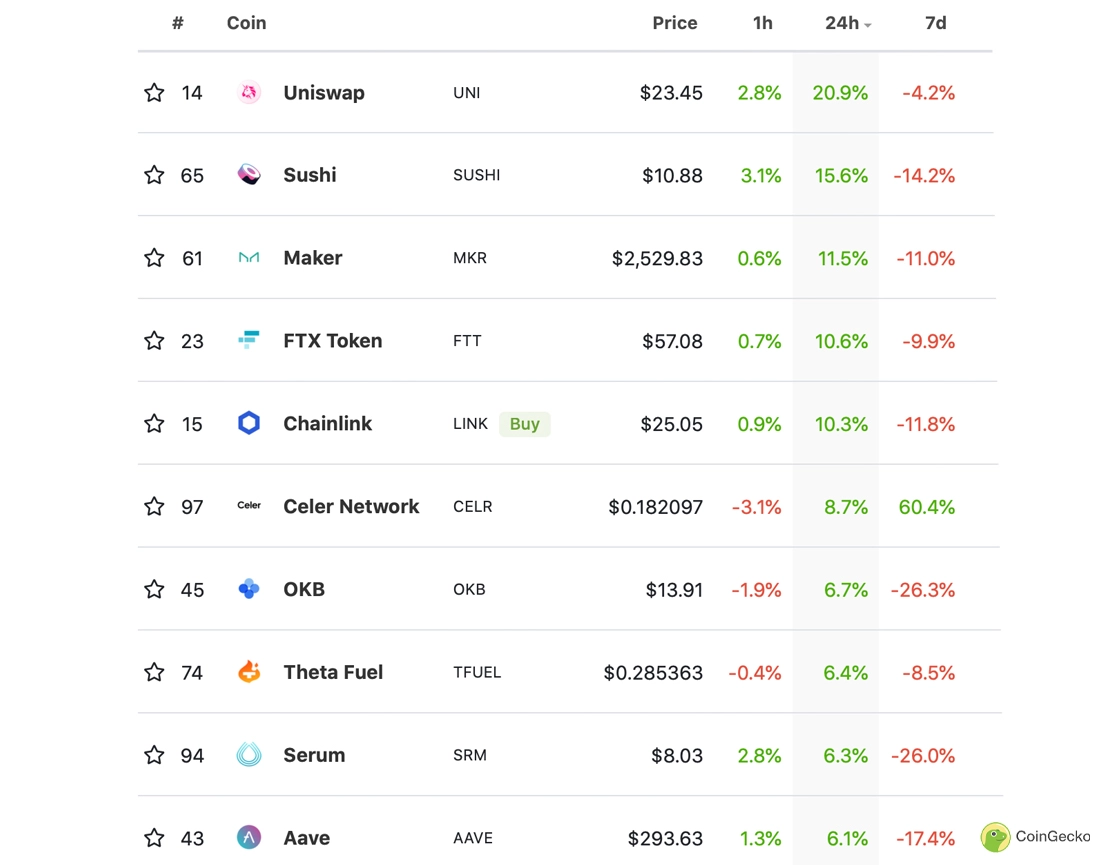

Uniswap ($UNI), the largest decentralized exchanged (Dex) saw its native token price surge over 35% in the last 24-hours. $UNI rose from a daily low of $17.77 to a daily high of $25.98 as the trading volume for the token saw a 500% rise. Over the past couple of days, Defi tokens have skyrocketed making double-digit gains at a time when the majority of the crypto market is still recovering from the correction on Friday caused by China’s yet another crypto ban.

Many attribute the surge in Defu token value and volume to China’s latest crypto crackdown guidelines as well. Chinese journalist Colin Wu claimed that the recent crackdown by the Chinese government would push native crypto traders towards Defi that would lead to a surge in Metmask wallet volumes and Dex protocols such as dYdX. The prophecy came true soon after as wxya registered a higher trading volume than Coinbase.

Veliko število kitajskih uporabnikov bo preplavilo svet DeFi, število uporabnikov MetaMaska in dYdX pa se bo močno povečalo. Vse kitajske skupnosti razpravljajo o tem, kako se naučiti defi.

- Wu Blockchain (@WuBlockchain) September 26, 2021

Even when the majority of the crypto market is in a consolidation phase, major Defi protocols registered double-digit gains including Ethereum ($ETH) on which most of the Defi protocols work. The surge in Defi volume might not be entirely coming from China but the ban on the centralized exchange would surely give Defi a boost.

Kitajska kripto prepoved lahko naredi pot za posvojitev Defija

The crypto crackdown in China was not the first of its kind and probably not the last one either and has been the case, crypto traders always find a way to trade despite all the restrictions. In 2017 when China banned all crypto exchanges in the country, traders started using VPNs to register on foreign exchanges. Now that major foreign crypto exchanges such as Huobi and Binance have announced the prekinitev of services, Chinese traders might turn to Defi for relief.

Defi lahko kitajskim trgovcem pomaga pri trgovanju brez registracije z uporabo KYC ali zaradi decentralizirane narave pod vladnimi radarji. To bi lahko pomagalo, da že priljubljeni trg Defi postane bolj mainstream. Skupna vrednost, zaklenjena v protokolih Defi, se približuje 200 milijard dolarjev, trenutno znaša 177.2 milijarde dolarjev, v zadnjem tednu pa se je povečala za 7%. Strokovnjaki na trgu pričakujejo, da bo Defi TVL še naprej rasla s kitajskim zanimanjem.

- 77

- 98

- vsi

- razglasitve

- Ban

- Billion

- binance

- blockchain

- povzročilo

- Kitajska

- kitajski

- prihajajo

- skupnosti

- konsolidacijo

- vsebina

- naprej

- par

- kripto

- Kriptovalute

- Kripto tržnica

- kripto trgovcev

- cryptocurrencies

- Decentralizirano

- Defi

- Dex

- dydx

- ethereum

- Izmenjava

- Izmenjave

- finančna

- prva

- Petek

- vlada

- Grow

- Smernice

- visoka

- držite

- Kako

- Kako

- HTTPS

- Huobi

- Vključno

- Povečajte

- obresti

- vlaganjem

- IT

- Novinar

- KYC

- velika

- Zadnji

- vodi

- UČITE

- Mainstream

- velika

- Večina

- Izdelava

- Tržna

- tržna raziskava

- MetaMask

- Mnenje

- Popular

- Cena

- porast cen

- Oprostitev

- Raziskave

- Storitve

- Delite s prijatelji, znanci, družino in partnerji :-)

- začel

- prenapetost

- čas

- žeton

- Boni

- trgovini

- trgovci

- Trgovanje

- Odklopite

- Uporabniki

- vrednost

- Obseg

- VPN

- denarnica

- teden

- delo

- svet

- wu