Vodilna decentralizirana borza, Uniswap, je postala prvi protokol DeFi, ki je za ponudnike likvidnosti ustvaril provizije za platformo v vrednosti več kot milijardo dolarjev.

10. avgusta je Lucas Outumuro, vodja raziskav pri zbiralniku podatkov kripto IntoTheBlock, Twitter delil tabelo, na kateri je razvidno, da so skupni prihodki od pristojbin Uniswappovih v2 in v3 Ethereum glavnih omrežij presegli milijardo dolarjev.

Including the fees generated by both Uniswap v1 and its v3 deployment on Optimism, Outumuro notes that roughly $1.02 billion has been distributed to Uniswap liquidity providers since the protocol’s creation in November 2018.

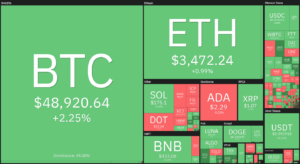

By contrast, IntoTheBlock’s data shows that the Bitcoin network has generated $ 2.24 milijarde in fees since its 2009 launch, while the DeFi-driven surge in activity on Ethereum has raised its total fee revenue to $4.74 billion in six years.

@Uniwap je pravkar postal prvi protokol, ki je presegel 1 milijard USD pristojbin

Čestitamo @haydenzadams in ekipa pic.twitter.com/pnA10t41Yo

- Lucas Outumuro (@LucasOutumuro) Avgust 10, 2021

Vendar surging Ethereum-powered game, Axie Infinity, has emerged as the leading DApp by fee revenue in recent weeks. According to Token Terminal, Axie has driven $308.5 million in platform fees over the past 30 days, equating to a daily average of nearly $ 10.3 milijonov.

According to data from Dune Analytics, popular NFT marketplace OpenSea also appears to have overtaken Uniswap by fee revenue recently, with the platform generating $ 4.2 milijonov in fees daily. According to CryptoFees, Uniswap represents $ 3.9 milijonov in daily platform fees.

Povezano: Ponudba Ethereuma se na kratko spremeni v deflacijo, ko se pristojbine za plin povečajo

With Ethereum’s recent London upgrades introducing a burn mechanism into the network’s fee market on August 5, the surging popularity of Ethereum-based DApps has resulted in $100 million worth of Ether being burned and more than 1,000 deflationary blocks being mined over the past week.

According to Ultrasound.Money, OpenSea currently ranks as the leading Ethereum DApp by burn rate after destroying 3,918 Ether (worth $12.5 million) since London went live.

Uniswap v2 se uvršča na drugo mesto z 2,344 eterji (7.5 milijona dolarjev), sledi Axie Infinity z 1,805 eterjev (skoraj 5.8 milijona dolarjev) in Tether s 1,555 etra (5 milijonov dolarjev).

- 9

- analitika

- Avgust

- Billion

- Bitcoin

- Cointelegraph

- kripto

- kripto podatkov

- dapp

- DApps

- datum

- Decentralizirano

- Decentralizirana izmenjava

- Defi

- deflacija

- vozi

- Dune

- Eter

- ethereum

- Izmenjava

- pristojbine

- prva

- GAS

- pristojbine za plin

- Glava

- HTTPS

- v blok

- kosilo

- vodi

- likvidnostno

- ponudniki likvidnosti

- London

- Tržna

- tržnica

- milijonov

- Denar

- mreža

- NFT

- platforma

- Popular

- Raziskave

- prihodki

- deli

- SIX

- dobavi

- prenapetost

- Tether

- žeton

- Odklopite

- teden

- vredno

- let