- In the past five days, the year-to-date laggard Dow Jones Industrial Average (DJIA) has played a positive catch-up.

- On a rolling 5-day performance basis, the DJIA has outperformed with a gain of +1.10% over the Nasdaq 100’s loss of -0.70% due to recent softness seen in the share price of Nvidia.

- Watch the key short-term support of 38,930.

To je nadaljnja analiza našega prejšnjega poročila, “US DJIA Technical: Uptrend intact with looming outperformance over Nasdaq 100” objavljeno 3. januarja 2024. Kliknite tukaj za povzetek.

On a year-to-date performance basis as of 13 March 2024, the Nasdaq 100 has managed to record a gain of 8.3% that surpassed the return of the Dow Jones Industrial Average of +3.50%.

Interestingly, in the past five days (5-day rolling basis as of 13 March), the laggard Dow Jones Industrial Average has started to play a catch-with with a return of +1.10% that overtook the Nasdaq 100’s loss of -0.70%.

The primary attribution to the current short-term outperformance of the Dow Jones Industrial Average over the Nasdaq 100 has been the lacklustre performance of the Artificial Intelligence (AI) theme play leader, Nvidia (third largest component market cap weightage stock in Nasdaq 100) where its share price has shed -5.6% over the same period.

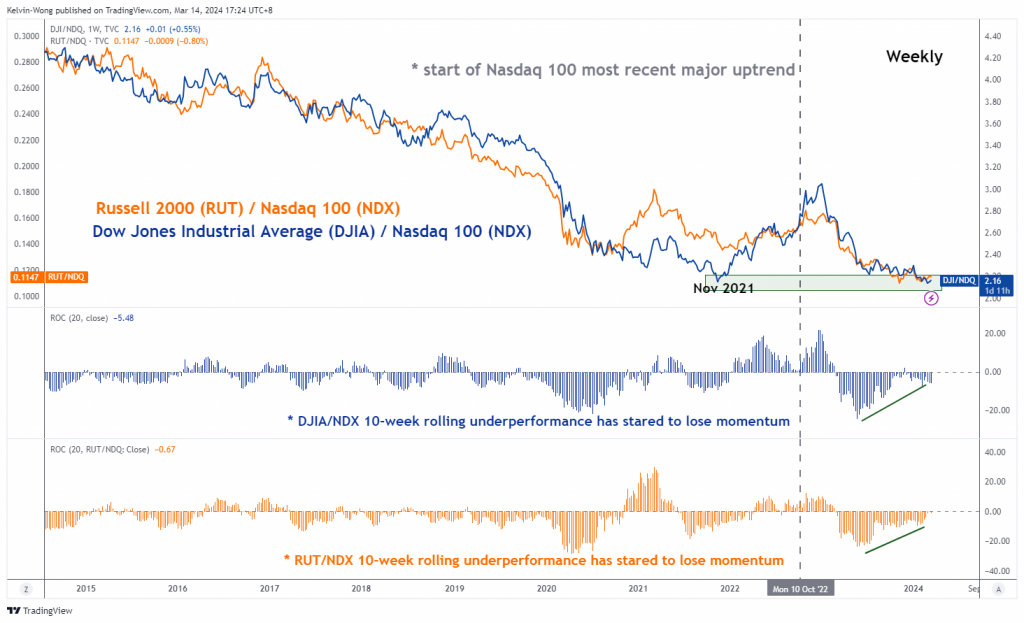

Potential major bullish basing condition in ratio chart of DJIA/NDX

Fig 1: Ratio charts of DJIA & Russell 200 over Nasdaq 100 as of 14 Mar 2024 (Source: TradingView, click to enlarge chart)

The ratio chart of the Dow Jones Industrial Average (DJIA) over the Nasdaq 100 has started to form a potential major basing formation by not breaking below its prior significant November 2021 swing low (see Fig 1).

Also, its 10-week rolling underperformance measured by the ratio’s rate of change has continued to display a bullish divergence condition which suggests a potential looming major outperformance of DJIA over the Nasdaq 100.

Price actions cleared above 20-day moving average

Fig 2: US Wall St 30 short-term trend as of 14 Mar 2024 (Source: TradingView, click to enlarge chart)

Yesterday, 13 March’s price actions movement of the Indeks US Wall St 30 (a proxy of the Dow Jones Industrial Average futures) staged a bullish breakout from its prior choppy minor range configuration in place since 23 February (see Fig 2).

In addition, the Index has also surpassed the 20-day moving average which suggests the potential revival of bullish momentum at least in the near-term horizon.

If the 38,930 short-term pivotal support holds, the Index may continue to shape “higher highs” for the next intermediate resistances to come in at 39,400 and 39,610 (also the upper boundary of the minor ascending channel from 14 February 2024 low).

On the flip side, a break below 38,930 negates the bullish tone for another round of choppy minor corrective decline that may expose the next intermediate supports at 38,660 and 38,380 (also the upward-sloping 50-day moving average).

Vsebina je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno družbe OANDA Business Information & Services, Inc. ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Če želite reproducirati ali ponovno distribuirati katero koli vsebino, ki jo najdete na MarketPulse, nagrajeni storitvi spletnega mesta z novicami in analizami forexa, blaga in globalnih indeksov, ki jo proizvaja OANDA Business Information & Services, Inc., dostopajte do vira RSS ali nas kontaktirajte na info@marketpulse.com. Obiščite https://www.marketpulse.com/ izvedeti več o utripu svetovnih trgov. © 2023 OANDA Business Information & Services Inc.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.marketpulse.com/indices/us-djia-technical-bullish-breakout-ahoy/kwong

- :ima

- : je

- :ne

- :kje

- 1

- 100

- 13

- 14

- 15 let

- 15%

- 200

- 2021

- 2023

- 2024

- 23

- 30

- 39

- 400

- 610

- 7

- 700

- 8

- a

- O meni

- nad

- dostop

- dejavnosti

- Poleg tega

- nasveti

- podružnice

- AI

- Prav tako

- an

- Analize

- Analiza

- in

- Še ena

- kaj

- SE

- okoli

- umetni

- Umetna inteligenca

- Umetna inteligenca (AI)

- AS

- At

- Avtor

- Avtorji

- avatar

- povprečno

- Nagrada

- Osnova

- premagati

- bilo

- spodaj

- Meja

- Pasovi

- Break

- Breaking

- zlom

- Bikovski

- bikovska divergenca

- poslovni

- nakup

- by

- cap

- spremenite

- Channel

- Graf

- Charts

- klik

- COM

- kombinacija

- kako

- Blago

- komponenta

- stanje

- poteka

- konfiguracija

- Povezovanje

- kontakt

- vsebina

- naprej

- naprej

- tečaji

- Trenutna

- Dnevi

- Zavrni

- Direktorji

- zaslon

- Razhajanja

- djia

- dow

- Dow Jones

- Industrijski indeks Dow Jones

- 2

- Elliott

- Povečaj

- Izmenjava

- izkušnje

- strokovnjak

- februar

- sl

- finančna

- Najdi

- pet

- Flip

- Pretok

- za

- tuji

- devizni

- forex

- obrazec

- Oblikovanje

- je pokazala,

- iz

- Sklad

- temeljna

- Terminske pogodbe

- Gain

- splošno

- Globalno

- svetovnih trgih

- drži

- obzorje

- HTTPS

- if

- in

- Inc

- Indeks

- indeksi

- industrijske

- Podatki

- Intelligence

- naložbe

- IT

- ITS

- januar

- jones

- Kelvin

- Ključne

- Največji

- Zadnja

- Vodja

- vsaj

- ravni

- kot

- statve

- off

- nizka

- Makro

- velika

- upravlja

- mar

- marec

- marec 2024

- Tržna

- Market Cap

- tržni obeti

- tržna raziskava

- MarketPulse

- Prisotnost

- max širine

- Maj ..

- mladoletnika

- Momentum

- več

- Gibanje

- premikanje

- drseče povprečje

- Nasdaq

- Nasdaq 100

- nujno

- novice

- Naslednja

- november

- november 2021

- številne

- Nvidia

- of

- uradniki

- on

- samo

- Komentarji

- or

- naši

- ven

- Outlook

- prekašal

- več

- strastno

- preteklosti

- performance

- Obdobje

- perspektive

- fotografija

- ključno

- Kraj

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Predvajaj

- igral

- prosim

- pozicioniranje

- pozitiven

- Prispevkov

- potencial

- Cena

- primarni

- Predhodna

- Proizvedeno

- zagotavljanje

- proxy

- objavljeno

- namene

- območje

- Oceniti

- razmerje

- Rekapitulacija

- nedavno

- zapis

- poročilo

- Raziskave

- Trgovina na drobno

- vrnitev

- Razveljavitev

- Valjanje

- krog

- rss

- Enako

- Vrednostni papirji

- glej

- videl

- prodaja

- višji

- Storitev

- Storitve

- Oblikujte

- Delite s prijatelji, znanci, družino in partnerji :-)

- delitev

- shed

- kratkoročno

- strani

- pomemben

- saj

- Singapur

- spletna stran

- Rešitev

- vir

- specializacijo

- začel

- zaloge

- Borzni trgi

- Strategist

- Predlaga

- podpora

- Podpira

- presegli

- swing

- tehnični

- Tehnična analiza

- deset

- da

- O

- tema

- tretja

- tisoče

- do

- TONE

- trgovci

- Trgovanje

- TradingView

- usposabljanje

- Trend

- edinstven

- navzgor

- us

- uporabo

- v1

- obisk

- Wall

- Wave

- Dobro

- ki

- zmago

- z

- Wong

- bi

- let

- Vi

- zefirnet