This is an opinion editorial by Justin Ehrenhofer, the vice president of operations and multi-coin Cake Wallet, a Bitcoin privacy educator and a moderator of the r/CryptoCurrency subreddit.

Coinbase je bil pred kratkim deležen kritik, potem ko je Zahteva Zakona o svobodi dostopa do informacij iz Tehnična poizvedba je razkril podrobnosti svoje pogodbe o zagotavljanju dostopa ameriškim službam za priseljevanje in carino (ICE) do svojega orodja za analizo verige blokov Coinbase Tracer.

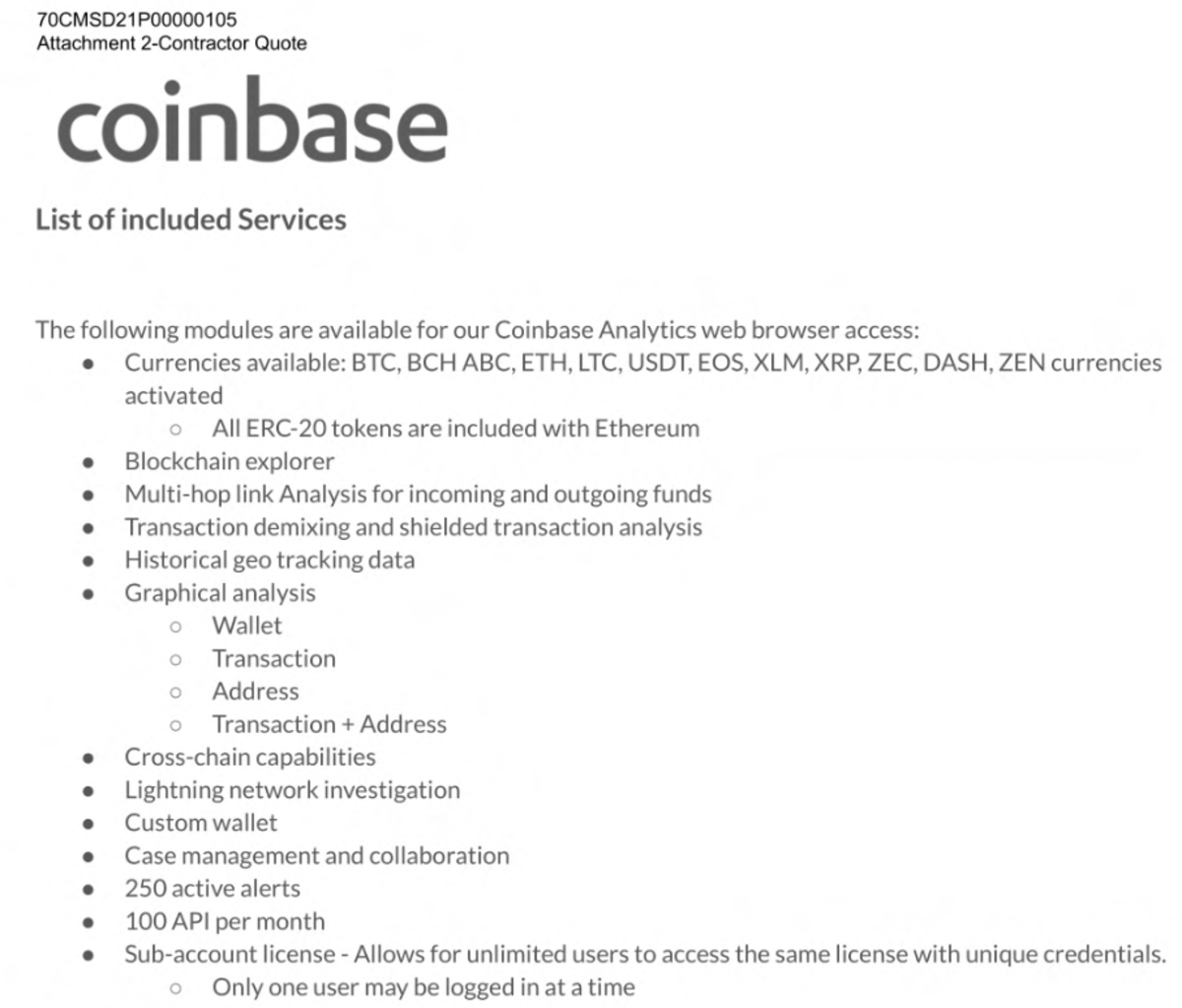

Coinbase agreed to provide ICE with surveillance data on 12 blockchains (including Bitcoin’s). Among other tools, ICE gained access to Coinbase’s “multi-hop analysis,” “Lightning network investigation,” “historical geo tracking data” and “transaction demixing and shielded transaction analysis.” You can see a summary of the scope in this screenshot obtained by Tech Inquiry:

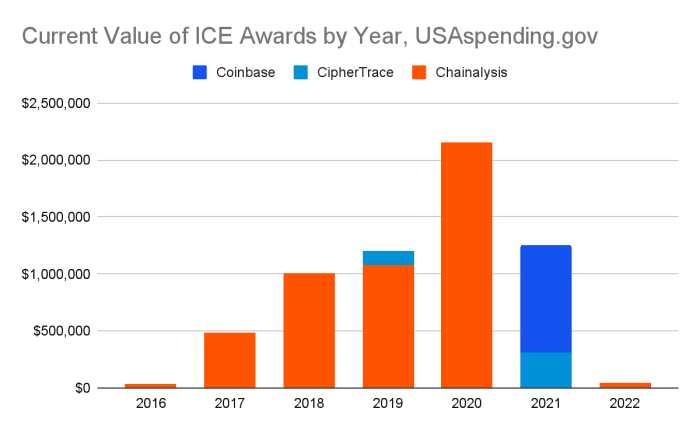

Za zagovornike zasebnosti in strokovnjake za skladnost s kriptovalutami obstoj teh funkcij ni presenetljiv. Chainalysis, CipherTrace, Elliptic in druga podjetja za analizo verige blokov že vrsto let prodajajo podobne storitve. Glede na spodnji grafikon je ICE kupil licence od Chainalysis od leta 2016.

Obseg nadzora blockchaina, ki je bil nekoč zakrit pred očmi javnosti, zdaj postaja splošno znan. Haainaliza, CipherTrace, Elipsasta in Coinbase vsi oglašujejo svojo ponudbo orodij za skladnost.

Chainalysis ponuja Reaktor za regulatorje in preiskovalce, KYT (»spoznaj svojo transakcijo«) za samodejno preverjanje skladnosti naslovov in transakcij, Kriptos za preverjanje na visoki ravni, Tržni Intel za raziskovalce in investitorje, Poslovni podatki za borze, da spremljajo dejavnosti svojih strank za poslovni razvoj in Odziv na kripto incidente za žrtve izsiljevalske programske opreme in drugih groženj. Podatke o nadzoru verige blokov prodaja isto podjetje za skladnost, raziskave, naložbe in trženje. In obstaja na desetine drugih podjetij, ki prodajajo podobne podatke za druge namene.

The ICE Fallout

Po val negativnega pritisnite po objavi podrobnosti pogodbe Coinbase z ICE je borza ponovila da »ne prodaja lastniških podatkov o strankah« in da »Coinbase Tracer pridobiva informacije iz javnih virov in ne uporablja uporabniških podatkov Coinbase. kdaj.”

Na prvi pogled bom sprejel trditve Coinbase, a tudi če so resnične, še vedno deli podatke o strankah z vlado ZDA.

Vaši 'zaščiteni' podatki so verjetno že v skupni rabi, na skrivaj

Coinbase je ki jih zahteva zakon za predložitev poročil o sumljivih dejavnostih (SAR) mreži za boj proti finančnemu kriminalu (FinCEN), če meni, da so nekatere dejavnosti sumljive. Ta poročila lahko vključujejo informacije o strankah, kot so imena, fizični naslovi in celo podatki o transakcijah in naslovih s kriptovalutami, če so na voljo.

BitAML, svetovalno podjetje za skladnost, ki se osredotoča na predpise o preprečevanju pranja denarja (AML), ima vodnik za oddajo SAR, povezanih s kriptovalutami, na njena spletna stran, which you can use to get a feel for the information that bitcoin exchanges commonly submit. SARs can be filed for all sorts of things, including situations where a customer refuses to comply with information requests.

Banke predložijo poročila o valutnih transakcijah (CTR) za vse dnevne vloge ali dvige gotovine nad 10,000 USD. RPK trenutno niso potrebni za prenose kriptovalut (npr. dvigi 20,000 USD v BTC z menjalne platforme), vendar si je FinCEN prizadeval za te v preteklosti. It’s likely that CTRs will be required for cryptocurrencies (as they allow users to hold their private keys and their ability to spend the coins, thus making them bearer instruments, like cash) in the near future. I can’t speak for Coinbase or whether it has submitted any CTRs, but Coinbase or other bitcoin exchanges may have already sent your information to FinCEN if you have deposited or withdrawn more than $10,000 in BTC via their platforms in a single day.

If Coinbase’s blockchain monitoring or compliance tools indicate that some bitcoin transaction on its platform is suspicious, it’s reasonable to expect that the exchange has submitted a SAR. ICE can easily use the blockchain analysis tool to find suspects of what it deems “financial crimes,” and then check to see if Coinbase or other exchanges have submitted SARs on those users.

Coinbase ne sme neposredno deliti podatkov o strankah z ICE, vendar podatke o strankah po potrebi deli s FinCEN, ki jih lahko deli z ICE. Zato je logično, da ICE zelo pogosto uporablja orodje za sledenje Coinbase za pomoč pri sledenju in spoznavanju identitete določenih strank Coinbase.

Ne boste prejeli obvestila, da se vaši podatki delijo v SAR. SAR so izrecno mora biti skrivnost. Menjalnicam in bankam vas je prepovedano obveščati. depresivno, kot obvezne prijave, nobeno od tega množičnega zbiranja podatkov ne zahteva naloga.

Vaši 'zaščiteni' podatki so javni

People should understand that the only truly “proprietary” information to Coinbase is the information you share directly with it. When you deposit and withdraw cryptocurrencies, you create public records that are usually trivially traced. If you withdraw bitcoin from Coinbase to your noncustodial wallet, Coinbase’s tool will likely show that transaction leaving Coinbase.

IP address surveillance is a large industry on its own. Bitcoin nodes are ultimately public servers. When you send bitcoin, the transaction needs to make its way into a public database. Companies run Bitcoin nodes to zbirajo prvi naslov IP, ki ga najdejo, povezan s transakcijo. In many cases, this gives these companies a good idea of your rough geographical location and sometimes even your home IP address.

That’s right: your home IP address, your wallet addresses and every transaction you ever make can be public information that is analyzed, packaged nicely and sold as tools to law enforcement. Per USAspending.gov, ICE alone has gotten access to these by issuing contracts currently valued at $6 million. The FBI and IRS have issued contracts to four analysis companies for $13.5 million and $17 million, respectively. The FBI contracts have a potential total value of over $40 million. Across all of these agencies and others, the cost to taxpayers could be as high as $79 million.

Jeza proti Coinbase ni rešitev

Morda ste na tej točki jezni na Coinbase. ne bodi

No, vsaj ne samo bodi jezen na to. Chainalysis je z ICE in drugimi agencijami v preteklih letih zaslužil veliko več denarja kot Coinbase, in če Coinbase ne bi prodal ICE tega orodja, bi ga lahko ICE zgradil sam.

Zato bi morali biti resnično jezni na verige blokov, ki omogočajo množični nadzor nad vsemi temi informacijami o transakcijah, in biti jezni na neupravičen množični nadzor, ki ga omogočajo SAR in CTR.

So, what do we do from here? It takes three things to enable better Bitcoin privacy:

- Set the record straight about the usefulness of these tools. They enable mass surveillance on nearly everything you do with your bitcoin. Stop beating around the bush and accept that a privacy problem exists for the 12 listed blockchains (including Bitcoin’s and Ethereum’s), as well as nearly all others.

- Incorporate meaningful and significant changes to break these tools. Hide the IP addresses being used to broadcast transactions better with tools like Dandelion++. Hide the amounts, addresses and transaction graphs. Bitcoin needs better default privacy protections to circumvent this mass surveillance. It’s almost impossible to kill these tools completely, but we can meaningfully reduce their surveillance scope by following Monero’s footsteps, for instance, of enabling sane privacy defaults across the board, not just for users of a niche tool.

- Stop using regulated entities that need to report SARs and CTRs. Using a noncustodial wallet to send more than $10,000 in bitcoin could prevent your information from being shared automatically.

Zakaj je to pomembno?

Bitcoin proponents have championed the usefulness of BTC za nakazila v Salvador and other countries. Bitcoin is certainly useful in many of these circumstances. However, many migrant workers are going to be scared off by Bitcoin’s transparency and the millions of dollars being poured into tracing Bitcoin transactions annually. It’s harder for ICE to target individual users of the traditional, centralized remittance system than it is for ICE to observe every single bitcoin payment to find many going to El Salvador exchanges, IP addresses and services.

Migrant workers often escape dangerous situations back home. Regardless of your political views on immigration, one should understand how someone in this situation would take great caution in protecting their privacy for fear of being deported.

Sadly, Bitcoin doesn’t protect the privacy of the vast majority of its users very well. Suppose El Salvador was to take the extreme (though very unlikely) step of zahtevajo remittances in itcoin. Would this be a net positive, breaking people away from centralized and regulated institutions that profit heavily off of the world’s poor? Or would this be a net negative, since one, most people will use regulated platforms to buy and sell bitcoin with fees anyways, and two, the vast majority of people will be surveilled by enemy actors (from the perspective of illegal immigrants) on the transparent blockchain?

The answer isn’t straightforward; there are positives and negatives, and Bitcoin will be the preferred option for some people. Still, I hope that loud voices in the Bitcoin community understand the challenges and risks associated with ICE watching every transaction, and that they loudly advocate for better default privacy protections on Bitcoin to protect the users they say Bitcoin was made for.

This is a guest post by Justin Ehrenhofer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Blockchain nadzor

- poslovni

- verigo

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- ICE

- strojno učenje

- nezamenljiv žeton

- Mnenje

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- zasebnost

- dokazilo o vložku

- W3

- zefirnet