As the chill of a new crypto winter sets in, the past offers itself as a flawed guide.

Last year, during the height of the mania, people started talking about cryptocurrency launching into a new “supercycle” – basically a paradigm shift wherein the familiar boom-bust cycle would be replaced by one of perpetual, if more linear growth, a la the internet from 2005 on.

It’s a long-running joke in investment circles that everyone thinks “this time is different” and everyone is, eventually, wrong. As a general proxy for human fear and greed, free markets are intrinsically prone to speculative manias. The only thing that makes crypto different is the sheer velocity with which these cycles happen. (And you think the internet is immune? Just ask the Facebook stock price).

Well, we’ve had the boom. Now comes the hard part. Crypto has already been through some bear markets. We should know what to expect. But will this time actually be different?

Učenje iz preteklosti

The issue with many of the predictions and assumptions made through the last bull run was that the sample size was insufficient. While the bubbles of 2013 and 2017 followed roughly similar patterns, the crypto-economies they represented were wildly different; 2021 was more different still.

But when prices were soaring, how easy it was to look back at the wildness of 2017 and say “we’re barely getting started”.

Now we’re on the downward arc and the temptation is to map the bleakness of 2018 onto our current situation. Already people are planning for the 2024 upcycle, as if all the possible permutations of international finance could be cleanly mapped onto the Mayan calendar.

To its adherents, that’s the whole point of Bitcoin’s mathematical certainty. But Bitcoin has never faced macroeconomic conditions like this, where interest rates are rising, energy costs are soaring and economies are tumbling towards recession.

After the dotcom collapse, it took the better part of a decade for the scions of web 2.0 to begin their inexorable takeover of the stock market. Could crypto be poised for a similar time in the wilderness?

Ctrl + Z, Ctrl + Y

To be clear, I don’t have any strong opinions as to what happens next, or how long this downturn might last. Rather it’s a reminder to keep an open mind in the face of unprecedented circumstances. Crypto’s only been here twice before; we’re still in the data-gathering phase.

What we do know is that, over a long enough timeframe, markets inevitably revert to the mean. What goes up must come down, and what descends into the depths of hell will eventually emerge spluttering into the light.

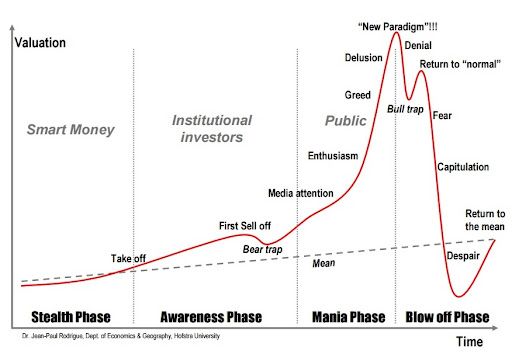

I’ve shared this speculative bubble chart before, but what’s often overlooked is the line, slowly ascending, around which all the excitement and despair occurs.

In many ways that line is the point of it all. It’s all well and good to chase shitcoins to the top of the new paradigm (*cough* supercycle *cough*) but your long-term focus should be on what the mean represents: the basic promise of blockchain technology and decentralised digital economies.

Ain’t nothing nice about it, but winter is your chance to step back and ask what that might still actually mean.

Luka iz CoinJarja

CoinJar UK Limited je registriral Financial Conduct Authority kot ponudnika izmenjave kriptosredstev in ponudnika skrbniške denarnice v Združenem kraljestvu v skladu s predpisi o pranju denarja, financiranju terorizma in prenosu sredstev (podatki o plačniku) iz leta 2017, kot je bilo spremenjeno (referenčna št. 928767). Kot vse naložbe tudi kriptosredstva nosijo tveganje. Zaradi potencialne nestanovitnosti trgov kriptosredstev lahko vrednost vaših naložb znatno pade in povzroči popolno izgubo. Kriptosredstva so zapletena in trenutno niso finančni produkti, ki jih urejata ASIC ali FCA, in ne morete dostopati do avstralskega organa za finančne pritožbe (AFCA) ali odškodninske sheme finančnih storitev Združenega kraljestva ali službe finančnega varuha človekovih pravic Združenega kraljestva v zvezi s kakršnim koli sporom z CoinJar v zvezi s trgovanjem s kriptosredstvi. Uporabljamo tretje osebe za bančništvo, hrambo in plačilne ponudnike in neuspeh katerega koli od teh ponudnikov lahko povzroči tudi izgubo vašega premoženja. Priporočamo, da pridobite finančni nasvet, preden se odločite za uporabo svoje kreditne kartice za nakup kriptosredstev ali naložbo v kriptosredstva. Dobiček je lahko predmet davka na kapitalski dobiček.

- 2021

- O meni

- dostop

- nasveti

- vsi

- že

- okoli

- ASIC

- Sredstva

- organ

- Bančništvo

- V bistvu

- pred

- Bitcoin

- blockchain

- Blokchain tehnologija

- boom

- bubble

- Bik

- Koledar

- Kapital

- opravlja

- Chase

- kako

- Odškodnina

- Pritožbe

- kompleksna

- stroški

- bi

- kredit

- kreditne kartice

- kripto

- cryptocurrency

- Trenutna

- Trenutno

- skrbnik

- ciklov

- desetletje

- drugačen

- digitalni

- Spor

- navzdol

- med

- energija

- vsi

- Izmenjava

- pričakovati

- Obraz

- soočen

- Napaka

- seznanjeni

- FCA

- financiranje

- finančna

- Firm

- Osredotočite

- brezplačno

- Skladi

- splošno

- pridobivanje

- dobro

- Rast

- vodi

- se zgodi

- višina

- tukaj

- Kako

- HTTPS

- človeškega

- Podatki

- obresti

- Obrestne mere

- Facebook Global

- Internet

- naložbe

- naložbe

- vprašanje

- IT

- sam

- Kraljestvo

- začetek

- vodi

- light

- Limited

- vrstica

- Long

- dolgoročna

- je

- IZDELA

- Izdelava

- map

- Tržna

- Prisotnost

- matematični

- morda

- moti

- Denar

- Pranje denarja

- več

- Nasdaq

- Ponudbe

- odprite

- Komentarji

- paradigma

- del

- zabava

- Plačilo

- ponudniki plačil

- ljudje

- faza

- načrtovanje

- Točka

- mogoče

- potencial

- Napovedi

- Izdelki

- dobiček

- Obljuba

- proxy

- nakup

- Cene

- RE

- recesija

- Priporočamo

- registriranih

- urejeno

- predpisi

- nadomesti

- zastopan

- predstavlja

- narašča

- Tveganje

- Run

- shema

- Storitev

- deli

- premik

- Podoben

- Velikosti

- nekaj

- začel

- zaloge

- borza

- močna

- predmet

- pogovor

- davek

- Tehnologija

- skozi

- čas

- časovni okvir

- vrh

- proti

- Trgovanje

- prenos

- Uk

- pod

- Velika

- Anglija

- brez primere

- uporaba

- vrednost

- VeloCity

- Volatilnost

- denarnica

- web

- Spletna 2.0

- Kaj

- medtem

- bi

- leto