- A 16% rally seen in Nvidia (ex-post earnings) has led the Nasdaq 100 to recoup its entire loss of -3.5% from last Friday, 16 February high to Wednesday, 21 February low.

- The current positive momentum and trend conditions of Nvidia may assert a further positive feedback loop back into the Nasdaq 100.

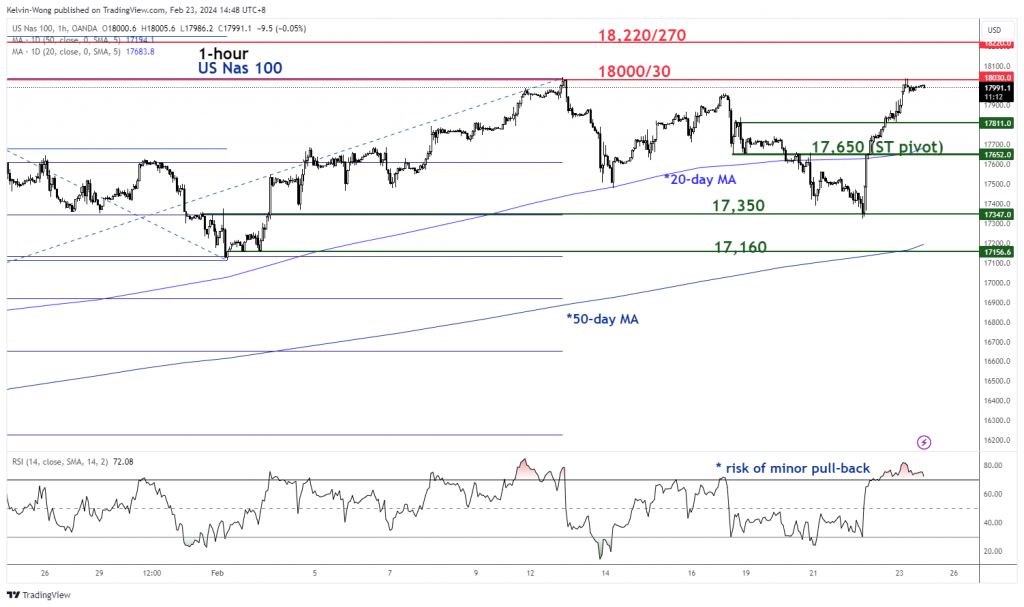

- Watch the key pivotal support at 17,650 with the next intermediate resistance at 18,220/270 for Nasdaq 100.

To je nadaljnja analiza našega prejšnjega poročila, “Nasdaq 100 Technical: Torpedoed by Nvidia, at risk of undergoing multi-week corrective decline” objavljeno 21. februarja 2024. Kliknite tukaj za povzetek.

What a roller coaster and wild ride it has been for the Nasdaq 100 which threaded on an initial minor corrective decline trajectory of -3.5% from its last Friday, 16 February high to this Wednesday, 21 February low.

Since the publication of our prior analysis, the price actions of the Indeks US Nas 100 (a proxy for the Nasdaq 100 futures) have indeed shaped a further pushdown and met the first intermediate support of 17,350 (printed an intraday low of 17,324 during late US session on Wednesday, 21 February).

Thereafter within four hours, the Index rallied by +1.8% and pushed higher yesterday, 22 February to recoup all the prior losses inflicted from last Friday. In the past two sessions, it has gained by +4.1% from Wednesday, 21 February intraday low of 17,324 to retest its current all-high level of 18,043 of 12 February (printed an intraday high of 18,037 during yesterday’s US session).

The remarkable “V” shaped rally has been attributed to the stunning +16.4% rally seen on the share price of Nvidia (the third biggest market cap component stock of Nasdaq 100) after it posted better than expected Q4 2023 earnings and issued positive guidance on its revenue in the current Q1 2024 quarter of around US$24 billion the surpassed analyst’s expectation of US$21.9 billion on the average.

Given the significant influence on the share price movement of Nvidia towards the US Nas 100 Index which can be traced back to a high positive 20-day correlation coefficient of 0.85 between the two as of yesterday, 22 February. Hence, it will be paramount to analyse the momentum and trend trajectory of Nvidia’s share price movement.

Medium-term and major uptrend phases intact for Nvidia

Fig 1: Nvidia medium-term and major trends as of 22 Feb 2024 (Source: TradingView, click to enlarge chart)

The medium-term upside momentum of Nvidia remains intact as depicted by the daily RSI momentum indicator which has been supported by a parallel ascending trendline support since 21 September 2023 and managed to stage a rebound right above the 50 level yesterday.

This positive momentum reading is likely to support the ongoing medium-term uptrend and major uptrend phases in place since the 31 October 2023 low and 28 December 2022 low respectively.

If the 627.20 key medium-term pivotal support holds, its medium-term uptrend phase trajectory remains intact potentially with the next medium-term resistances to watch at 878.60 and 1,014.25/1,126.10).

Nasdaq 100 may see another fresh all-time high

Fig 2: US Nas 100 medium-term & major trends as of 23 Feb 2024 (Source: TradingView, click to enlarge chart)

Slika 3: Kratkoročni trend US Nas 100 od 23. februarja 2024 (Vir: TradingView, kliknite za povečavo grafikona)

Yesterday’s “V-shaped” rally in the price actions of the Index and the integration back above its 20-day moving average has increased the odds of a new potential short-term impulsive upmove sequence for its short and medium-term uptrend phases.

Given the current rally has been swift and abrupt that led its hourly RSI momentum indicator to hit a rather extreme overbought level of 81.70 which in turn may see the risk of an imminent minor pull-back below the first intermediate resistance of 18,030 (close to the current all-time high level of 18,043 printed on 12 February).

If the potential minor pull-back manages to hold above the 17,650 short-term pivotal support (20-day moving average & close to the 61.8% Fibonacci retracement of yesterday’s rally from the 21 February low to the 22 February high), the Index may continue its short-term impulsive upmove sequence with the next intermediate resistance to watch at 18,220/270.

However, failure to hold at 17,650 negates the bullish tone to expose the next intermediate supports of 17,350 and 17,160 (also the upward-sloping 50-day moving average).

Vsebina je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno družbe OANDA Business Information & Services, Inc. ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Če želite reproducirati ali ponovno distribuirati katero koli vsebino, ki jo najdete na MarketPulse, nagrajeni storitvi spletnega mesta z novicami in analizami forexa, blaga in globalnih indeksov, ki jo proizvaja OANDA Business Information & Services, Inc., dostopajte do vira RSS ali nas kontaktirajte na info@marketpulse.com. Obiščite https://www.marketpulse.com/ izvedeti več o utripu svetovnih trgov. © 2023 OANDA Business Information & Services Inc.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.marketpulse.com/indices/nasdaq-100-technical-bulls-rescued-by-nvidia-again/kwong

- :ima

- : je

- :ne

- 1

- 10

- 100

- 12

- 15 let

- 15%

- 16

- 160

- 17

- 20

- 2022

- 2023

- 2024

- 22

- 23

- 28

- 31

- 350

- 50

- 60

- 7

- 70

- 700

- 9

- a

- O meni

- nad

- dostop

- dejavnosti

- Poleg tega

- nasveti

- podružnice

- po

- spet

- vsi

- Prav tako

- an

- analizirati

- Analize

- Analiza

- in

- Še ena

- kaj

- SE

- okoli

- AS

- At

- Avtor

- Avtorji

- avatar

- povprečno

- Nagrada

- nazaj

- BE

- premagati

- bilo

- spodaj

- Boljše

- med

- največji

- Billion

- Pasovi

- Bikovski

- Biki

- poslovni

- nakup

- by

- CAN

- cap

- Graf

- klik

- Zapri

- koeficient

- COM

- kombinacija

- Blago

- komponenta

- Pogoji

- poteka

- Povezovanje

- kontakt

- vsebina

- naprej

- Korelacija

- korelacijski koeficient

- tečaji

- Trenutna

- vsak dan

- december

- Zavrni

- upodobljen

- Direktorji

- med

- Plače

- Elliott

- Povečaj

- Celotna

- Izmenjava

- pričakovanja

- Pričakuje

- izkušnje

- strokovnjak

- ekstremna

- Napaka

- februar

- februar

- povratne informacije

- Fibonaccijevo

- finančna

- Najdi

- prva

- Pretok

- za

- tuji

- devizni

- forex

- je pokazala,

- štiri

- sveže

- Petek

- iz

- Sklad

- temeljna

- nadalje

- Terminske pogodbe

- pridobljeno

- splošno

- Globalno

- svetovnih trgih

- Navodila

- Imajo

- zato

- visoka

- več

- hit

- držite

- drži

- URE

- HTTPS

- if

- neizbežna

- impulzivno

- in

- Inc

- povečal

- prav zares

- Indeks

- Kazalec

- indeksi

- vplivajo

- Podatki

- začetna

- integracija

- v

- naložbe

- Izdala

- IT

- ITS

- Kelvin

- Ključne

- Zadnja

- Pozen

- Led

- Stopnja

- ravni

- kot

- Verjeten

- off

- izgube

- nizka

- Makro

- velika

- upravlja

- upravlja

- Tržna

- Market Cap

- tržni obeti

- tržna raziskava

- MarketPulse

- Prisotnost

- max širine

- Maj ..

- pol

- mladoletnika

- Momentum

- več

- Gibanje

- premikanje

- drseče povprečje

- na

- Nasdaq

- Nasdaq 100

- nujno

- Novo

- novice

- Naslednja

- številne

- Nvidia

- oktober

- Kvota

- of

- uradniki

- on

- v teku

- samo

- Komentarji

- or

- naši

- ven

- Outlook

- več

- vzporedno

- Paramount

- strastno

- preteklosti

- perspektive

- faza

- faze

- fotografija

- ključno

- Kraj

- platon

- Platonova podatkovna inteligenca

- PlatoData

- prosim

- pozicioniranje

- pozitiven

- objavljene

- Prispevkov

- potencial

- potencialno

- Cena

- Predhodna

- Proizvedeno

- zagotavljanje

- proxy

- Objava

- namene

- potisnilo

- Q1

- četrtletje

- rally

- precej

- reading

- odboj

- Rekapitulacija

- ostanki

- izjemno

- poročilo

- Raziskave

- Odpornost

- oziroma

- Trgovina na drobno

- . \ t

- prihodki

- Razveljavitev

- Ride

- Pravica

- Tveganje

- RSI

- rss

- Vrednostni papirji

- glej

- videl

- prodaja

- višji

- september

- Zaporedje

- Storitev

- Storitve

- Zasedanje

- sej

- shaped

- Delite s prijatelji, znanci, družino in partnerji :-)

- delitev

- Kratke Hlače

- kratkoročno

- pomemben

- saj

- Singapur

- spletna stran

- Rešitev

- vir

- specializacijo

- Stage

- zaloge

- Borzni trgi

- Strategist

- Osupljiva

- podpora

- Podprti

- Podpira

- presegli

- SWIFT

- tehnični

- Tehnična analiza

- deset

- kot

- da

- O

- tretja

- ta

- tisoče

- do

- TONE

- proti

- trgovci

- Trgovanje

- TradingView

- usposabljanje

- usmeritev

- Trend

- Trends

- OBRAT

- dva

- v postopku

- edinstven

- Upside

- navzgor

- us

- uporabo

- v1

- obisk

- Watch

- Wave

- Sreda

- Dobro

- ki

- Wild

- bo

- zmago

- z

- v

- Wong

- bi

- let

- včeraj

- Vi

- zefirnet