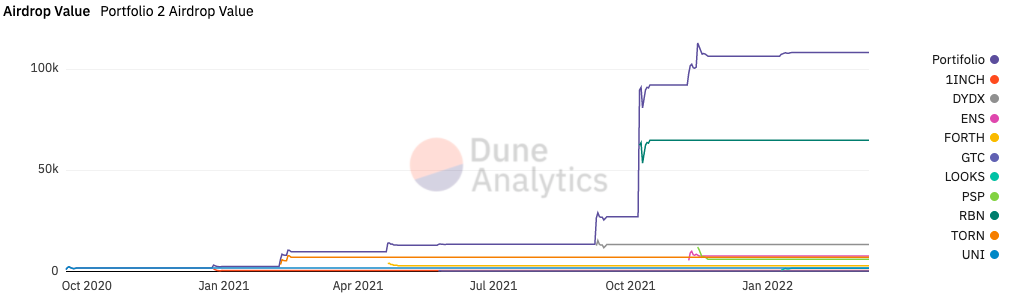

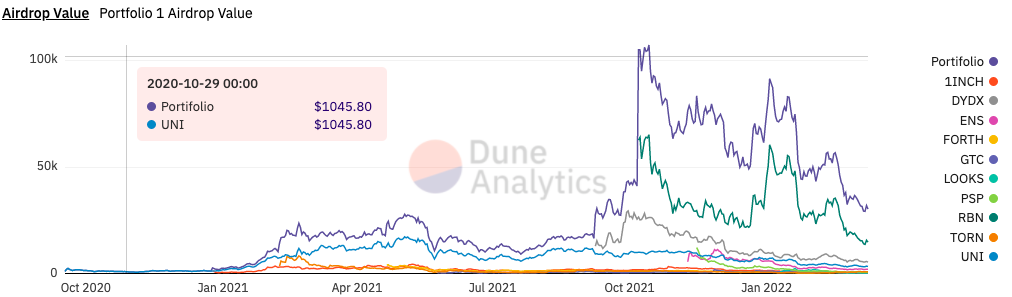

It appears that profit-seeking web3 users would have been better off selling their airdrops rather than holding them.

Novo Armaturna plošča developed by Messari data scientist, Yule Andrade, has revealed that selling each of the 10 most significant Ethereum zračne kapljice a week after receiving them would be twice as profitable — or 112.5%, to be precise — as holding them.

The 10 airdrops included wxya, Odklopite, Izgleda Redko, Gitcoinin Ime storitve Ethereum.

Specifically, a user who received the median number of tokens for each airdrop and sold them would have earned $108,393, according to Andrade’s dashboard.

A user who held the 10 airdrops until Mar. 10, would have a portfolio worth $30,349.

Andrade also provided portfolio values for people who sold airdrops two weeks, one month, and three months after receiving them, with decreases in returns the longer selling was postponed.

Andrade’s data puts hard evidence to the idea that, for the profit-seeking user, airdrops should generally be sold quickly, rather than held. This flies in the face of the sentiment that airdrops are given to the community to allow them to steward a platform with governance.

Brantly Millegan, who is still the director of operations at Ethereum Name Service, according to his LinkedIn, kljub temu, da je vpleten v polemike, slavno tweeted of the ENS airdrop: “you were not airdropped free money, you were airdropped responsibility.”

With users generally better off selling their airdrops, it may be hard to convince them to stick around for both responsibility and a depressed portfolio.

To be sure, not every airdrop was lower on Mar. 10 than a week after it dropped. The median airdrop of 400 of Uniswap’s UNI tokens, would’ve been worth $1,959 if sold a week after their Sept. 16 airdrop. Proving an exception to the rule, those tokens are now worth $3,686, according to Andrade’s dashboard.

Outside the Scope

Gitcoin’s GTC is also up a modest 7% as of Mar. 10 against its June 1 price which is a week after its May 25 airdrop. The decentralized exchange aggregator, 1inch’s INCH token, is also up 13% against its one-week-past airdrop price.

So not all tokens are necessarily better off sold. Plus there are other benefits outside of the scope of Andrade’s dashboard — people who received LOOKS, for example were able to receive ETH fees if they staked their airdropped tokens, making the

And of course, the overall crypto market is down 20% in the last 90 days, making airdrop holders look particularly bad. So while they may look like they should’ve taken the money and run, it’s possible that the future may show those who sold that they did so too early.

Preberite izvirno objavo na Zavračevalec

- "

- $3

- Po

- Zračni desant

- Airdrops

- vsi

- okoli

- ozadje

- počutje

- Prednosti

- meja

- skupnost

- kripto

- Kripto tržnica

- Armaturna plošča

- datum

- podatkovni znanstvenik

- Kljub

- razvili

- DID

- Direktor

- navzdol

- padla

- Zgodnje

- ETH

- ethereum

- Primer

- Izmenjava

- Obraz

- pristojbine

- brezplačno

- Prihodnost

- upravljanje

- imetniki

- HTTPS

- Ideja

- vključeno

- IT

- Izdelava

- Tržna

- Messaria

- Denar

- mesec

- mesecev

- Najbolj

- Številka

- operacije

- Ostalo

- ljudje

- platforma

- Portfelj

- mogoče

- Cena

- donosno

- hitro

- prejeti

- vrne

- Razkrito

- Run

- Znanstvenik

- sentiment

- Storitev

- pomemben

- So

- prodaja

- žeton

- Boni

- Uporabniki

- Web3

- teden

- WHO

- vredno