The past couple of months have not been kind to cryptocurrencies. The sector’s aggregate market capitalization plunged 50% from a Nov. 10 peak at $2.87 trillion to the current $1.44 trillion. Solana’s (SOL) padec je bil še bolj brutalen, trenutno se trguje pri 88 $ po 66-odstotnem popravku od njegove najvišje vrednosti vseh časov pri 260 $.

Pinning the underperformance exclusively to the recent network outages seems too simplistic, and it doesn’t explain the accelerated decoupling over the past week, so let’s take a look at what might be going on.

Solana omrežje utrpelo štiri incidente in the span of a few months. According to the project’s developers, a sudden spike in the number of computing transactions caused network congestion, which crippled the network.

Zanimivo je, da se omrežje spopada z zastoji, saj razvijalci oglašujejo zmogljivost 50,000 transakcij na sekundo (TPS). Zadnji incident 7. januarja je bil pripisan napadu porazdeljene zavrnitve storitve (DDoS), vendar nam podatki kažejo, da so omrežni napadi manj pomembni kot uporaba DApps.

Glavni investicijski direktor Cyber Capital Justin Bons kritizirali the network’s security, mentioning that DDoS can be used to “temporarily gain proportional-staked control over the network by attacking other stakeholders.”

Sergey Zhdanov, chief operating officer of crypto exchange EXMO UK, also said DDoS attacks and similar outages “don’t resnično vplivajo na zaupanje omrežja” and should be disregarded. Zhdanov makes a point comparing Ethereum network fees surpassing $50 as a similar hiccup, but not significant enough to cause investors to abandon it for good.

Solana’s main decentralized application metric started to display weakness earlier in November after the network’s total value locked (TVL), which measures the amount deposited in its smart contracts, began to linger at $15 billion.

Notice how Solana’s DApp deposits saw a 44% decrease in three months, as the indicator reached its lowest level since Sept. 8. As a comparison, Fantom’s TVL currently stands at $9.5 billion, a 79% increase in three months. Another DApp scaling solution competitor, Terra (LUNA), se je TVL povečal za 60 % na 16 milijard USD.

Niti 10 milijonov dolarjev, ki jih je zbral Solana’s decentralized finance (DeFi) application Hubble Protocol in early January was enough to recover investors’ confidence. Crypto heavyweights like Three Arrows, Digital Currency Group, Delphi Digital and Crypto.com Capital backed the launch of the crypto-backed stablecoin and zero-interest borrowing platform.

TVL in število aktivnih naslovov se je zmanjšalo

Zaklenjena skupna vrednost ni več primarna metrika, ki odraža močne temelje, kar pomeni, da ima 66-odstotni popravek cene v igri druge dejavnike kot le zmanjšan TVL. Za potrditev, ali se je uporaba DApps dejansko zmanjšala, bi morali vlagatelji analizirati tudi število aktivnih naslovov v ekosistemu.

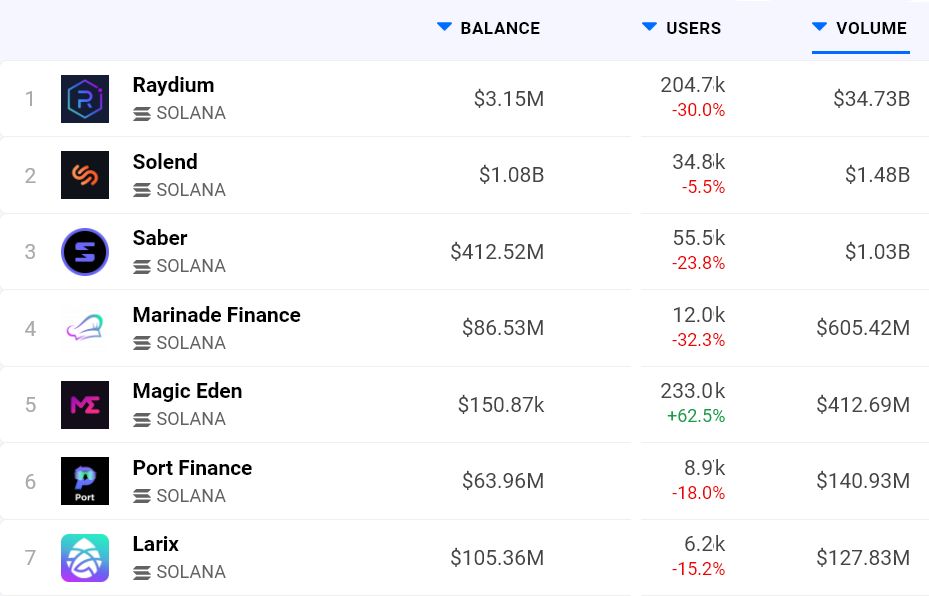

Kot kažejo podatki DappRadar 28. januarja, se je število omrežnih naslovov Solana, ki komunicirajo z večino decentraliziranih aplikacij, zmanjšalo za 18 % na 32 %, razen za tržnico nezamenljivih žetonov (NFT) Magic Eden.

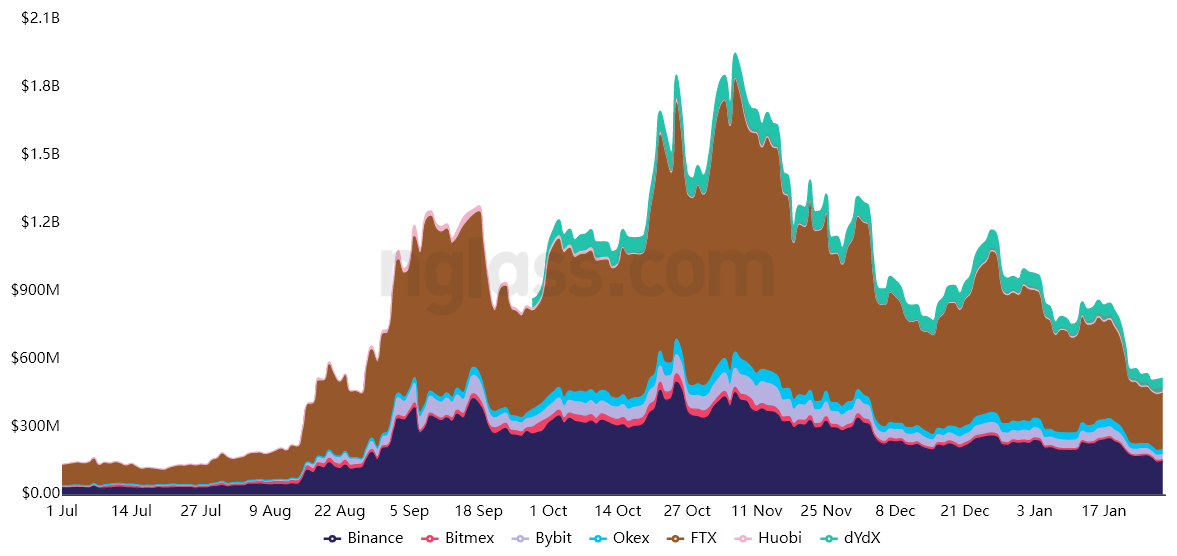

Manjše zanimanje za Solana DApps se je odrazilo tudi v odprtih obrestnih merah za terminske pogodbe, ki so 2. novembra dosegle najvišjo vrednost pri 6 milijardah dolarjev, vendar so se nedavno soočile s strmo korekcijo.

The above chart shows how derivatives traders’ interest in Solana plunged 75% in less than three months. That is especially concerning because a smaller number of futures contracts might reduce the activity of arbitrage desks and market makers. For example, it is common for participants to self-limit their exposure to 20% of the asset volume or open interest.

Podatki o izvedenih finančnih instrumentih so lahko posledica, ne pa vzrok

It’s probably impossible to pinpoint the correlation and causation between SOL’s price drop, the decrease in the network’s Apps use, and the fading interest from derivatives traders. However, none of those indicators point to a price recovery anytime soon.

The data above suggests that Solana holders should be less concerned about momentary outages and focus on the ecosystem’s use versus competing chains. As long as the ecosystem remains healthy, investors have no reason to lose trust due to temporary network outages.

Tu so navedena izključno stališča in mnenja Avtor in ne odražajo nujno stališč Cointelegrafa. Vsaka naložbena in trgovalna poteza vključuje tveganje. Pri odločitvi morate izvesti lastno raziskovanje.

- 000

- 7

- O meni

- Po

- aktivna

- Oglaševanje

- uporaba

- aplikacije

- aplikacije

- arbitražo

- sredstvo

- Billion

- Zadolževanje

- kapaciteta

- Kapital

- Kapitalizacija

- Vzrok

- povzročilo

- šef

- Glavni operativni direktor

- Cointelegraph

- Skupno

- računalništvo

- zaupanje

- pogodbe

- bi

- par

- kripto

- kripto izmenjava

- Crypto.com

- cryptocurrencies

- valuta

- Trenutna

- dapp

- DApps

- datum

- DDoS

- Decentralizirano

- Decentralizirane aplikacije

- Decentralizirane finance

- Defi

- Izvedeni finančni instrumenti

- Mize

- Razvijalci

- digitalni

- digitalna valuta

- zaslon

- porazdeljena

- Drop

- padla

- Zgodnje

- ekosistem

- zlasti

- ethereum

- omrežje ethereum

- Primer

- Izmenjava

- soočen

- dejavniki

- pristojbine

- financiranje

- Osredotočite

- FTX

- Osnove

- Terminske pogodbe

- dogaja

- dobro

- skupina

- tukaj

- imetniki

- Kako

- HTTPS

- Povečajte

- vplivajo

- obresti

- naložbe

- Vlagatelji

- IT

- januar

- Zadnji

- kosilo

- Stopnja

- zaklenjeno

- Long

- Izdelava

- Tržna

- Tržna kapitalizacija

- tržnica

- milijonov

- mesecev

- Najbolj

- premikanje

- mreža

- NFT

- ne gnojivo

- nezamenljiv žeton

- Častnik

- odprite

- deluje

- Komentarji

- Ostalo

- Udeleženci

- platforma

- Predvajaj

- Cena

- Projekt

- Obnovi

- okrevanje

- zmanjša

- Raziskave

- Tveganje

- Je dejal

- skaliranje

- sektor

- varnost

- pomemben

- Podoben

- pametna

- Pametne pogodbe

- So

- Solana

- stabilno

- začel

- močna

- začasna

- Zemlja

- žeton

- trgovci

- Trgovanje

- transakcija

- Transakcije

- Zaupajte

- Uk

- us

- ameriški dolar

- vrednost

- Proti

- Obseg

- teden

- Kaj

- v