Over the past few weeks, higher price consolidation was observed for most altcoins and Ethereum has been one of them. Among various on-chain developments on the back of its $3300-$3400 stagnation, the one observed over the past 24-hours, related to Ether’s transactional USD volumes, was significant. However, its immediate impact on the market may vary according to other factors pertaining to Ethereum’s ecosystem.

Razmerje Ethereum NVT doseže najvišjo vrednost 15 mesecev

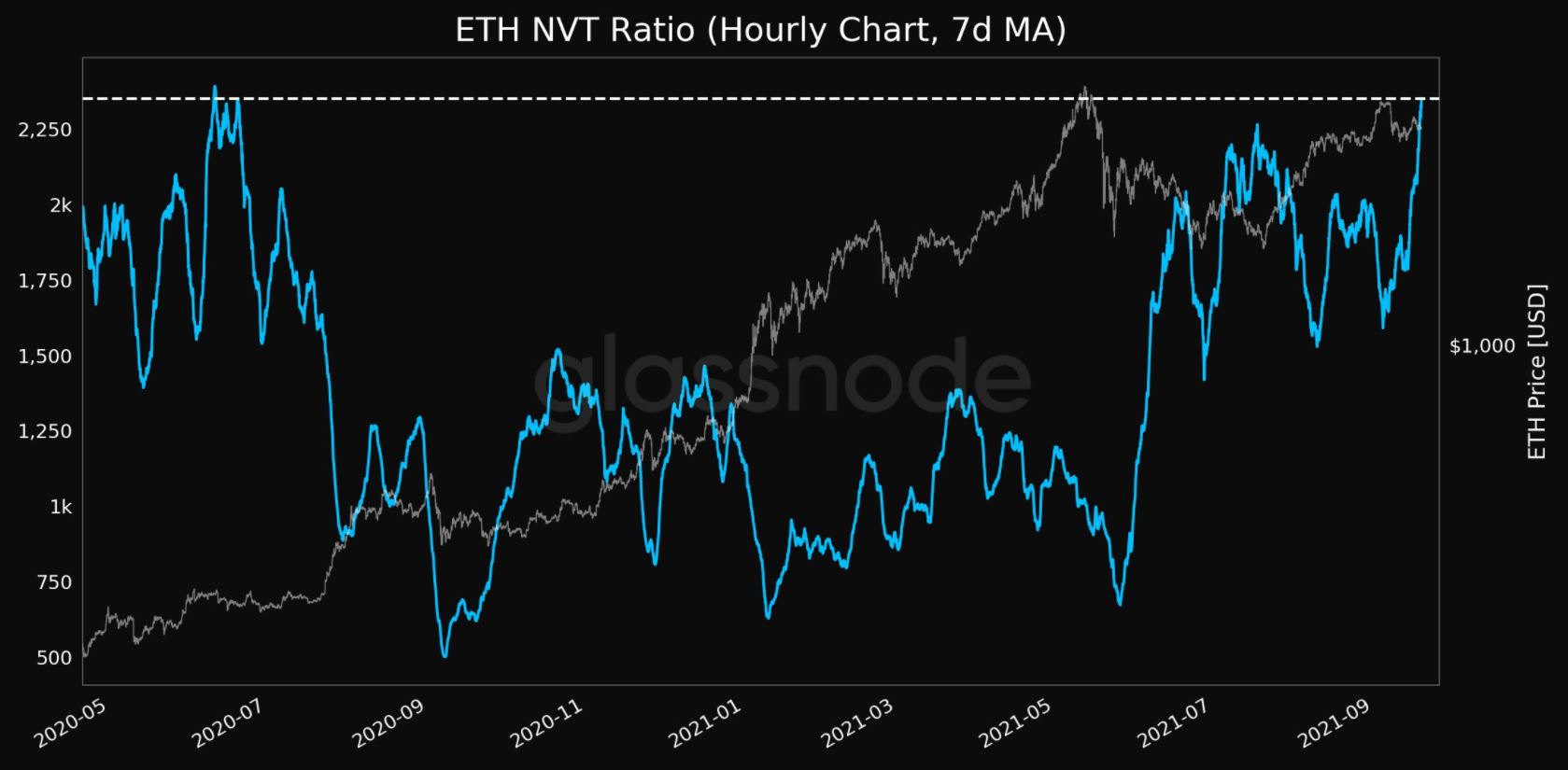

Zdaj glede na stekleno vozlo data, Ethereum’s NVT ratio reached a new 15-month high in the charts, indicating that the network value was rising in comparison to on-chain volumes transferred. NVT Ratio is defined as the network value to transactions ratio but its impact on the market might be dependent on the market state as well.

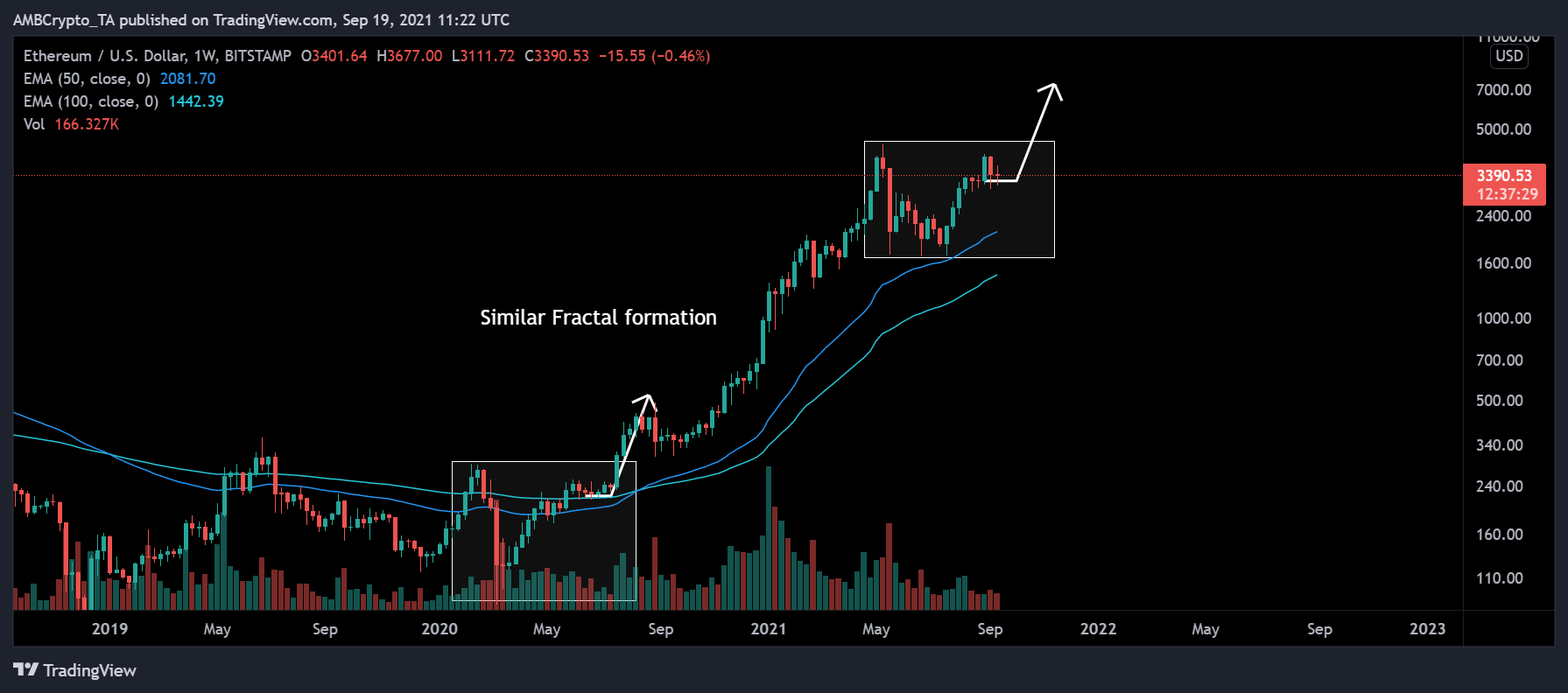

In order to understand the likelihood of a significant turnaround, let us compare the current price structure of Ethereum with that in June 2020 (the last time when the NVT ratio was this high).

Kot je prikazano na zgornji tabeli, je bil Ethereum priča fraktalni formaciji med junijem 2020 in septembrom 2021, ko je razmerje NVT doseglo podobno območje. V obeh primerih je bil za Ethereum opazen velik padec, preden se je razmerje NVT pospešilo na lestvicah.

Potem ko je razmerje NVT junija 2020 doseglo svojo najvišjo vrednost, se je cena Etra konsolidirala v istem območju še 6 tednov, preden se je prebila proti novemu ATH. Tako je mogoče ugibati, da podobni pogoji povečujejo možnost, da Ether doseže drugo raven ATH, če se trenutni cenovni razred vzdržuje naslednjih nekaj tednov.

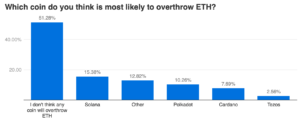

However, a major change in the narrative between June 2020 and September 2021, is the involvement of the Defi and NFTs market. In June 2020, DeFi applications were beginning to bud, before exploding in terms of activity and interest. It was a speculative space and there was an air of uncertainty with DeFi. At present time, it is a multi-billion industry as its credibility rose in 2021.

Trenutno so transakcije DeFi prevladovale v omrežju ETH in preneseni obseg v verigi je združil tako tradicionalne prenose kot dejavnost DeFi.

Kako spreminja fraktalno pripoved?

Medtem ko je utemeljitev novega rekordnega doslej največja, se fraktalna pripoved s prisotnostjo DeFi spreminja, saj je likvidnost trenutno bolj razporejena v verigi Ethereum kot kdaj koli prej. Cena se lahko konsolidira dlje, kot je bilo pričakovano, ali pa se prebije prej. Vendar razmerje NVT, ki prikazuje podobne podatke kot v preteklosti, ni primer "ponavljanja zgodovine" v smislu gibanja cen.

Kam vlagati?

Naročite se na naše e-novice

- 2020

- 7

- Altcoins

- med

- aplikacije

- zlom

- spremenite

- Charts

- konsolidacijo

- Posoda

- Trenutna

- datum

- Defi

- DID

- ekosistem

- Eter

- ethereum

- stekleno vozlišče

- visoka

- HTTPS

- vpliv

- Povečajte

- Industrija

- obresti

- IT

- Stopnja

- likvidnostno

- velika

- Tržna

- mreža

- NFT

- Da

- Ostalo

- predstaviti

- Cena

- območje

- So

- Vesolje

- Država

- čas

- Trgovanje

- Transakcije

- us

- ameriški dolar

- vrednost

- Obseg