Once upon a time in the financial services industry, when dinosaurs roamed the Earth, there was significant value for technology providers just in being a large, established brand. Big brands used to show stability, strong offerings and ability to scale.

However, today many startups offer the same if not better. The premium placed on brand name still exists among some enterprise clients, but it’s long outlived its usefulness, as the gap in capabilities it once signified has evaporated. Instead, we are hurtling

forward into an era where product quality will dictate vendor choice for all organizations concerned with maintaining their competitive advantage.

Let’s address the core reasons that exist for going with big name brands and how they’ve been undermined by the evolution of fintech in recent years. Namely, let’s talk about buying from a one-stop shop, corporate stability and continuity, security and privacy

in kakovost izdelkov.

Konec vse na enem mestu

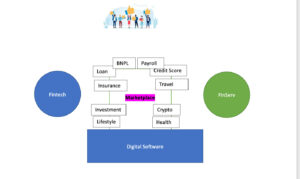

Companies used to rely on big monolithic core computing systems to get things done. This led to a strong preference towards purchasing all-encompassing solutions that could provide multiple services while only requiring being integrated once into an organization’s

technology stack. With the microservices revolution, the architectural design of software systems has broken up the monolithic systems into discrete functions that operate as independent services. New services can now be easily added to a company’s software

architecture without requiring a complete rebuild of the underlying code. Some innovative companies even created app stores full of third party solutions to support customers using their technology platforms.

At the same time, the multiplying needs in the market has made it clear that single, catchall solutions can’t solve everybody’s pain points. That has created space for startups to create niche solutions that address specific market segments well. It has

also motivated large companies to acquire or develop niche solutions. The days of relying solely on large, monolithic technology platforms are over and plug and play is now in.

Povečana vzdržljivost ob zagonu

Že v prvem desetletju spletnih zagonskih podjetij je obstajala upravičena zaskrbljenost, ali bi velike korporativne stranke lahko zaupale novemu ponudniku rešitev, ki je zbral nekaj milijonov dolarjev, še približno leto kasneje.

Solution contracts are typically several years in length. Why would you want to enter one with a counterparty that might not be able to fulfill it. However, innovative fintech companies today have largely overcome this business continuity problem thanks

to greater access and deeper engagement with capital markets.

Put simply, innovative fintechs are now raising more money than they used to. Even if, like most startups, they are in the red while they focus on growth, most well-run fintechs operate at run rates that ensure years of runway. And in the event that rapid

growth places greater demands on resources, the market has shown it is willing to provide additional capital to startups that have viable business models.

Problem neprekinjenega poslovanja danes ni tak, kot je bil pred desetletjem.

Ohranjanje varnosti in zasebnosti podatkov

Enterprise customers also have compliance concerns when it comes to securing their data and meeting regulatory privacy requirements. When companies used to hold data on-premises, it required significant investment in managing and securing physical resources

(hardware, office space, etc.) and a team of individuals trained and skilled in meeting compliance needs. Today, with everything in the cloud, startups can easily ramp up their security posture and privacy protection standards to the highest degree. The tools

that are necessary to harden the security of a company and defend against intrusions are all available online, primarily as SaaS offerings.

Nekaterim je težko sprejeti, da a

SOC2 Type II compliant startup has the same security as a majority corporation. However, once a company has set the standard for its security posture, it’s all about the employees implementing it. And in this respect many startups are no different than

major corporations, with security professionals moving between large companies and startups all the time, diffusing the knowledge and implementation of best practices.

It’s all about product

Ko odpravite pomisleke, povezane s poslovno stabilnostjo in skladnostjo, se morate odločiti le, katera tehnološka rešitev je boljši izdelek. In tako mora biti. Danes vse temelji na podatkih, kajne? Zakaj torej ne bi primerjali rezultatov?

Danes obstajajo mlada podjetja na področjih obdelave plačil, neobančništva, boja proti pranju denarja/KYC in drugih, ki so zelo konkurenčna in morda boljša od svojih uveljavljenih partnerjev blagovnih znamk.

One game-changing technology is artificial intelligence (AI), with machines optimizing results across too many variables for the human mind to comprehend. Just like the dinosaurs’ massive size didn’t prevent them from losing the evolutionary battle with

mammals, and specifically humans, so too the slower moving fintech brands of yore are feeling the pressure from more agile startups focused on integrating AI technology.

In payments, AI has already made a significant difference in pre-transaction fraud prevention. The days of simple rules sets are vanishing fast. They have been replaced with risk scoring engines and the most advanced solutions also incorporate AI/machine

learning. The pre-transaction fraud prevention companies that pioneered the use of AI for online eCommerce are standalone companies now worth billions and are protecting many of the most recognizable brands in online retail. Yet just a handful of years ago,

the market was dominated by subsidiaries of massive corporations.

Jarki se krčijo, ohranite svojo prednost

Dolgoročno bodo podjetja, odprta za delo z najboljšim izdelkom namesto z najstarejšim ugledom, izostrila lastno konkurenčno prednost. Tisti, ki ne želijo odpreti svojega tehnološkega sklada za pregled, bodo umrli in bodo sčasoma šli po poti dinozavrov.

Morda je bilo vedno tako. Toda z naraščajočim številom tehnoloških motilcev v trenutni dobi fintecha se bo cikel ustvarjalnega uničenja zgodil hitreje. Želite staviti na dinozavra?

- ant finančni

- blockchain

- blockchain konferenca fintech

- chime fintech

- coinbase

- coingenius

- kripto konferenca fintech

- FINTECH

- fintech aplikacija

- fintech inovacije

- Fintextra

- OpenSea

- PayPal

- paytech

- plačilna pot

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- trak

- tencent fintech

- fotokopirni stroj

- zefirnet