The chance of a recession in the United States has now hit 100%, according to new Bloomberg Economics model projections — meaning that it is “effectively certain” the country’s economy will contract over the next year.

Bitcoin, the first and foremost cryptocurrency, was born out of a global economic recession — but has never existed inside one. The same goes, of course, for Ethereum and every crypto protocol spawned after it. If the aforementioned projections are correct, the blockchain and cryptocurrency industry will enter a new, distinct and defined chapter of existence.

Central bank policy vs. tokenomics

The uncertain and fluid economic policy for fiat currencies has come into even sharper contrast with the fixed, mathematics-based “tokenomics” of major cryptocurrencies. Bitcoin, for example, has a set amount of new coins minted every block — with an ultimate supply cap of 21 million coins. (Though many have already been permanently lost, making the real total supply effectively smaller).

“The current macroeconomic situation is precisely the environment Bitcoin is meant to thrive in,” Hunain Naseer, head of content at COIN360 told The Block. “It is purpose-built to withstand the kind of arbitrary controls that are wreaking havoc on fiat currencies around the world.”

Ethereum’s economics, meanwhile, have stolen the spotlight following its high-profile move from an energy-intensive proof-of-work consensus mechanism to the more environmentally friendly proof-of-stake, which was dubbed "Združitev."

The supply growth of ether has declined to -0.04% over the past 30 days, according to tracker ultrasound.money, making it deflacijski over that span. Proponents of the second-ranked crypto protocol have already expressed excitement over ether’s deflationary potential in periods of increased demand — such as a future bull market.

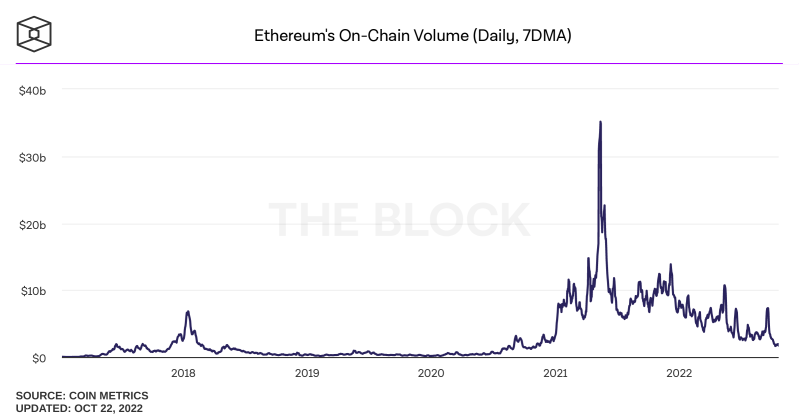

On-chain volume for Ethereum is in a general decline. Source: Blok

Focus remains on Fed rate hikes

Despite crypto proponents unsurprisingly finding many cryptocurrencies’ tokenomics favorable, crypto markets remain closely tied to macro factors — including rate hikes from the U.S. Federal Reserve.

The near-unanimous expectation for the Fed’s Nov. 1-2 policy meeting is that another big interest rate hike will be approved. The question many pundits are asking revolves around how much further the central bank can push interest rates before putting too much strain on economic growth.

More hawkishness from the Fed may not portend positive price action for cryptocurrency investors — but blocks will continue to be produced while transparent and math-based economics will remain in play.

© 2022 The Block Crypto, Inc. Vse pravice pridržane. Ta članek je na voljo samo v informativne namene. Ni na voljo ali namenjen uporabi kot pravni, davčni, naložbeni, finančni ali drug nasvet.

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Centralna banka

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Fed

- Fed Reserve

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- politika

- poligon

- dokazilo o vložku

- recesija

- Blok

- W3

- zefirnet