Ministrstvo za finance ZDA naj bi pripravljalo pregled, v katerem bi poudarilo izzive, ki jih predstavljajo odkupi stabilnih kovancev, in učinek morebitnega zagona na trgu kriptovalut.

According to a Sept.16 report from Bloomberg citiranje anonymous sources, Treasury officials are readying policy recommendations designed to ensure stablecoin holders can freely convert between their tokens and other assets.

The report states the lawmakers hope to mitigate “the most urgent risks” associated with Tether (USDT) and other stable tokens, also emphasizing the threats a “fire-sale run” on crypto assets could wreak for financial stability broadly.

Critics have long scrutinized Tether’s redemption process and backing and found it wanting, with some holders trdijo, to have been unable to redeem USDT for fiat using the company’s website over the years.

After years of failing to deliver promised audits, Tether has recently published attestation reports claiming the stablecoin is backed by $62.6 billion in assets — 49% of which is komercialni papir while cash and bank deposits comprise just 10%.

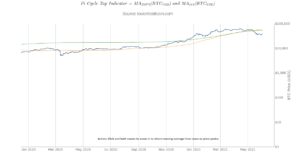

Medtem ko so uradniki zakladnice domnevno najbolj zaskrbljeni zaradi Tetherja, nekoč hegemonistični status USDT na trgih stabilnih kovancev upada - relativni tržni delež žetona se je od začetka leta 25 zmanjšal za 2021%.

After starting the year representing roughly 76% of stablecoin capitalization, Tether’s dominance over the sector has fallen by one-quarter to represent 56.5% of combined stable token market cap today, according to CoinGecko.

Letos sta med upadom Tetherja znana tržna deleža USD Coin (USDC) in Binance USD, ki sta danes zrasla s 13.7% oziroma 3.40% kapitalizacije stablecoin na 23.9% oziroma 10.4%.

Decentralized stable tokens have also shown notable growth during 2021, with TerraUSD growing from 0.65% to 2.11% while MakerDAO’s DAI increased from 4.23% to 5.13%.

Podatki CoinGecka ugotavljajo tudi upad tržnega deleža dolarja Paxos, ki se je zmanjšal z 1.15% na 0.85%. Vendar pa je vsak stabilencoin, ki mu je sledil CoinGecko, v letu 2021 povečal svojo tržno vrednost.

- sredstvo

- Sredstva

- Banka

- Billion

- binance

- Bloomberg

- BUSD

- Kapitalizacija

- Denar

- Coin

- CoinGecko

- Cointelegraph

- kriza

- kripto

- kripto sredstvo

- Kripto industrija

- DAI

- datum

- Dolg

- Dollar

- Fiat

- finančna

- Grow

- Pridelovanje

- Rast

- HTTPS

- Industrija

- IT

- zakonodajalci

- Long

- Tržna

- Market Cap

- Prisotnost

- Ostalo

- paxos

- politika

- poročilo

- Poročila

- pregleda

- Tveganje

- Run

- Delite s prijatelji, znanci, družino in partnerji :-)

- Stabilnost

- stabilno

- Začetek

- Države

- Status

- Tether

- Tether (USDT)

- grožnje

- žeton

- Boni

- Ministrstvo za finance

- nas

- ameriški dolar

- USD kovanca

- USDC

- USDT

- Spletna stran

- leto

- let