at any moment.

- The global economy is getting worse and bitcoin is counterparty-free, sound money, so it should behave similarly to 2015 at the end of QE.

- The Fed will be forced to reverse its narrative in the coming months which could relieve downward pressure on stocks.

- Bitcoin is closely tied to the U.S. economy at this point, and the U.S. will weather the coming recession better than most other places.

To je to za ta teden. Hvala bralcem in poslušalcem. Če vam je všeč ta vsebina, se naročite, pregledajte in delite!

To je gostujoča objava Ansela Lindnerja. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc. oz Bitcoin Magazine.

- 000

- 10

- 2019

- 2020

- 7

- O meni

- Ukrep

- vsi

- že

- vedno

- Ameriška

- Analiza

- Obvestila

- Apple

- april

- povprečno

- Banka

- Bear Market

- postanejo

- pred

- spodaj

- Bitcoin

- Bitcoin Cena

- Block

- Blog

- BTC

- BTC Inc.

- Building

- Bikovski

- Osrednji

- Centralna banka

- nekatere

- spremenite

- Charts

- kako

- prihajajo

- kompleksna

- Potrošnik

- Potrošniki

- vsebina

- pogodbe

- Corona

- stroški

- bi

- pokrov

- Covid-19

- Crash

- Trenutna

- Trenutno

- datum

- dan

- razvoju

- razpravlja

- padla

- med

- olajšanje

- Gospodarska

- Gospodarstvo

- oceniti

- ocene

- dogodki

- pričakovati

- Stroški

- izkušen

- izražena

- Fed

- Zvezna

- zvezne rezerve

- finančna

- prva

- temeljna

- splošno

- pridobivanje

- stekleno vozlišče

- Globalno

- Globalno gospodarstvo

- dogaja

- Gold

- dobro

- Gost

- Gost Prispevek

- hash

- hitrost hash

- tukaj

- več

- Zgodovinski

- zgodovina

- Domov

- Ohišje

- Kako

- HTTPS

- vpliv

- Inc

- vključujejo

- Povečajte

- narašča

- Indeks

- inflacija

- integrirati

- zainteresirani

- naložbe

- IT

- Stopnja

- vrstica

- malo

- Livestream

- živi

- Pogledal

- si

- Makro

- Mainstream

- vzdrževati

- velika

- marec

- Tržna

- merjenje

- ukrepe

- Denar

- mesec

- mesecev

- več

- Najbolj

- premikanje

- Blizu

- nujno

- normalno

- številke

- Komentarji

- Ostalo

- lastne

- del

- Plačajte

- ljudje

- ključno

- Podcast

- Točka

- politika

- tlak

- predogled

- Cena

- Analiza cen

- primarni

- količinsko

- Kvantitativnega popuščanja

- Cene

- ocena

- bralci

- recesija

- zapis

- odražajo

- registri

- sprosti

- pomembno

- Najem

- najemnine

- REST

- prihodki

- nazaj

- pregleda

- S&P 500

- Shelter

- podobno

- saj

- So

- nekaj

- posebej

- Spotify

- standardna

- Začetek

- Zaloge

- moč

- naročiti

- sistem

- pogovor

- tehnični

- Tehnična analiza

- zato

- vezana

- orodje

- Teme

- tradicionalna

- tipično

- nas

- Ameriško gospodarstvo

- razumeli

- vrednost

- vrednoti

- Video

- Volatilnost

- Watch

- teden

- Tedenski

- Kaj

- bi

- leto

- let

- youtube