- A massive sell-off sets in across the cryptocurrency market.

- Quant has recorded weekly gains of about 20.61%.

- The community wonders if the uptrend will continue.

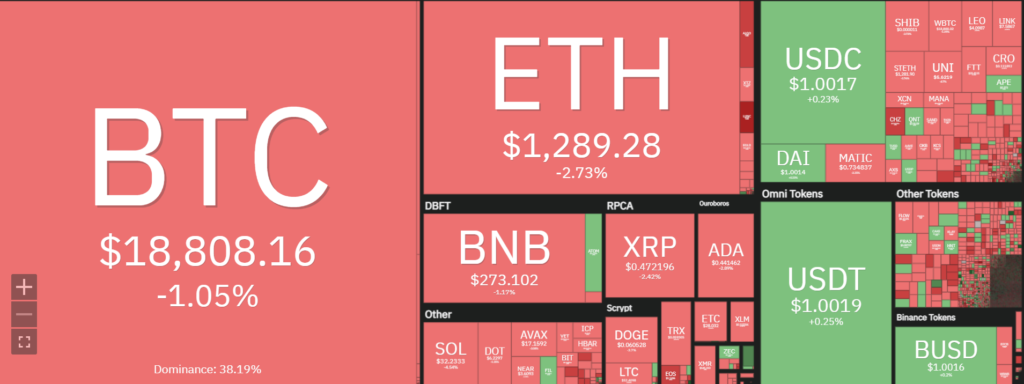

O kripto trg is currently experiencing a broad-based sell-off, with all of the top 10 coins by market capitalization in the red. However, one coin that has bucked the trend is Količina (QNT), which is up about 6.25% on the day.

Quant has also been on a continuous uptrend in the last 7 days, gaining about 20.61%. The coin is currently trading at $119.74, after hitting an intraday high of $121.53 a few hours ago.

This comes as a bit of a surprise, considering that Quant has been one of the worst-performing glavne kripto valute over the past few weeks. However, it seems that the recent market sell-off has provided an opportunity for investors to buy Quant at a discount.

Bitcoin and Ethereum have shed 1.45% and 3.12% respectively while the gainers of the day are led by QNT, ATOM, and APE.

The next level of resistance for QNT is at $122, which is where the coin found support during the previous sell-off. If the bulls can push the price above this level, we could see a move toward $135 in the short term. On the other hand, if the bears take control of the market, Quant could retrace to $110.

Quant (QNT) price analysis on the daily chart indicates that the coin is in a clear uptrend as 5 clear green candlesticks have emerged. The MACD indicator also supports this view as it is currently in the positive territory and the signal line is below the MACD line.

The RSI indicator is currently above 65 which indicates that the coin is in the overbought region. However, this does not mean that the uptrend is over as the RSI can remain in the overbought region for an extended period of time. This means that there is still room for the price to move higher in the short term before bulls take a breather.

The moving average lines are showing a bullish crossover as the 50-day moving average has crossed above the 200-day moving average. This is a bullish sign that indicates that the market sentiment is turning positive and that the bulls are in control of the market.

The Quant price is currently trading above all of the major moving averages which is a bullish sign. The next level of resistance is at $122 and if the bulls can push the price above this level, we could see a move toward $125 in the short term. On the other hand, if the bears take control of the market, Quant could retrace to $110.

Disclaimer: Stališča in mnenja ter vse informacije v tej napovedi cen so objavljene v dobri veri. Bralci morajo opraviti svoje raziskave in ustrezno skrbnost. Vsakršno dejanje bralca izvaja izključno na lastno odgovornost. Coin Edition in njegove podružnice ne bodo odgovorne za kakršno koli neposredno ali posredno škodo ali izgubo.

Ogledi:

0

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Coin Edition

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- Novice o trgu

- novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- Analiza cen

- dokazilo o vložku

- Količina (QNT)

- W3

- zefirnet